Rolls-Royce’s (LSE:RR) share price has continued to crumble in recent sessions. At 70.05p per share, the engineer has halved in value during the past 12 months. I wouldn’t rule further weakness out either as the world lurches towards recession.

But I’m someone who invests to hold shares for a long time, say a decade or more. So should I buy the FTSE 100 firm following its plunge?

Three reasons to buy Rolls-Royce

First off, Rolls-Royce shares look dirt-cheap, on paper. At Friday’s closing price, it trades on a price-to-earnings growth (PEG) ratio of 0.4. A stock can be considered undervalued if it trades on a multiple below 1.

Secondly, City analysts believe the engine builder will continue growing earnings despite tough macroeconomic conditions. It’s hard to say the same for many other UK shares.

In fact, annual earnings are expected to grow an impressive 363% in 2022. An even-better 588% increase is predicted for next year too.

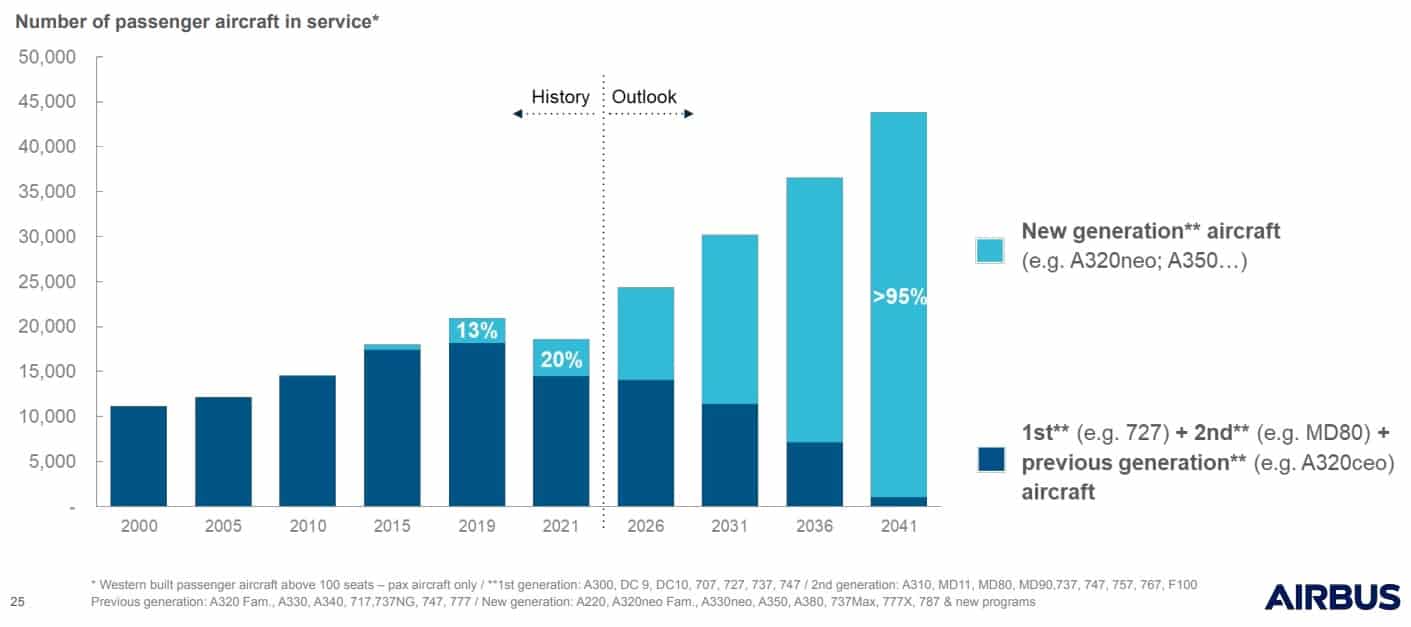

And finally, industry experts think the commercial aviation industry will grow strongly over the next two decades. This could supercharge demand for Rolls-Royce’s aeroplane engines and aftermarket services.

Airbus thinks there will be 46,930 aircraft in service by 2041. That’s up considerably from the 22,880 that were flying in 2020.

Cheap for a reason?

Having said all that, I’m not tempted to buy Rolls-Royce shares just yet. The FTSE 100 firm has a series of problems to overcome to deliver long-term growth.

And remember that City estimates are just that. There are many obstacles that could scupper forecasts in the near term and beyond. This is why the Rolls-Royce share price is so cheap on paper.

Recovery in peril

Admittedly, news from the aviation sector remains highly encouraging. British Airways owner IAG, for instance, said it has seen “no indication of weakness” in forward bookings when it updated the market last week.

But conditions could get much tougher moving towards and into 2023 as inflation soars and consumers feel the pinch. Travel association ABTA said last week that 36% of Britons, for example, plan to take fewer holidays next year.

The aviation industry’s recovery is also in peril as the staffing crisis among airlines and airports persists. Mass flight cancellations have already affected revenues at Rolls-Royce’s aftermarket division.

Too much risk

Soaring costs are another threat to Rolls in the short-to-medium term. It announced in August that “the war in Ukraine, inflationary pressures, and supply chain constraints” all damaged profits between January and June. These problems were tipped to endure next year too.

The engineer also faces increasing currency headwinds if the pound continues to crumble. Sterling’s slump cost it £464m in the first half of 2022 alone.

Ordinarily, I’d be willing to accept some near-term uncertainty if a share’s long-term outlook is compelling. But Rolls-Royce’s colossal debt pile makes investing in the company a gamble right now. It had more than £5bn worth of net debt as of June.

There are clearly things to like about Rolls-Royce. I feel, however, that it carries too much risk to be considered a wise investment for me.