Inflation has been running rampant this year. As a result, share prices of non-energy-related companies have suffered due to waning consumer demand. Nonetheless, there are a couple of shares that have been able to pull their weight, with Unilever (LSE: ULVR) being one of them. As such, could Unilever shares be a good inflation hedge for my portfolio?

Good Degree of progression

Looking at Unilever’s stock performance year-to-date against the FTSE 100, I can see it’s done relatively well. Its share price is largely unmoved while the UK index has declined by about 5%. Additionally, Unilever has a 3% dividend yield that has helped investors further hedge against the impact of inflation on their investments.

What’s behind the robust Unilever share price performance then? It can be attributed to its strong brand presence paired with demand inelasticity for most of its products. These brands tend to be staples such as Dove, Knorr, Cif, and more. Hence, the company can maintain its already excellent profit margins by passing on higher costs to consumers. This was evident in the half-year results that saw numbers coming in above consensus.

| Metrics | Amount (H1 2021) | Analysts Earnings Estimates (H1 2022) | Amount (H1 2022) |

|---|---|---|---|

| Revenue | €25.8bn | €29.0bn | €29.6bn |

| Underlying Earnings per Share (EPS) | €1.33 | €1.27 | €1.34 |

A new Dawn

That said, despite the strong performance, investing in Unilever shares involves a couple of risks. For one, CEO Alan Jope is planning to leave at the end of 2023. This is partly due to pressure from unhappy investors after Unilever bungled its attempt to buy GSK‘s consumer healthcare business. Renowned fund manager Terry Smith even accused it of losing its focus on profit. Therefore, the long-term outlook for the company remains uncertain as competition for a new CEO is hot, with competitor Reckitt Benckiser also searching.

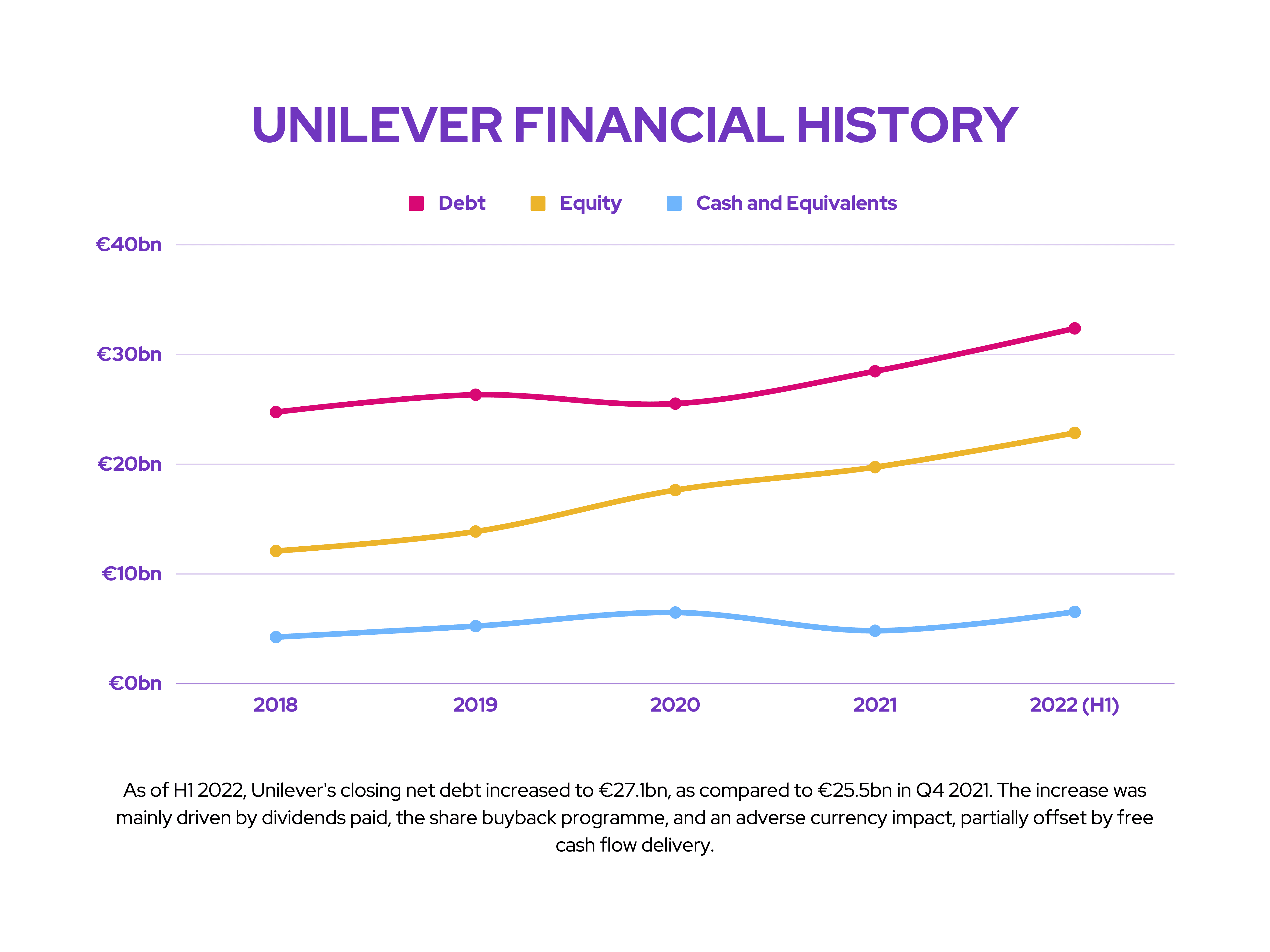

Second, Unilever’s financials aren’t in the best state. Its balance sheet leaves plenty to be desired as it currently has a debt-to-equity ratio of 141.6%. Its debt has also been steadily increasing since 2018 due to dividend payouts. In my opinion, this isn’t good allocation of capital as I’d rather have Unilever pay off debt and shore up cash levels than give out dividends and incur higher debt.

Positive Signal?

So, what do I make of Unilever shares? Well, it’s worth noting that the stock recently received favourable coverage from Goldman Sachs. The investment bank maintains its neutral rating on the stock, but stated that pricing momentum should support the group’s growth outlook.

Consequently, analysts at Goldman expect Unilever to report 8.5% sales growth in Q3, which is higher than the average consensus of 7.9%. Overall, this would translate into full-year growth of 7.8%, compared to the company’s guidance of 6.5%. And with India set to overtake the US as the producer’s largest business region, the emerging market could help boost sales by quite some margin in the medium term.

Nevertheless, I’m still not convinced enough to purchase Unilever shares. While the short-term prospects look decent for the company, I’m less certain about its long-term vision given the state of its balance sheet and departing CEO. I’ve no doubt that the blue-chip stock will do just fine, but I reckon I can boost my wealth by buying shares in companies that have better growth potential and more robust financials.