Lloyds (LSE: LLOY) shares have struggled somewhat this year, declining 14% amid a wider drawdown in FTSE 100 stocks. In my view, the current economic climate holds both risks and opportunities for the bank’s shareholders.

Let’s explore three factors that I believe could determine the next move for the Lloyds share price.

The housing market

Lloyds is the UK’s largest mortgage lender. It corners around 18% of the British market, with the closest competitor NatWest claiming 12%. Accordingly, the black horse bank’s fortunes are closely linked to fluctuations in domestic real estate prices.

The housing market may have already entered a more sustained period of slower growth.

Kim Kinnaird, director at Halifax Mortgages

With hundreds of mortgage deals pulled from the market in recent weeks and the average five-year fixed-rate offer breaching 6%, many experts are beginning to take a gloomy view on the future for UK property. Indeed, Halifax (which is part of Lloyds Banking Group), is among those making bearish calls.

This could spell trouble for Lloyds shares. The bank’s net income would likely drop in the event households struggle to keep up with mortgage payments. Nonetheless, taking a longer-term view, the UK has a persistent problem with housing supply, which acts as an ongoing tailwind.

Overall, a robust balance sheet should allow the bank to ride any potential short-term volatility that affects its mortgage-dominated loan book in my view.

Interest rates

In addition to the Bank of England’s special operation in the gilts market, another consequence of the government’s new fiscal policies is the prospect of higher interest rates. Some experts are predicting the base rate could almost treble to 6% next year.

Rising interest rates are traditionally viewed as good news for banking shares. The reasoning behind this is that they can increase the interest on loans they make. On the face of it, this is positive for Lloyds, but it could be a Catch-22 situation if tightening monetary policy raises the likelihood of a UK recession.

A possible recession

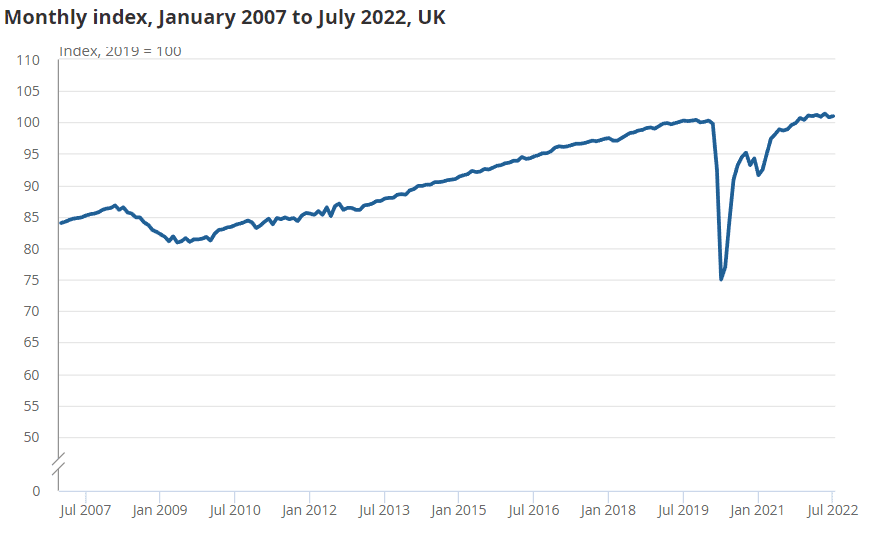

So how likely is a recession? It’s a difficult question to answer, but the latest ONS data on UK GDP growth reveals anaemic progress with a 0.2% expansion in July 2022. Rising borrowing costs combined with elevated geopolitical uncertainty fuelled by the war in Ukraine will continue to weigh on UK plc in my view.

Given its greater domestic focus than rivals Barclays and HSBC, a recession in Britain could be particularly harmful for Lloyds if there’s an increase in the number of bad loans.

There’s a risk the bank might respond to a financial crisis by slashing dividend payments, as happened in 2007. This concerns me as the 5% dividend yield is one of the stock’s most attractive features in my opinion.

Would I buy Lloyds shares today?

The outlook for Lloyds is mixed in my view. I can see strength in both the bull and the bear case. Much will depend on wider economic developments.

I already own a number of Lloyds shares. In light of the uncertain future, I’m comfortable with my present position. I won’t be buying more shares today, but I won’t sell my existing holdings either.