While a stock falling 40% is usually a cause for concern, I don’t see this as the case with Scottish Mortgage (LSE: SMT) shares. In fact, the drop in price could very well be a buying opportunity for my portfolio.

After every storm comes a rainbow

The decline in the trust’s share price can be attributed to its heavy weighting towards growth stocks. These equities don’t fare particularly well during a bear market, as has been the case in both the US and China, where Scottish Mortgage’s top holdings are based. While these are the cause of the fund’s weakness, they also now present me with an opportunity to buy the shares at a discount.

| Scottish Mortgage Investment Trust Holdings | Holding % |

|---|---|

| Moderna | 7.1% |

| Tesla | 6.5% |

| ASML | 5.5% |

| Illumina | 4.3% |

| Tencent | 3.7% |

| Meituan | 3.6% |

| Space Exploration Technologies | 3.0% |

| Amazon | 3.0% |

| Northvolt | 2.9% |

| NIO | 2.6% |

Since the last quarter, the FTSE 100 fund has opted to shift around a number of its top holdings. The likes of Alibaba, Nvidia, and Kering have taken a back seat, while Space Exploration Technologies, Northvolt, and NIO take their place.

Should you invest £1,000 in ITM Power right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if ITM Power made the list?

Concrete opportunities

Scottish Mortgage hasn’t had the best luck over the past year. It’s suffered a combination of rising interest rates and Chinese lockdowns. These have led to staggering declines for growth stocks, which get their valuations from future cash flows. Nonetheless, with Covid officially declared endemic in most countries and China slowly reopening, the path is set for a potential rebound.

In addition to that, Scottish Mortgage presents other long-term growth opportunities with its American names. For one, Moderna will be preparing for multiple product launches that include vaccines for flu and other viruses. These shots are all currently in stage three trials and if successful, could continue Moderna’s success. Moreover, Tesla recently announced a record number of vehicles produced with lots more to come as demand for electric vehicles shows no signs of waning. Meanwhile, ASML has a global monopoly on extreme ultraviolet lithography machines used by semiconductor foundries. As such, the world’s third-biggest semiconductor equipment maker has a bright future ahead.

Trust the process

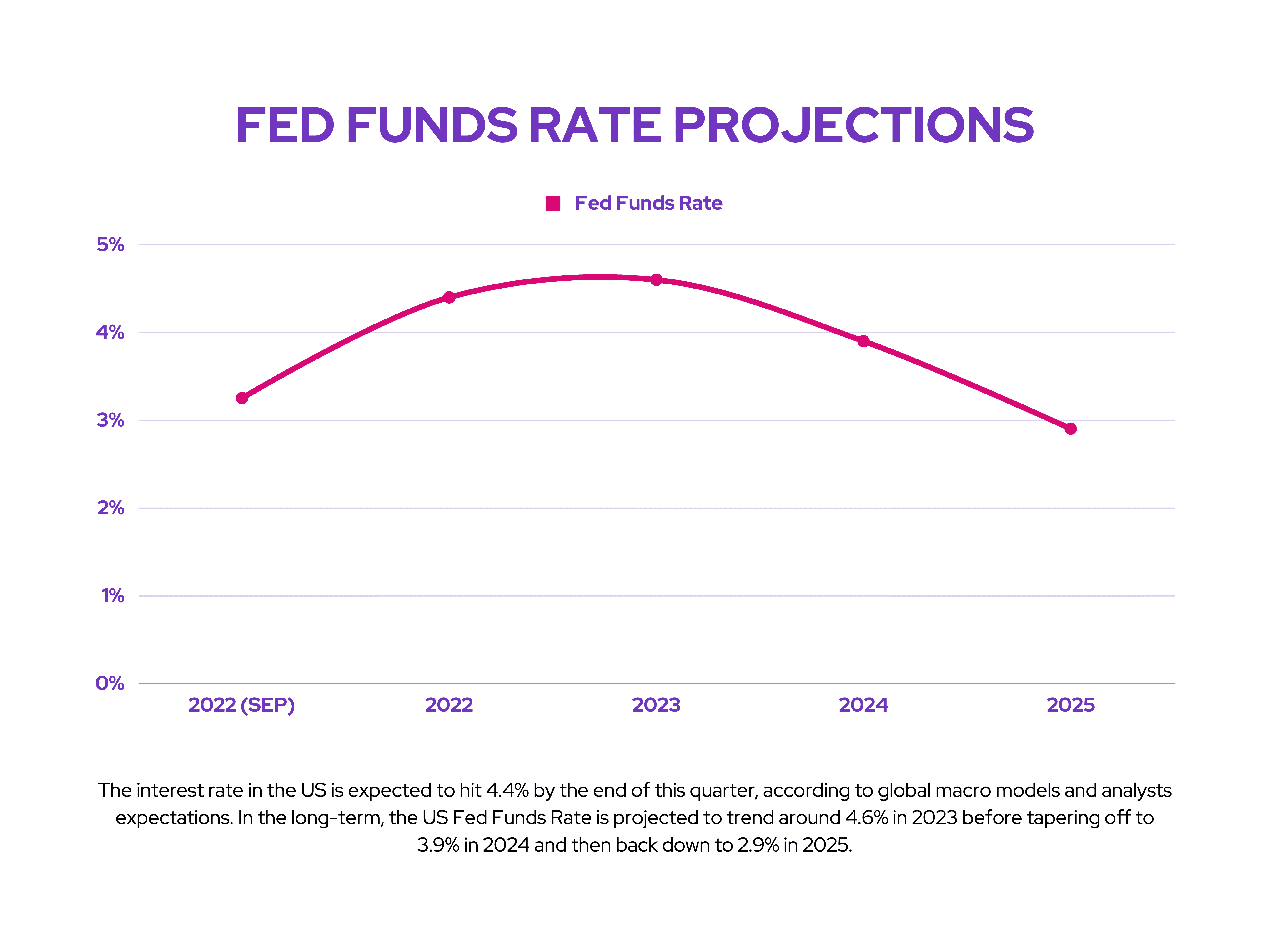

So, does this mean Scottish Mortgage shares are set to explode from here? Well, not necessarily. While the start of Q4 has seen investors sparking a relief rally in hopes that the Federal Reserve in the US will pivot on its interest rate hikes soon, Fed funds futures seem to tell a different story. Thus, the risk remains that the US central bank could still overreact and cause a recession.

Additionally, there’s the risk that China reverts to locking down once again, which could ruin any recovery in the Scottish Mortgage share price. This has happened on several occasions, making Chinese stocks something of a double-edged sword. I’ll be keeping a close eye on Chinese politics, as well as statements made by Fed members.

Nevertheless, I’m convinced that the impact of lockdowns and inflation will be minimal in five years’ time. This is the timeline that Scottish Mortgage manager Baillie Gifford sets out for investors to expect a meaningful return. I’m confident in its ability to generate excellent returns. This is why I’ll buy the shares for my portfolio. And I’ll buy regularly to smooth out my overall price (known as pound cost averaging) if its share price continues to head lower. After all, the fund has an excellent track record of beating the market over the long term.