Paying attention to what legendary investors are getting up to is a good idea in uncertain times. So I’ve been checking out what Warren Buffett has been buying through his company, Berkshire Hathaway.

Buffett might be best known for investments in Apple, Coca-Cola, and Kraft Heinz. But the self-made billionaire also has considerable stakes in certain US oil stocks.

It’s made me wonder: should I consider buying BP (LSE: BP) shares for my own portfolio?

A ‘Big Oil’ fan

According to hedge fund tracking website Hedge Follow, Buffett owns shares worth $23.4bn in Chevron. In fact the oil major accounts for 7.8% of Berkshire Hathaway’s entire portfolio.

Another 3.8% of his investment company’s portfolio is dedicated to Occidental Petroleum. These shares were worth $11.4bn at the last valuation.

In fact Warren Buffett has spent a fortune to buy big stakes in these businesses in 2022. It suggests that the so-called Sage of Omaha is becoming increasingly bullish on the outlook for oil prices.

After all, in 2020 he claimed that “when you buy into a huge oil production company, how it works out is going to depend on the price of oil to a great extent. It’s not going to be your geological home runs or super mistakes or anything like that. It is an investment that depends on the price of oil.”

Why Warren Buffett might like BP

Warren Buffett prefers largely to invest Berkshire Hathaway’s cash on stocks listed in the US. But I think he might like the look of BP. Just like Chevron and Occidental Petroleum, a buoyant crude price would (obviously) also lift profits here.

On top of this, I believe Buffett might like the FTSE 100 stock because of the solid track record it has recently in cutting costs.

The billionaire said in 2006 that “you want a management that, over a five- or 10-year period, discovers and develops oil at lower-than-average unit cost.” He added that he “would pay the people that did that well… because they’re creating wealth for me.”

BP’s upstream unit production costs fell to $6.53 per barrel of oil equivalent in the first half of 2022. This was down 11% year on year and keeps the company’s recent record of solid cost reductions going.

Time for me to jump in?

As I say, I think it’s worth watching what successful investors like Warren Buffett do. But this doesn’t mean that I’ll be investing in BP shares any time soon.

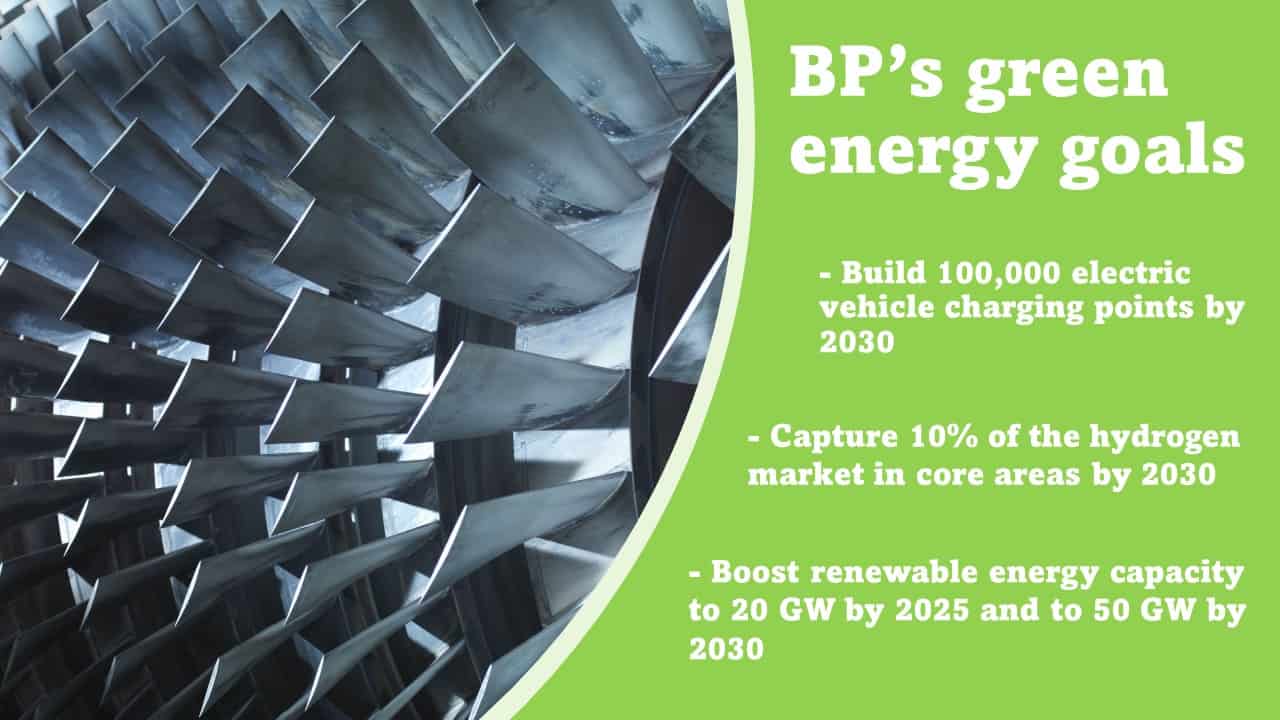

I like the steps the company is taking to embrace the energy transition. As the graphic above shows, the business is investing heavily to capitalise on soaring demand for low-carbon power.

The trouble is that its move towards hydrogen and renewables carries huge execution risks that could smack future earnings. What’s more, BP will still rely on oil to drive group profits for many years to come, a dangerous position as demand is tipped to fall.

McKinsey & Co predict crude prices will range between $50 and $60 a barrel over the long term as consumption declines. This would be a huge reduction from current levels above $90. And I think prices could fall even lower as governments accelerate plans to fight the climate crisis.