On paper, these FTSE 100 dividend stocks offer terrific all-round value. So should I increase my holdings in them?

Persimmon

Persimmon’s (LSE: PSN) sinking share price has prompted me to consider topping up my holdings. The housebuilder’s fresh descent in recent sessions has sent its dividend yield to an eye-popping 18.5%. Meanwhile, its corresponding P/E ratio has toppled to 4.9 times.

Persimmon has been an excellent dividend-paying stock over the past decade. Due to the UK’s chronic homes shortage and government inaction to boost build rates I think the long-term outlook for shareholder returns looks attractive too.

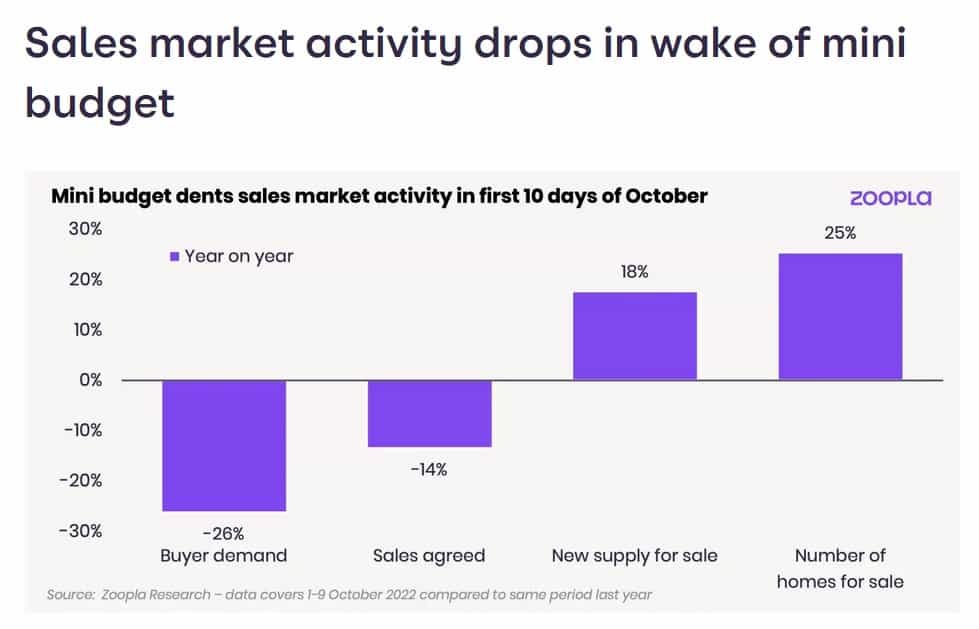

But with homebuyer demand slipping I’m happy to delay increasing my holdings. Property listings business Zoopla says that enquiries on its website have fallen by a fifth in the past fortnight. This follows the release of the government’s mini-budget that pushed up mortgage rates.

Worryingly for Persimmon, mortgage rates are in danger of further heavy rises in the weeks and months ahead. This reflects ongoing turbulence in bond and currency markets as well as ongoing pressure from runaway inflation.

Barratt Developments underlined the trouble that higher rates are causing last week.

In its latest trading statement, it said reservation rates fell by a third between 1 July to 9 October. It attributed “wider economic uncertainty” and “increased mortgage interest rates and reduced mortgage availability” as the factors behind the slump.

I’m expecting Persimmon’s next market update on 8 November to confirm the turbulence affecting the housing industry. Until the outlook becomes clearer I won’t be building my position in this stock.

DS Smith

However, I am tempted to add to my holdings in DS Smith (LSE: SMDS). The packaging manufacturer has recovered ground in more recent sessions, but I believe it remains heavily oversold in 2022, as recent trading news suggests.

Today, DS Smith’s share price carries a P/E ratio of just 7.6 times for this year. Its dividend yield sits at a healthy 6.2%.

Soaring cost inflation poses a threat to the cardboard box maker. But, so far, the company is being able to effectively navigate the problem.

DS Smith has been increasing prices and introducing cost-saving measures to protect its margins. And the huge success of these measures led to the business hiking its half-year profits forecasts on Tuesday.

It now expects adjusted operating profit “of at least £400m” in the six months to October, it said. That’s up from the £276m it reported in the same 2021 period.

I think the critical role that DS Smith’s products play in e-commerce should deliver exceptional profits growth in the coming years. It’s also my belief that sales should rise following its decision to ditch plastic packaging amid accelerating customer demand for greener solutions.

I bought my DS Smith shares back in 2018. I plan to hold them for the long haul.