Rolls-Royce’s (LSE: RR) share price has bounced back from its lows in mid-October. In fact, the FTSE 100 enginebuilder has risen by around 15% in just three weeks.

Demand for Rolls-Royce shares hasn’t risen on the back of any company- or industry-specific news. They’ve been carried higher by an improvement of broader investor confidence in recent days.

Should I join the stampede and buy the troubled blue-chip share?

Danger here

Rolls-Royce has exposure to many different engineering markets and industries. However, its fortunes are closely tied to those of the airline industry. Its civil aerospace division generates more than 40% of underlying revenues.

So a bet on Rolls-Royce shares can be seen as a bet on the travel sector. And an uncertain outlook here worries me as a potential investor. Jet sales and aircraft servicing revenues depend on strong airline profits and flight activity.

Recovery to slow?

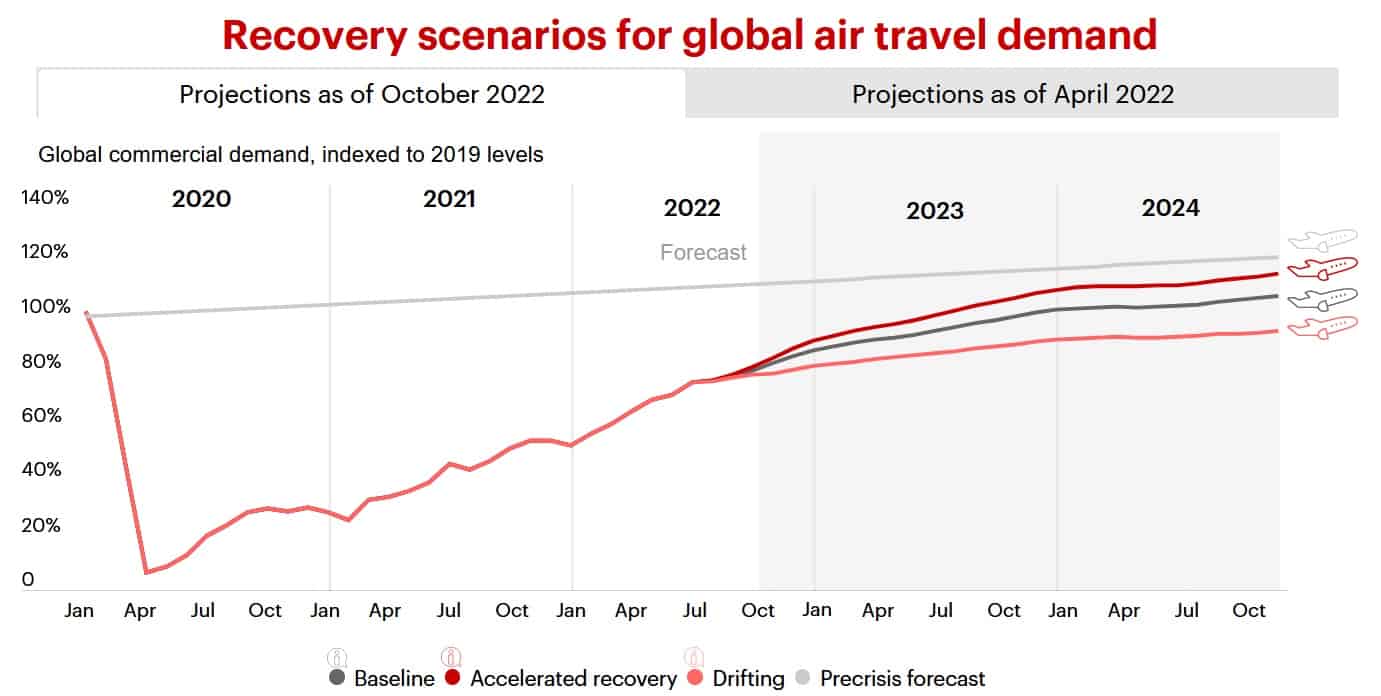

The precariousness facing the airline sector is highlighted in a fresh report from Bain & Company. For 2022, analysts at the management consultancy have upgraded their revenues estimates for the industry. They now expect turnover to hit $525bn this year, or 84% of pre-pandemic levels.

However, Bain said that it expects a lower rate of growth over the next 18 months as discretionary spending begins to decline.

The firm said that its current growth estimates could be downgraded too, “amid mounting recession concerns in many key economies” and “turbulence with OPEC+ resulting in recent cuts to oil supplies”. It added that business travel isn’t tipped to recover fully until 2025.

Defence demand

The problem for Rolls-Royce is that it also supplies product to other cyclical industries. So as the chances of an economic downturn increase, its broader profits outlook worsens.

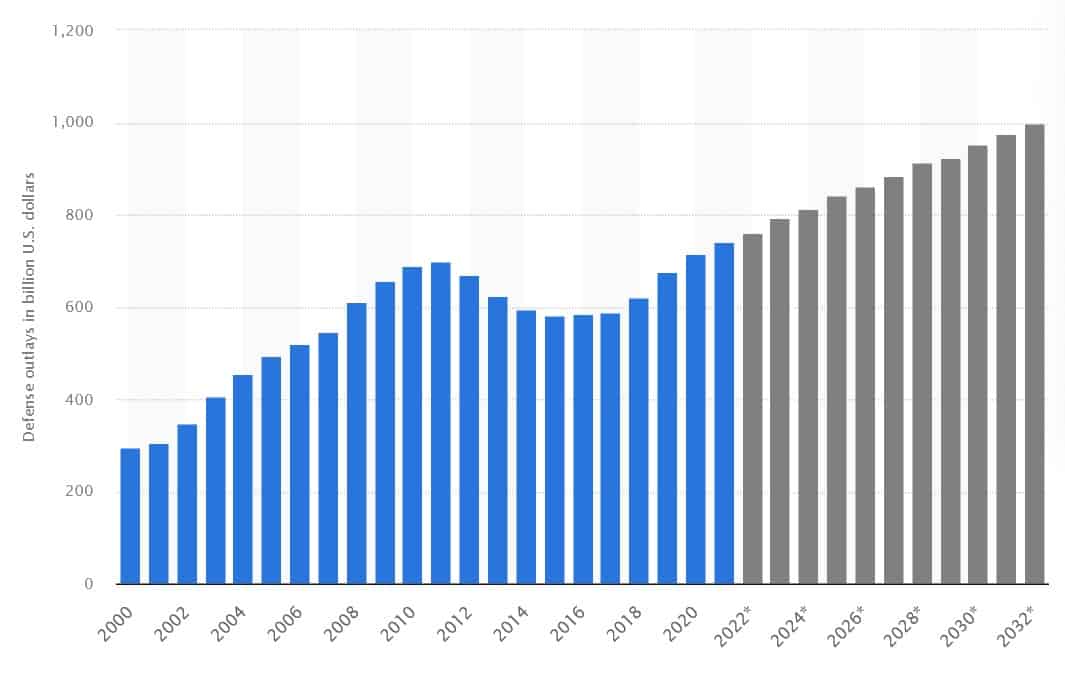

On the plus side, the business also generates considerable revenues from defence customers. This provides it with some welcome earnings visibility as defence budgets remains broadly unaffected by economic conditions.

In fact, its defence division enjoys huge long-term opportunities as global arms spending soars. Statista thinks defence expenditure in the US — a major user of Rolls-Royce aircraft engines — will grow strongly every year over the next decade.

The verdict

However, this isn’t enough to encourage me to invest. Even the bright long-term outlook for the airline industry will not tempt me to buy Rolls-Royce shares.

This is because of the company’s gigantic debt pile. It stood at $5.1bn as of June, and a slump in the global economy will hamper its ability to pay this down.

Consequently, Rolls could struggle to fund its growth programmes. It might also have trouble restarting its dividend programme (the engineer hasn’t paid a dividend since 2019).

Today, Rolls-Royce’s share price trades on a whopping price-to-earnings (P/E) ratio north of 270 times. This is far, far too high, in my opinion, given its high-risk profile. So I’d rather buy other UK shares right now.