Since the commencement of earnings season, Rolls-Royce (LSE: RR) stock has rebounded rather substantially, jumping from 66p to 87p. Despite that, the Rolls-Royce share price could be losing steam for several reasons. Here’s why.

A Rolls-Royce update

The FTSE 100 group released a Q3 update last week. Overall, it was a positive statement as management reiterated its guidance for FY22. This is good news considering the current macroeconomic outlook and a potential recession on the cards. The guidance for its full-year is as follows.

- Low-to-mid-single digit underlying revenue growth

- Full year underlying operating profit margin at approximately 3.8%

- Modestly positive free cash flow

Although the Rolls-Royce share price faced an initial negative response, the engine maker continued to see its main revenue driver in Civil Aerospace gain momentum. This comes on the back of a recovery in flying hours as travel demand remains robust.

On the other hand, the Derby-based firm reported strong demand from its Defence customers with $1.8bn in contract renewals. Hence, a low double-digit percentage operating margin is expected for the year. Additionally, its Power Systems segment continues to show strong growth with a hefty order book.

Levelling off

Nonetheless,I think the Rolls-Royce share price faces headwinds in the short-to-medium term. Although the company is showing signs of growth and improvement, I’m expecting more, particularly in the Civil Aerospace segment.

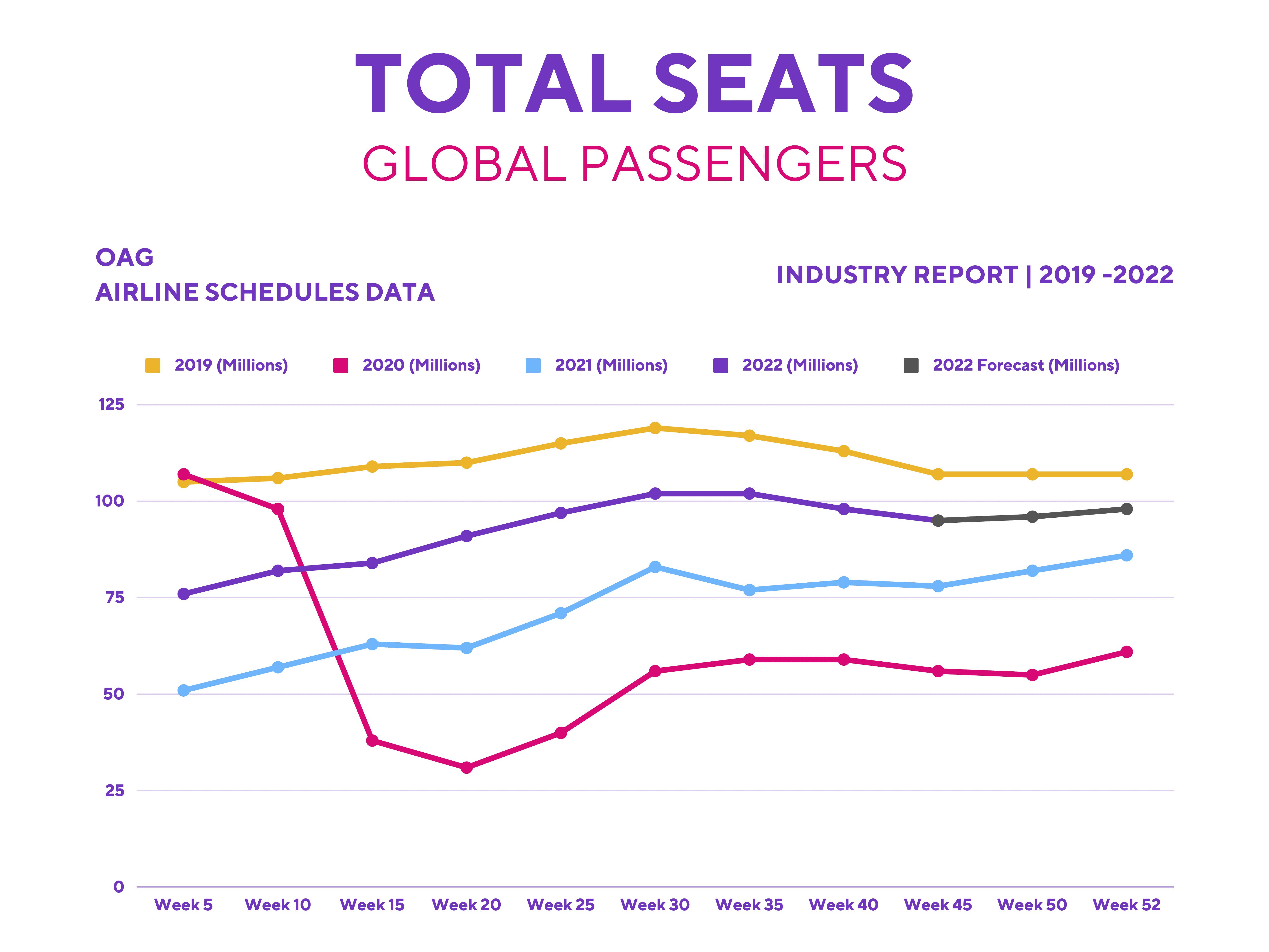

According CEO Warren East, Rolls-Royce’s engines’ flying hours only constitute 65% of 2019 levels. While the segment continues to grow, it’s important to note that flying hours for its engines still lag behind overall traffic numbers in air travel. This currently stands at 88% of 2019 levels, and is expected to reach 92% later this year.

So, why does Rolls-Royce lag behind the wider industry? Well, this is because on the commercial front, the manufacturer only services and produces engines for long-haul aircraft. These include the likes of the Airbus A380, A350, and Boeing 787.

Recovery in long-haul travel is still lagging due to Asia and China’s COVID restrictions. Pair that with the drawdown of the Airbus A380, and the number of Rolls-Royce engines in service are reduced. Not to mention, the British firm only holds 18% of the engine market share, which further waters down the number of potential engines it can service. As such, long-haul travel, especially to and from Asia will need to recover in order for the Rolls-Royce share price to continue its trajectory upwards.

Chinks in the armour

On the financial side of things, even though the sale of ITP Aero salvaged its balance sheet slightly, I still can’t look past its eye-watering debt levels. Hargreaves Lansdown analyst Sophie Lund-Yates even stated the following.

Engine flying hours will never take off completely while restrictions remain in China. At the same time, the debt pile is still suffocatingly large, and that will limit growth for a while.

Sophie Lund-Yates

Admittedly, its future projects involving clean energy and UltraFan certainly bring lots of upside potential. Nevertheless, I’m wary of its ability to fund such projects at full capacity due to the current state of its finances. Therefore, until Rolls’ financials improve, I’ll be keeping it on my watchlist. After all, a broker from Berenberg recently reiterated its ‘hold’ rating for the stock with a price target of £1.