I don’t have a bottomless pit of cash to draw upon. But Coca-Cola HBC (LSE: CCH) is a Warren Buffett-like share of which I’d like to boost my holdings in November.

Coca-Cola HBC’s share price remains vastly cheaper than it was 12 months ago. In fact, it trades at a whopping 24% discount.

The descent reflects the impact of the war in Eastern Europe on its operations. It also underlines the threat that revenues could slump as consumer spending power sinks.

I’m thinking of using this weakness as an excuse to go dip buying however. Its current forward price-to-earnings (P/E) ratio of 14.5 times sits well below its historical average.

What’s more, latest financials from US-listed The Coca-Cola Company (NYSE: KO) have reinvigorated my appetite for the stock.

Fizzy results

Coca-Cola is one of billionaire Buffett’s favourite stocks. He’s held shares in the soft drinks giant since 1988. And today, it is the third-largest holding within his Berkshire Hathaway investment firm.

Brand power is an important quality that Buffett searches for when he chooses which stocks to buy. Coca-Cola’s update on Wednesday reveals how powerful this weapon is.

Organic revenues at the Coke, Sprite and Dr Pepper manufacturer leapt 16% in the three months to September, it said. Volumes ticked 4% higher year on year. And operating profit at constant exchange rates jumped 18% year on year.

Coca-Cola has been hiking prices in response to mounting costs. But thanks to the colossal popularity of its products, sales and volumes continue to rise. Demand remains rock-solid even as inflation sits at multi-decade highs.

In fact, Coca-Cola hiked its full-year forecasts on the back of its third-quarter performance.

A Buffett-like beauty

Coca-Cola HBC’s role as bottling partner of The Coca-Cola Company gives it the same benefits of brand power. But the similarities don’t end there.

Coca-Cola HBC also has considerable strength in depth. It bottles fizzy pop along with juice, water, tea, coffee and energy drinks. It also has exposure to increasingly popular categories (such as low-calorie drinks which it serves through its Coca-Cola Zero Sugar product).

This helps protect revenues from changing consumer tastes and allows it to exploit fast-growing categories.

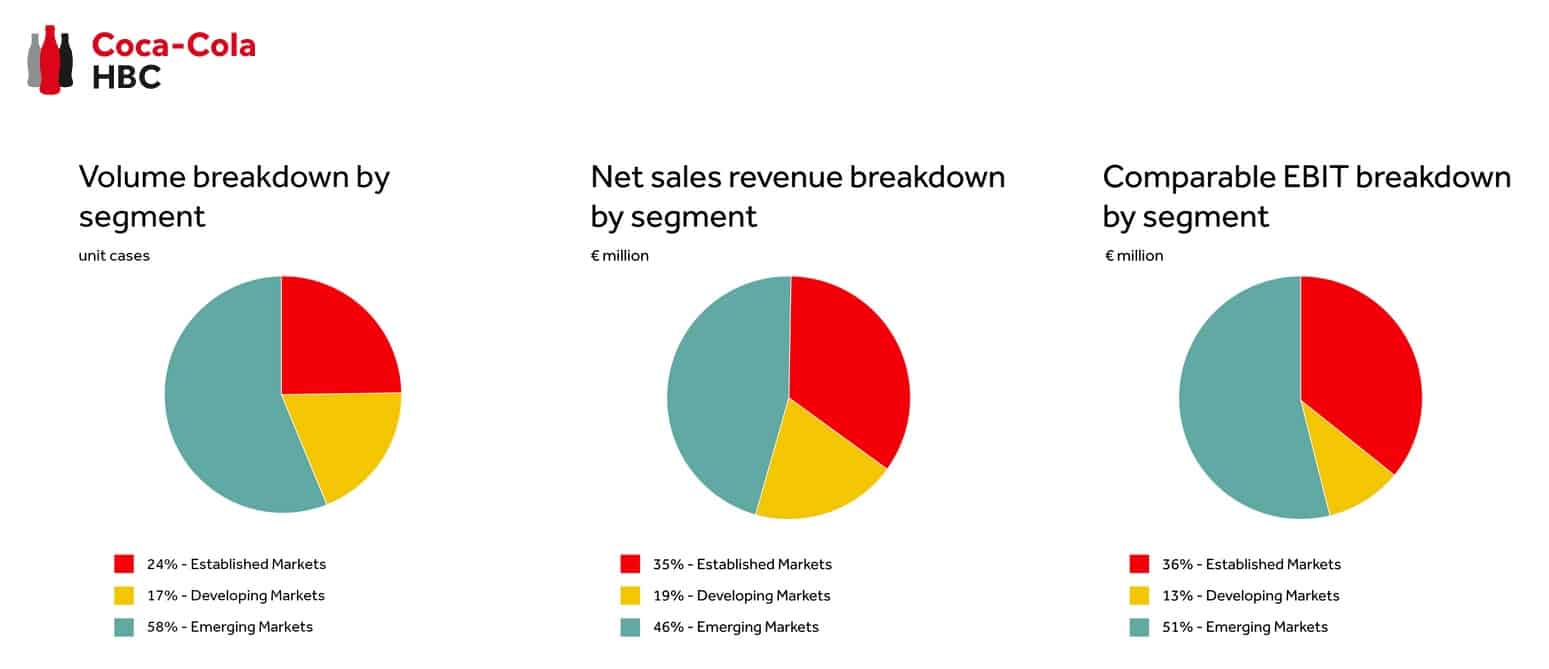

Like its US partner, Cola-Cola HBC has a huge geographic footprint as well. This provides protection to earnings in case of localised problems. And it gives the FTSE 100 firm exposure to developing and emerging markets in Eastern Europe and Africa.

Mark the date

Coca-Cola HBC is due to release its own financial update on 8 November. I think earnings here could also beat expectations for the third quarter, resulting in impressive share price gains of its own.

The soft drinks market is a incredibly competitive one. And this presents a huge risk to the FTSE 100 company. But Coca-Cola HBC’s brilliant track record versus its rivals provides me with reassurance.

I believe recent price weakness makes this Buffett-like stock a great buy for long-term investors.