International Consolidated Airlines (LSE: IAG) shares soared by as much as 10% yesterday. This comes on the back of a bullish update. Could this pop spark a rally and mark a turning point for the stock?

Higher than expected

In tandem with competitor easyJet, IAG released a solid statement, reassuring investors of its outlook. The airline only expects to report its complete set of figures in two weeks’ time. Nonetheless, sentiment from the board was generally positive. As such, it’s understandable why investors were optimistic about IAG shares.

“Trading during the third quarter has been better than expected due to passenger revenue strength. As a result, we now expect pre-exceptional operating profit for the third quarter to be in the region of €1.2bn. Forward bookings remain at expected levels for the time of year, with no indication of weakness, and accordingly our fourth quarter expectations remain unchanged as of today.”

CFO Nicholas Cadbury

Given the board’s previous outlook of achieving profitability by the end of the year, this wasn’t too much of a surprise. However, given the current macroeconomic climate, optimism surrounding IAG shares have been muted since its Q2 results.

Chilly winter

It isn’t clear skies for IAG just yet, though. The company still faces a number of headwinds in the short and medium term. Although Heathrow has agreed to lift its cap on passenger numbers, the bigger picture doesn’t look as rosy. While Europe’s busiest airport is expecting a busy Christmas period, it expects a cooldown in travel demand going into 2023.

Even though IAG’s Q3 and Q4 numbers are expected to come in hot, it worries me that the airline may not be able to maintain its momentum going into the new year. For that reason, I’m worried that any recovery in IAG shares could be short lived.

It’s also worth mentioning that given the current macroeconomic environment, it could be a matter of time before the slowdown in consumers’ discretionary spending catches up to IAG’s top line. A recession is being penned in for 2023 after all. Not to mention, travel to Asia still remains at low levels. Therefore, the outlook for next year remains uncertain.

Turbulent times ahead

So, do I think IAG shares are worth a position in my portfolio? Well, I’ve no doubt that it will continue its path to recovery. Having said that, I believe it’ll face a tough 2023 to maintain profitability while returning to pre-pandemic levels. This is also why analysts only predict a 30% upside to its current share price.

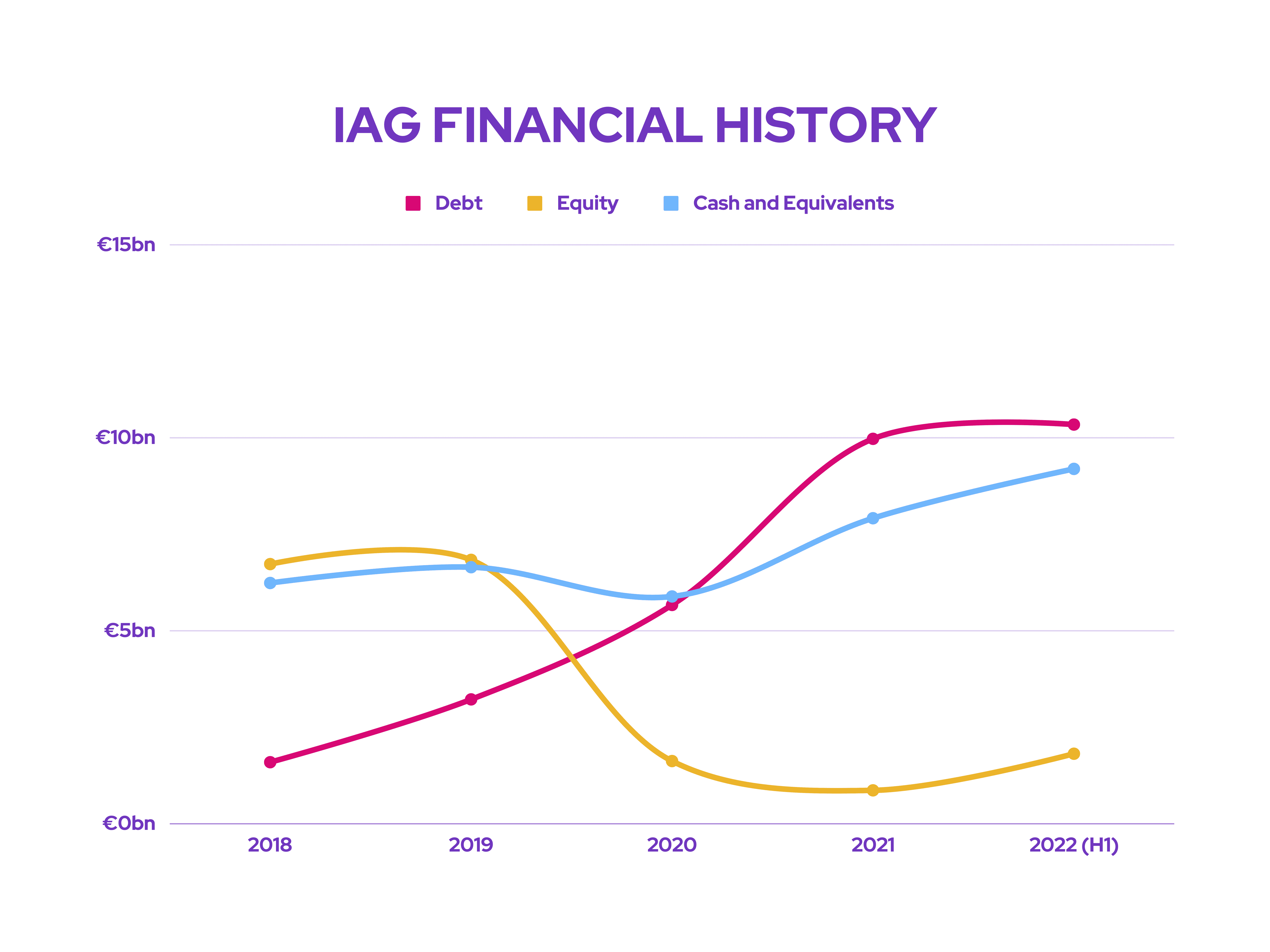

Management is going to have to find the right balance between growth and margins during a cost-of-living crisis. And they’ll have to do this while keeping the company’s debt in mind. IAG still has an abundance of debt to repay, and the longer it puts it off, the more it’s going to cost the firm.

It’ll be interesting to see what the board’s outlook is when IAG announces its full results at the end of the month, nonetheless. Along with this, I’m keen to see how much fuel it’s hedged, and at what price. This could ultimately impact its bottom line moving forward. But for now, I won’t be buying IAG shares.