Shares in the newly branded International Distributions Services (LSE: IDS) saw a big crash last week. With the stock already down more than 60% this year, could this present me with a buying opportunity? Or is this merely a value trap?

A Royal rebrand

When Royal Mail reported its first-quarter results in July, it opted to change its name to International Distributions Services. The reason for the rebrand was “to have clearer financial separation” between the group’s two businesses — Royal Mail and GLS. The former mainly operates in the UK, while the latter is known for its operations internationally.

Having said that, the change of name only came into effect earlier this month. In the week leading up to its rebrand, IDS shares rose as much as 12%. This was a head-scratcher as the logistics company didn’t release any news. So, why did the stock jump?

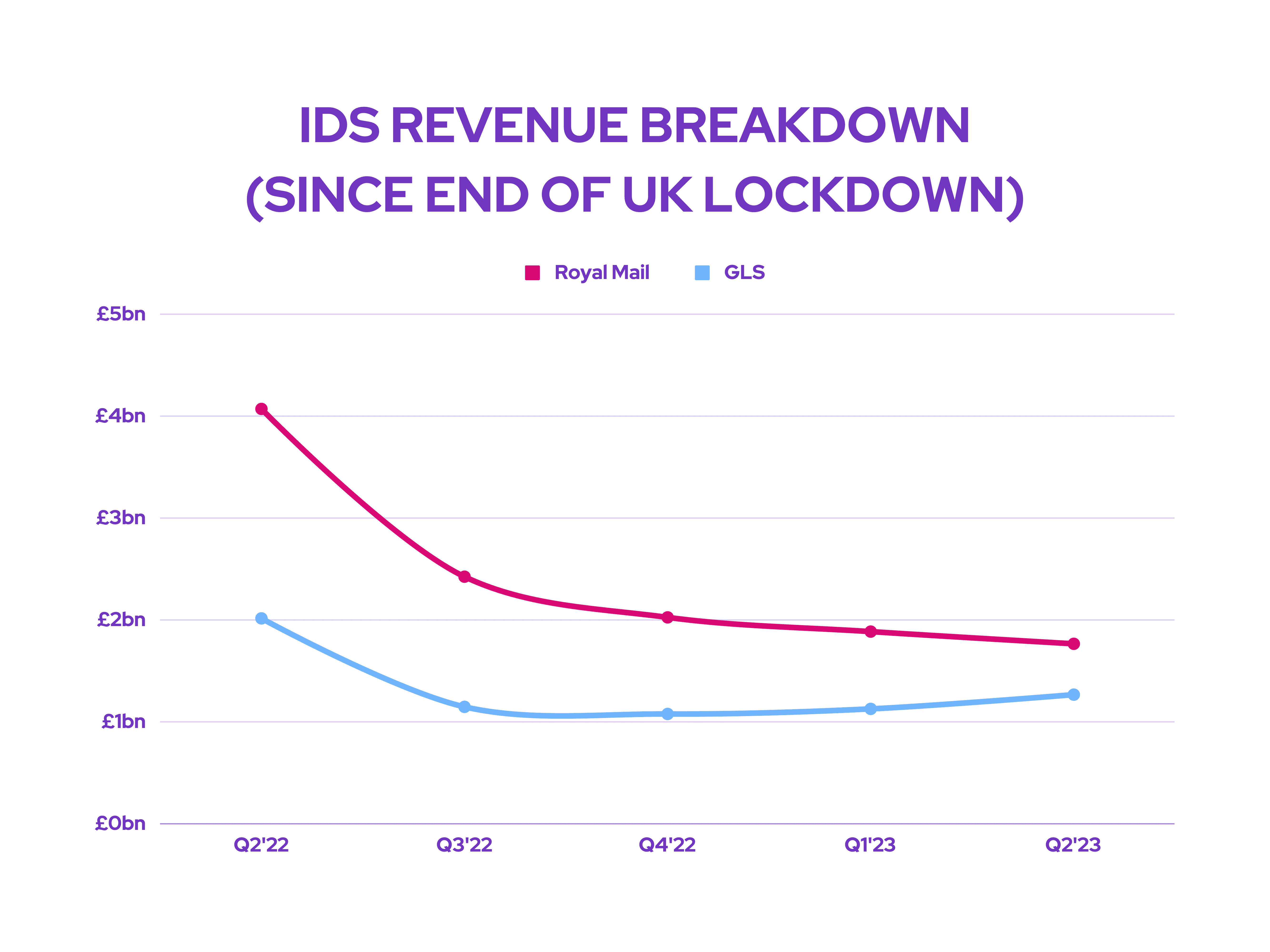

Well, one plausible reason could be the speculation about the potential break-up of the group’s two divisions. Since the end of the pandemic, Royal Mail’s revenue and profits have been on a steady decline, with GLS seeing contrasting fortunes. But given that the majority of the firm’s revenue comes from Royal Mail, IDS shares have since sunk as a result. As such, a spin-off like the one seen between GSK and Haleon could be possible.

Losses are stacking up

IDS shares took a tumble on Friday and are back down to the lows for this year. This occurred when the courier said it needed to cut more than 7% of its workforce. Along with that, the FTSE 250 firm now expects £219m of first-half losses. Moreover, it expects to lose up to a staggering £350m for its full year, and that’s without even taking a further 19 days of strikes into account.

Royal Mail claims that it’s already lost £70m from just three days’ worth of strikes by its staff. Hence, a further 19 days could prove even more damaging. And despite the stellar GLS performance so far this year, analysts don’t think the international segment’s strong enough to support IDS shares from falling further.

Shrinking volume

Nonetheless, there’s an argument to be made that IDS shares are trading at an extremely cheap price. After all, it has a price-to-earnings (P/E) ratio of just three. It’s also got an excellent dividend yield of 9%, which looks lucrative.

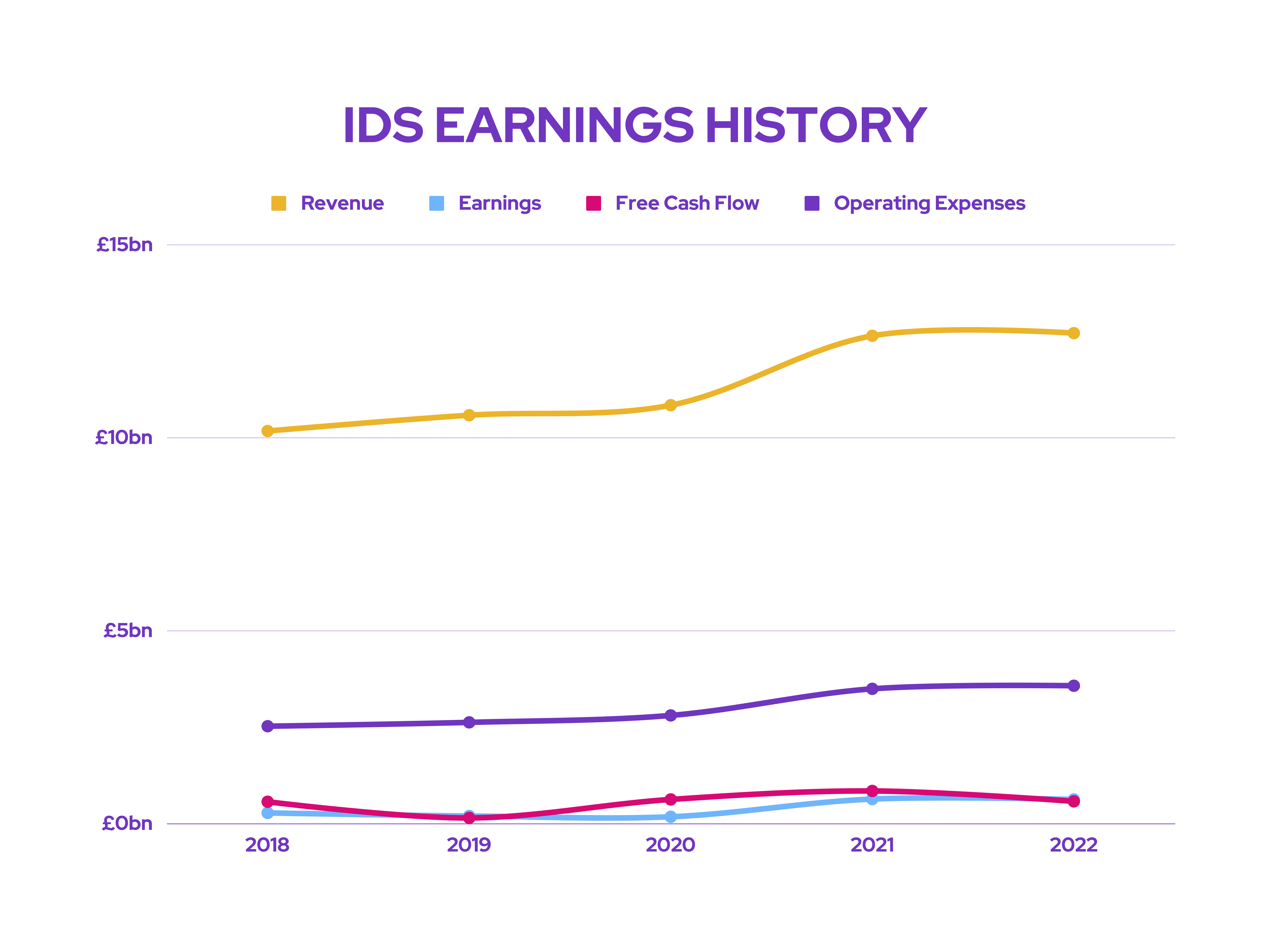

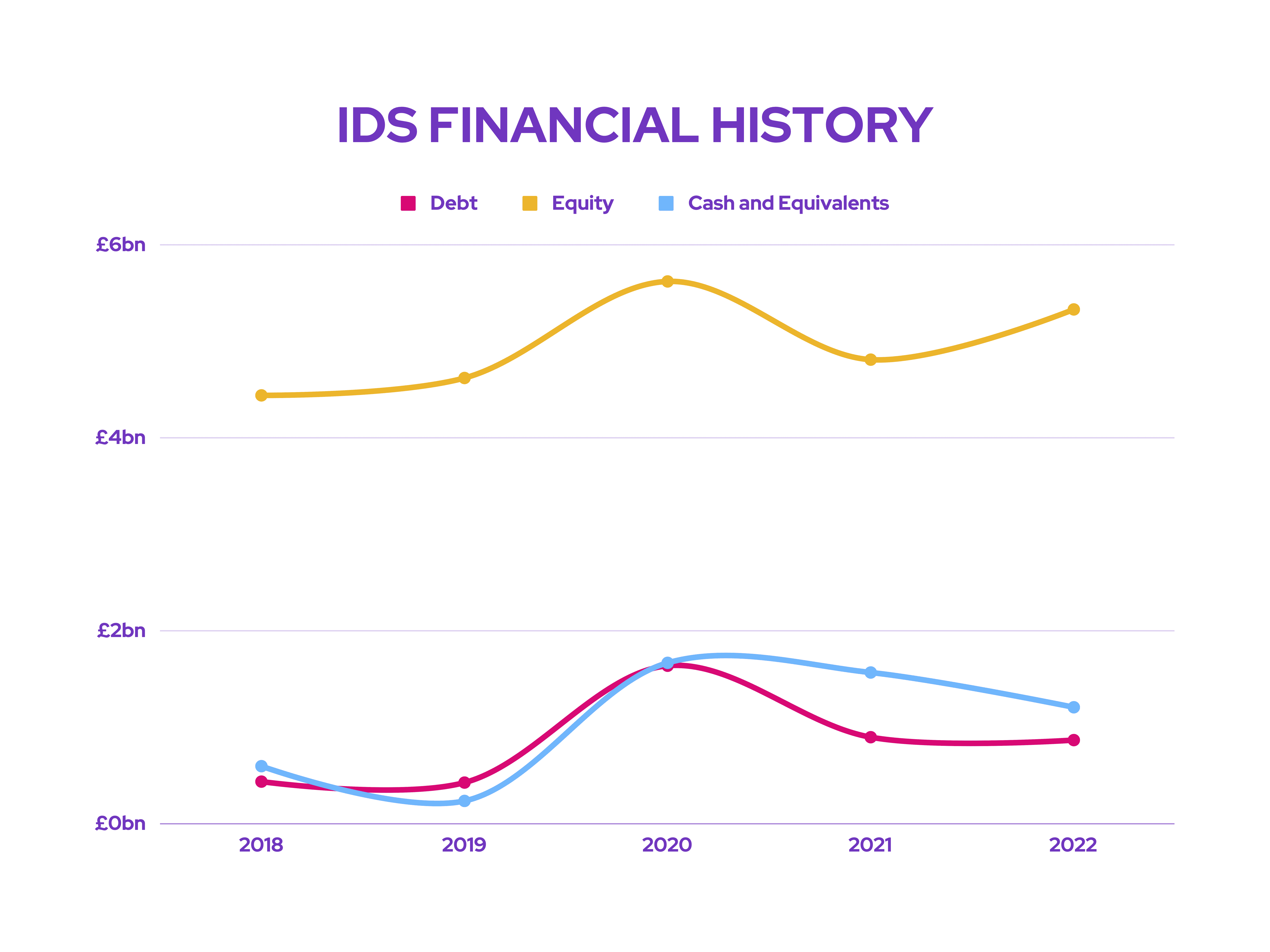

However, I should point out that these are lagging indicators as they’re based on the company’s previous earnings figures. Given its latest revised outlook, its price-to-earnings-growth (PEG) ratio is now forecasted to be negative. Consequently, I’m expecting its balance sheet to shrink, and its dividend to follow.

Overall, I think IDS shares are a value trap. The board’s efforts have been unsuccessful to date, with no plan in place to resolve its current disputes. Furthermore, the current recessionary backdrop isn’t going to help its parcel volumes in the short to medium term either.

Additionally, a number of brokers such as Peel Hunt and Deutsche recently downgraded their ratings for IDS shares to ‘sell’. Therefore, I’ll be steering clear of this stock as I expect there to be further downside, having taken its most recent developments into account.