Dividend investors need to trade extremely carefully heading into the new year. Corporate profits could sink at many FTSE 100 stocks as the economy toils, putting dividend forecasts for 2023 in danger.

Here are two top income shares I expect to pay big dividends next year. Both carry yields above the 3.8% FTSE index average.

Big dividends

As the global economy stumbles, profits (and consequently dividends) at commodity-producing companies are in danger of sinking.

In the case of Anglo American (LSE: AAL), City analysts think annual earnings will fall by double-digit percentages through to 2023. Yet brokers also believe the company will pay above-average dividends over the period.

Shareholder payouts are tipped to fall to 230 US cents per share this year and again to 196 cents in 2023. But these projections yield an impressive 5.9% and 5% respectively.

Commodities boom

Of course, dividend forecasts have a history of falling flat. But it seems like investors can expect Anglo American to hit these payout targets as well. Dividend estimates are covered between 2.3 times and 2.4 times through the forecast period. This is above the benchmark minimum of 2 times that provides a wide margin of safety.

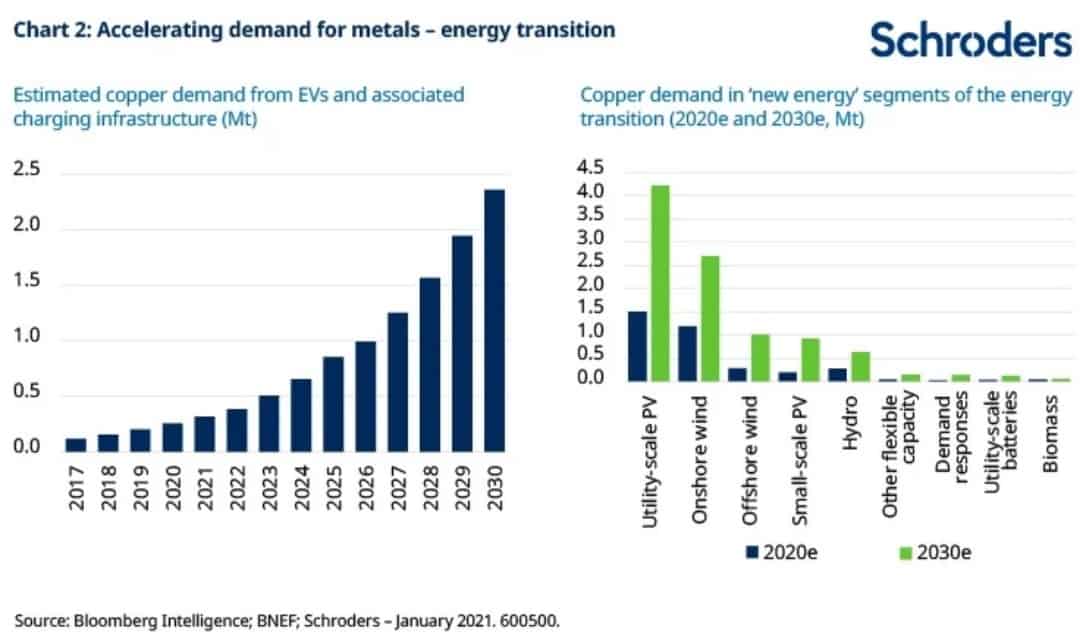

With cash to invest, I’d buy Anglo American shares to hold for the long term. I expect revenues to soar when economic conditions improve and the next commodities supercycle gets under way. Demand for its copper, for example, should leap as the energy transition turbocharges production of electric cars and renewable energy technology.

At current prices the miner also trades on a forward price-to-earnings (P/E) ratio of 7.3 times. I find its excellent all-round value hard to ignore.

7% dividend yields

Aviva (LSE: AV) also offers a combination of giant dividend yields and low earnings multiples. The insurance giant’s forward P/E ratio sits at 9.8 times. Its dividend yields for 2022 and 2023, meanwhile, clock in at 7% and 7.2% respectively.

Unfortunately, Aviva’s projected dividends aren’t as well covered by those at Anglo American. They range between 1.5 times and 1.7 times for the next few years.

But on the plus side, dividend coverage here has often trailed the desired target of 2 times. Yet it still has a rich history of paying FTSE 100-beating dividends, thanks to its terrific cash generation.

Balance sheet strength

Encouragingly, the company still has considerable balance sheet strength today. In fact, it has even touted the possibility of fresh share buybacks in the coming months. Its improving Solvency II capital ratio jumped to 223% in September.

Rising costs across the insurance industry pose a threat to future profits. But I still expect Aviva to grow earnings strongly over the long term. Ageing Western populations should drive demand for its retirement products and similar services. It can also put its balance sheet to work with profits-boosting acquisitions.