The Taylor Wimpey (LSE: TW) share price has been on a steady decline this year. Last week’s events exacerbated its fall even further with its stock now down a whopping 50%. So, should I buy shares in the housebuilder for my portfolio?

Heavy winds

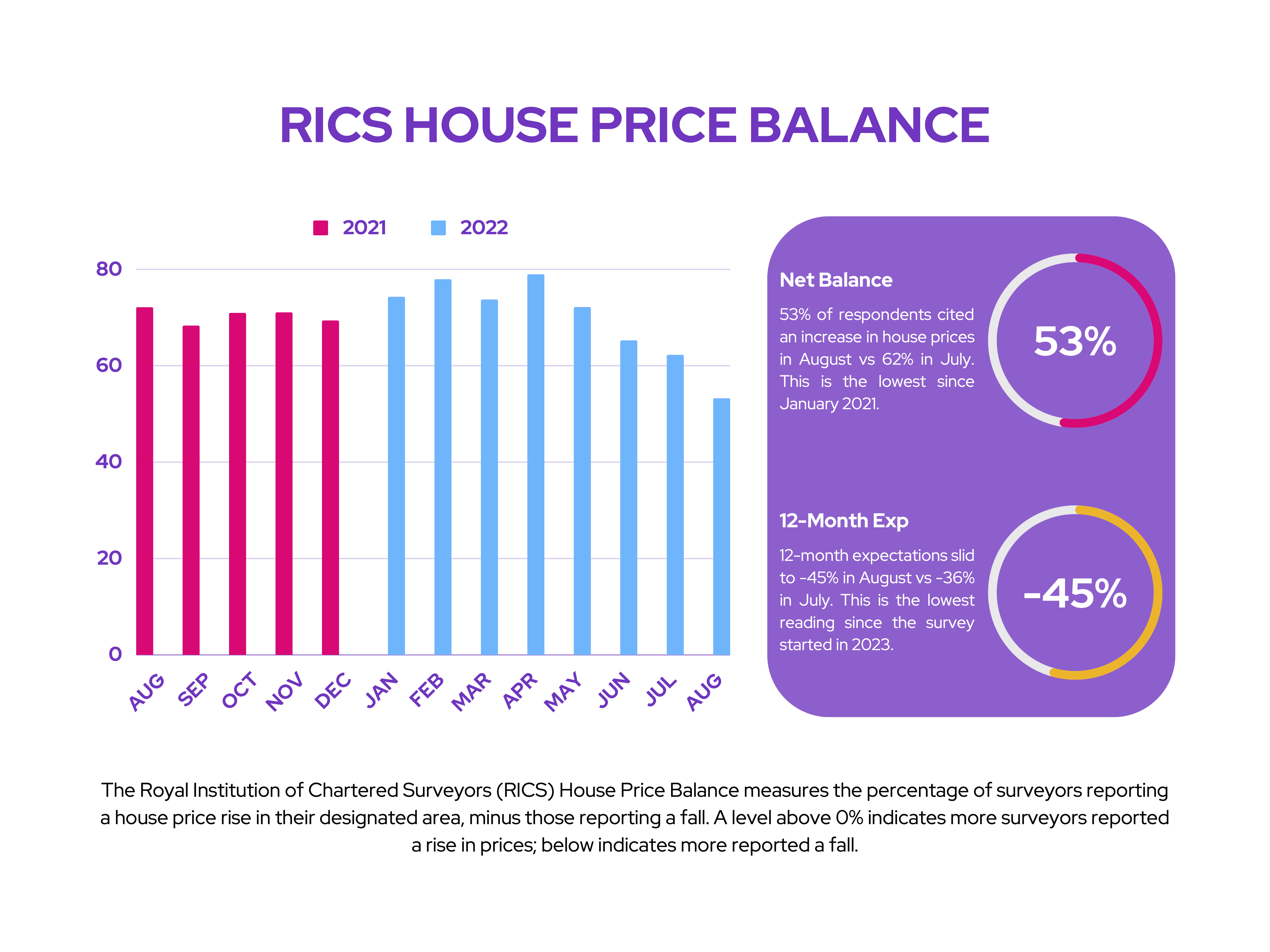

Fears of a declining property market have been making the news for the past couple of months. This has been evident in the most recent housing data. Reports from the likes of Nationwide, Halifax, and RICS have all been pointing towards a declining market as of late. All this data doesn’t bode well for housebuilders such as Taylor Wimpey.

To rub more salt into the wound, Taylor Wimpey’s lack of projects in London and the south east could see its top line impacted more than its peers. This is because houses in those regions tend to be more insulated against crashes due to unprecedented demand. This is also why the Berkeley share price has managed to outperform the rest of its peers.

Falling dominoes

What caused the Taylor Wimpey share price to drop 15% last week, however, was Kwasi Kwarteng’s new mini-budget which caused the British pound to crash. As such, investors are expecting the Bank of England to radically hike interest rates at its next meeting. This could inevitably bring mortgage rates to highs not seen in decades and be the start of a domino effect in triggering a property market crash as over 2m households have to remortgage at a higher rate next year.

While the latest Taylor Wimpey trading update painted a rather positive outlook, things have turned south very quickly. Management had previously mentioned that higher costs were being offset by higher property prices. However, this was due to demand outstripping supply. As a result, it saw healthy margins with a strong order book. But if mortgage rates spike rapidly, Taylor Wimpey could face cancellations flooding in, and see its top and bottom lines significantly impacted.

Strong foundations

Brokers and economists have been predicting a property market crash of anywhere between 10% to 20% over the next two to three years. However, with the Taylor Wimpey share price down 50%, I believe its shares are currently in oversold territory. While the short term could present further downside, I believe the long-term prospects surrounding the company and the UK property market remain bright.

The firm’s balance sheet is rock solid, after all. With a debt-to-equity ratio of 2%, consisting of £4.28bn in cash and only £87m of debt, the company is undoubtedly in an excellent position to weather a property market crash. I also have confidence in CFO Chris Carney to allocate capital efficiently as he has a good track record of capital discipline.

Additionally, it’s worth pointing out that no revisions to the company’s price target have been made thus far. Analysts still rate Taylor Wimpey a moderate buy. Moreover, it still holds an average price target of £1.47, presenting a 65% upside. Therefore, I’ll be putting Taylor Wimpey on my watchlist for now, and may consider buying shares if its share price continues to go lower.