Bank shares have had a tumultuous time. Last week, British banks saw monumental declines across the board and Lloyds (LSE: LLOY) was no exception. So, here’s why the stock lost 10% of its value, and whether I’ll be adding to my current position.

Gilt-y sell-off

When Chancellor Kwasi Kwarteng unveiled the country’s new mini-budget just under two weeks ago, a massive sell-off in government bonds (gilts) followed. This is because holders lost confidence in the government’s ability to pay off its debt, thus making its gilts a high-risk investment.

As a result, the British pound tumbled to lows not seen since the 1980s. In order to mitigate the collapse, the BoE stepped in to buy these gilts. However, it will still have to raise interest rates sharply to further tame inflation and claw back the value of the pound.

A toxic relationship

So what does all this have to do with Lloyds? Well, mortgage rates and interest rates have a rather direct relationship. A radical hike at the next monetary policy committee could see even the best two-year fixed mortgage rates go as high as 6.5% by mid-2023. In anticipation of an emergency rate hike, high street banks were quick to pull their mortgage deals last week, with over 40% of deals scrapped in a matter of days.

Lloyds is the nation’s biggest mortgage provider. Therefore, its main revenue source may have a very bumpy road ahead. And it doesn’t help that economists have predicted a housing market crash of as much as 20% over the next two to three years.

With over 2m households having to remortgage next year, Lloyds’ top and bottom lines could see massive drops as households struggle to repay their mortgages. This would mean that the ‘black horse’ bank would have to allocate further provisions, impacting its net income and its share price as a result.

Shaky ground

While higher interest rates do improve the FTSE 100 bank’s margins through higher net interest income, these gains could be offset by the amount of bad debt and lack of loans due to higher mortgage and interest rates. Additionally, its appeal as a dividend stock will also be at risk. Lloyds may have to pause payouts to cover bad debts from defaulting customers.

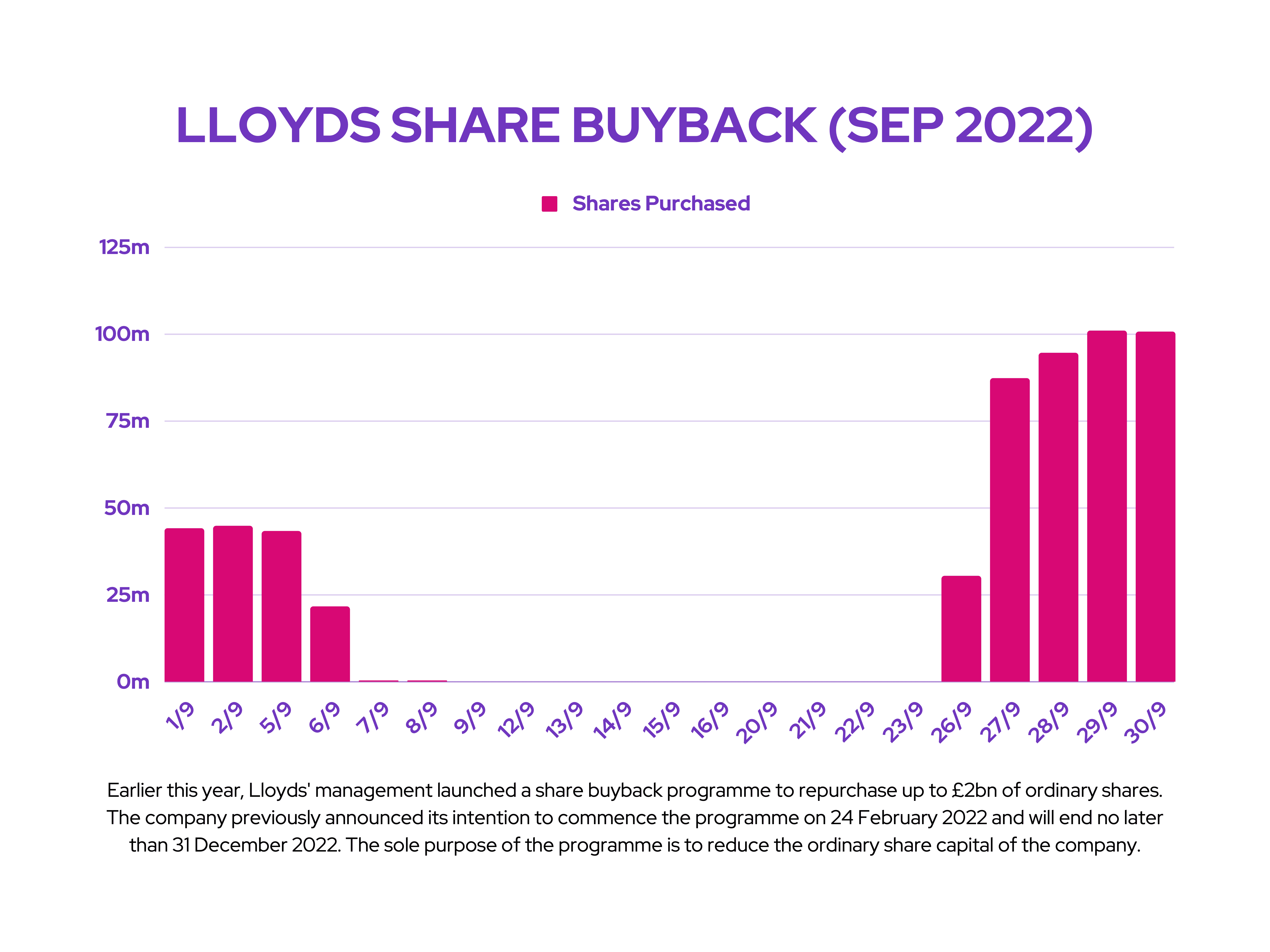

Nonetheless, it’s worth noting that Lloyds has attempted to shore up some investor confidence in recent days. Since the Lloyds share price tumbled, management has been buying back shares hand over fist. This means that the business thinks that its current share price is undervalued. After all, it slowed down its buybacks when the share price was at a much higher level between 7 September and 23 September. That being said, the future for the Lloyds share price remains cloudy as new policies stay on shaky ground with further details yet to be announced.

It’s worth noting that there haven’t been any revisions to Lloyds’ price target thus far. The stock still has an average rating of a ‘moderate buy’ with an average price target of 66p. For that reason, I’ll be holding onto my position for the time being.