Defensive sectors such as telecommunications tend to be robust during an economic downturn. This was the case with BT (LSE: BT.A) earlier this year. However, its performance has faltered in recent months. Here’s what happened and whether I think the BT share price is a bargain buy for me today.

Top and bottom lines

Despite growing its top and bottom lines during an economic downturn, investors weren’t too happy with the results. This came as a bit of a surprise to me, especially when CEO Philip Jansen reiterated the company’s guidance for FY23.

| Metrics | FY23 Outlook |

|---|---|

| Revenue | “Revenue growth” |

| EBITDA | >£7.9bn |

| Capital expenditure | £5.0bn |

| Free cash flow | £1.3bn to £1.5bn |

| Cost savings to FY25 | £2.5bn to £3.0bn |

Diving deeper into the numbers, I started to understand why the BT share price dropped even further. The FTSE 100 conglomerate’s financials worsened by quite some margin. EPS may have doubled, but this was mostly due to tax rebates. In fact, pre-tax profit actually dropped 21% due to higher depreciation and costs.

| Metrics | H1 2023 | H1 2022 | Change |

|---|---|---|---|

| Revenue | £10.37bn | £10.31bn | 1% |

| Adjusted EBITDA | £3.87bn | £3.75bn | 3% |

| Operating income | £1.23bn | £1.44bn | -14% |

| Profit before tax (PBT) | £831m | £1,009m | -21% |

| Diluted earnings per share (EPS) | 8.8p | 4.2p | 110% |

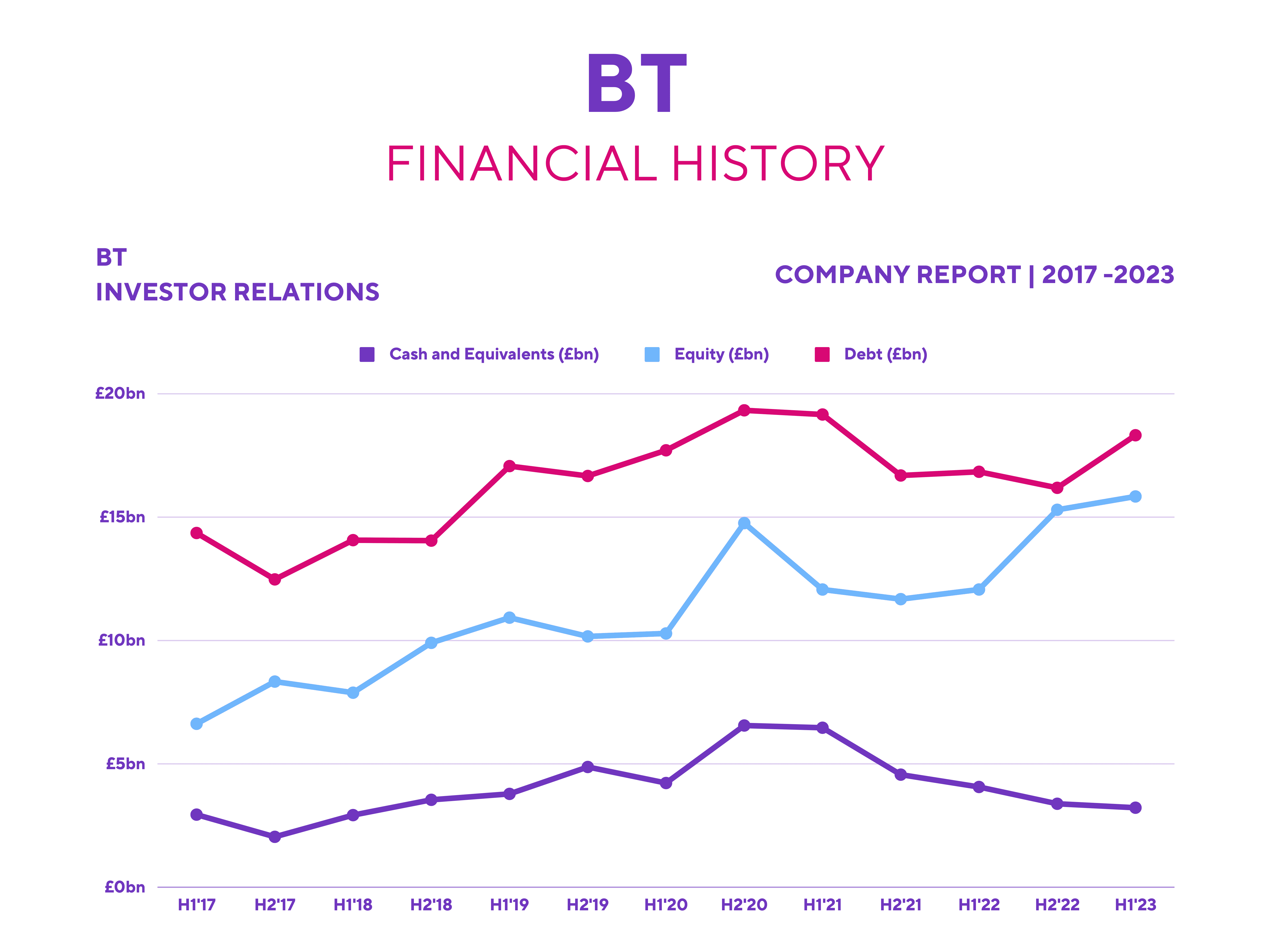

Net debt got substantially worse in the half too, seeing a 4% increase from £18.24bn to £19.04bn. While no repayments are due this financial year, it certainly limits the firm’s future earnings potential. Additionally, the group’s normalised free cash flow saw a major decline of 82%, dropping from £360m to £64m. To add insult to injury, its dividend also remains flat at 2.31p which certainly didn’t please dividend investors.

Silver linings

Nonetheless, there were silver linings that could potentially boost the BT share price. For one, the Consumer and Openreach segments continued to see modest growth. And while its Enterprise segment saw a decline, this was caused by legacy product declines and the migration of a key customer.

| Division Revenue | H1 2023 | H1 2022 | Change |

|---|---|---|---|

| Consumer | £4.99bn | £4.86bn | 3% |

| Enterprise | £2.44bn | £2.57bn | -5% |

| Global | £1.62bn | £1.65bn | -2% |

| Openreach | £2.84bn | £2.71bn | 5% |

Although the decline in Enterprise may seem lacklustre, the board sees this as a temporary result from the current macroeconomic conditions. As a matter of fact, the segment has seen continued growth from small/medium enterprises, small offices, and home offices, over the past two quarters.

Moreover, full fibre internet connections (FTTP) witnessed 331k of net additions in Q2. Nevertheless, it’s worth pointing out that 130k connections were lost as a result of reduced broadband market growth and strike action. With a planned cost-price increase set for next year, this doesn’t bode well for the group either. Especially when the likes of Vodafone, Three and Virgin are threatening to grab market share with their new joint ventures.

The impact of industrial action has certainly been felt, which is why actions taken to mitigate this are crucial. As such, help from the government surrounding energy bills could allow the board to increase wages while maintaining margins, thus potentially resolving the stand-off between workers and the board.

Dialling down the enthusiasm

So, is the BT share price good value today? Well, there are certainly positives that stand out. The telecommunications company remains the market leader with loyal and satisfied customers. Moreover, it has a number of long-term tailwinds which could boost its revenue growth, such as increase FTTP adoption and its joint venture with Warner Bros Discovery.

Having said that, I’m not expecting BT to generate sustainable double-digit income growth. This is especially true given its eye-watering debt pile. Therefore, Barclays may have reiterated its ‘overweight’ rating for the stock with a price target of £2.20, but I think there are much better stocks with better financials and earnings potential I can invest in.