Companies whose products command significant customer loyalty often have a great track record of paying dividends. And I’ve invested in several FTSE 100 stocks whose brands have made them ideal income stocks.

Stocks that reap the benefit of strong brand power tend to enjoy excellent earnings stability. Consumers can be relied upon to keep buying their products even when times get tough. As a consequence these companies have the confidence and the means to increase dividends year after year.

Shares that manufacture much-loved labels also have more wiggle room to raise prices and thus protect margins. They know that volumes will remain strong even if they become costlier, allowing them to pass on the problem of increased costs to shoppers.

Soaring sales

This is why, as a dividend investor myself, I’ve chosen to invest in drinks business Diageo (LSE:DGE). Its labels like Captain Morgan rum, Smirnoff vodka, and Johnnie Walker whiskey are among the most sought after in these categories.

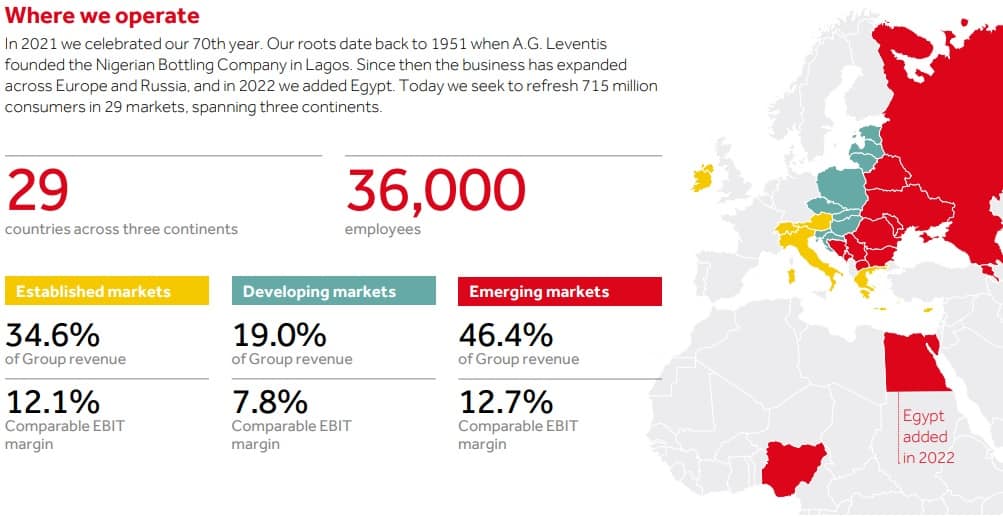

For the same reason I’ve bought shares in Coca-Cola HBC (LSE:CCH), bottler of world-famous drinks brands including Coke, Fanta, and Sprite. I’ve also loaded up on food and household goods manufacturer Unilever (LSE:ULVR). Famous product lines here include Dove soap and Magnum ice cream.

The cost-of-living crisis is battering spending on food and essentials as well as discretionary goods. Yet sales at each of these three FTSE 100 shares have continued growing strongly in 2022.

This week Coca-Cola HBC said organic revenues (excluding Russia and Ukraine) jumped 19.6% between July and September. Over the same period Unilever grew underlying revenues 10.6%, thanks in part to a strong performance from its ‘billion+ euro brands.’

According to Kantar Worldpanel, Unilever owns 13 of the 50 best-performing global brands in 2021.

Strength in depth

Each of these FTSE index shares has a strong track record of long-term dividend growth. Diageo, for instance, has raised ordinary payouts at a compound annual growth rate of 6.07% for the past 20 years.

But this is down to more than just terrific brand power. These companies also operate across a wide range of consumer product categories, which in turn reduces the risk that weakness in one product area poses to group profits.

Unilever, for example, continued making decent profits even as sales of margarines like Flora fell sharply. The business makes everything from bleach and deodorant to ice cream, washing powder, and mayonnaise.

On top of this, these FTSE 100 stocks have broad geographic footprints to protect group earnings from trouble in one or two territories. And it provides them with excellent opportunities to grow profits (and therefore dividends), too. This is because each has significant operations in emerging markets where consumer spending power is rising sharply.

Top FTSE 100 stocks to buy

Like any UK share, Unilever et al aren’t immune to temporary earnings trouble that can damage dividends.

Fresh Covid-19 lockdowns in its major Chinese market pose a threat to Diageo, for instance, as bars and restaurants are shuttered. Unilever and Coca-Cola HBC could see sales of their sweet products dip as people switch to healthier lifestyles.

But I’m happy to endure some near-term disappointment. I invest for the long term, and I believe these FTSE 100 shares have the tools to keep delivering excellent dividend income over this horizon.