Apple (NASDAQ: AAPL) is one of the world’s most traded stocks. Like many tech giants, it’s renowned for its ability to outperform the S&P 500 on almost every time horizon. So, how much would I have now if I’d invested £1,000 in Apple stock three years ago?

Big Apple

If I’d invested £1,000 back then, the stock would have generated a return of approximately 130% on my investment. To complement this, the Nasdaq-listed firm pays a dividend, which would increase my overall return by an additional $55.44, bringing the total return to around £2,800. This is what it would translate to in real income, inclusive of exchange rates, but excluding broker fees and capital gains tax.

| Metrics | Apple stock |

|---|---|

| Amount invested | £1,000 |

| Post-conversion to USD | $1,298.50 = 22 shares |

| Stock growth | 136.18% |

| Total dividends | $55.44 |

| Total 3-year return | $3,122.24 |

| Post-conversion to GBP | £2,794.84 |

Although the growth of Apple stock is approximately 130%, investing over three years ago would have grown my investment by more than two times. That’s because of the impact of a weak pound and strong dollar today. If I compare this to the performance of the US’s three main indexes, Apple stock still outperforms by quite a substantial margin, even excluding dividends.

| Index/Metrics | Dow Jones | S&P 500 | Nasdaq |

|---|---|---|---|

| Index growth | 11.77% | 22.7% | 31.07% |

Stock up on Apple?

The stock has been performing rather poorly this year. This is due to bear market conditions as a result of high inflation and rising interest rates, sparking fears of a recession.

But CEO Tim Cook will be reporting the firm’s Q4 results later this month. Here are its earnings estimates going into its Q4 earnings release. Beating earnings estimates and a decent outlook going into its next financial year could send its share price higher and recover some of its losses this year.

| Metrics | Amount (Q4 2021) | Earnings estimates (Q4 2022) |

|---|---|---|

| Total revenue | $83.36bn | $88.90bn |

| Diluted earnings per share (EPS) | $1.24 | $1.27 |

Taking a bite

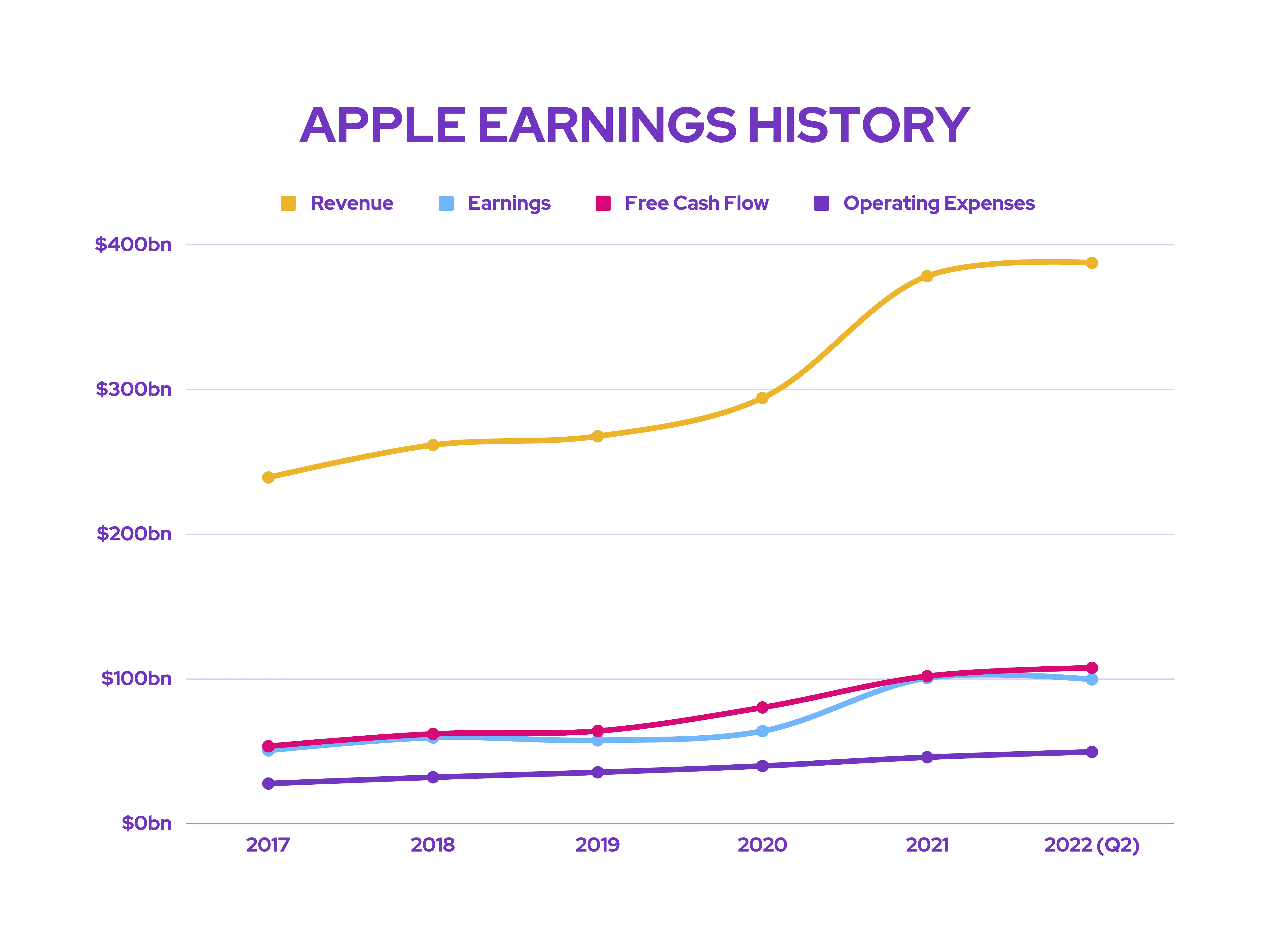

Will I be buying Apple stock any time soon then? Well, for starters, the iPhone owner has an excellent history of producing excellent returns consistently. And it’s been able to grow its revenues and profit margins over the last decade. As a matter of fact, Warren Buffett is such a huge fan of the stock that it makes up 40% of Berkshire Hathaway‘s equity portfolio.

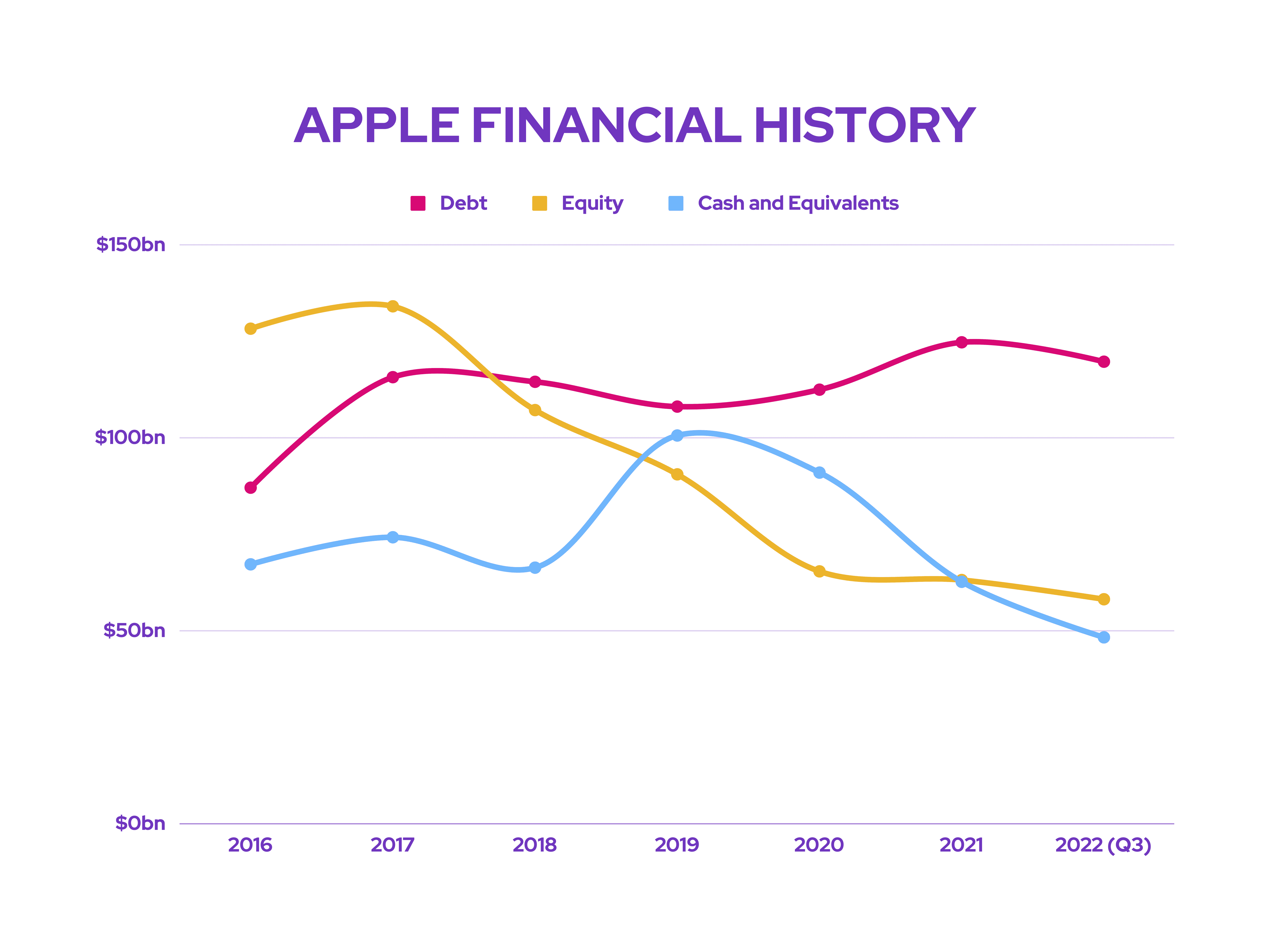

However, it’s worth pointing out that the firm’s balance sheet could do with some improvement. Its debt-to-equity ratio is considered to be relatively high, at over 200%. This is especially worrying when it has $127.5bn worth of debt to pay within the next year, with only $51.5bn worth of cash and $45.4bn worth of receivables due within a year.

Nonetheless, Apple stock has a market cap of $2.28trn, so raising cash through a small stock offering (leading to stock dilution) shouldn’t be too big an issue. Even so, I’m wary that the current recessionary backdrop could force Apple to dilute shareholders more than expected as consumer spending slows down.

Although past performance is no indicator of future returns, the company still has a lot going for it, and I don’t see Apple losing its place as the world’s number one brand for electronics soon. Even Morgan Stanley has labelled it a top stock pick in the event of a US recession. Therefore, with an average ‘strong buy’ rating and price target of $182, I’ll be using the current bear market as an opportunity to start sinking my teeth into Apple stock.