The Rolls-Royce (LSE: RR) stock price nosedived as the COVID-19 pandemic rattled markets in early 2020. Stock markets have staged a meaningful recovery since then. Rolls-Royce stock has not. Here’s why.

Flight times

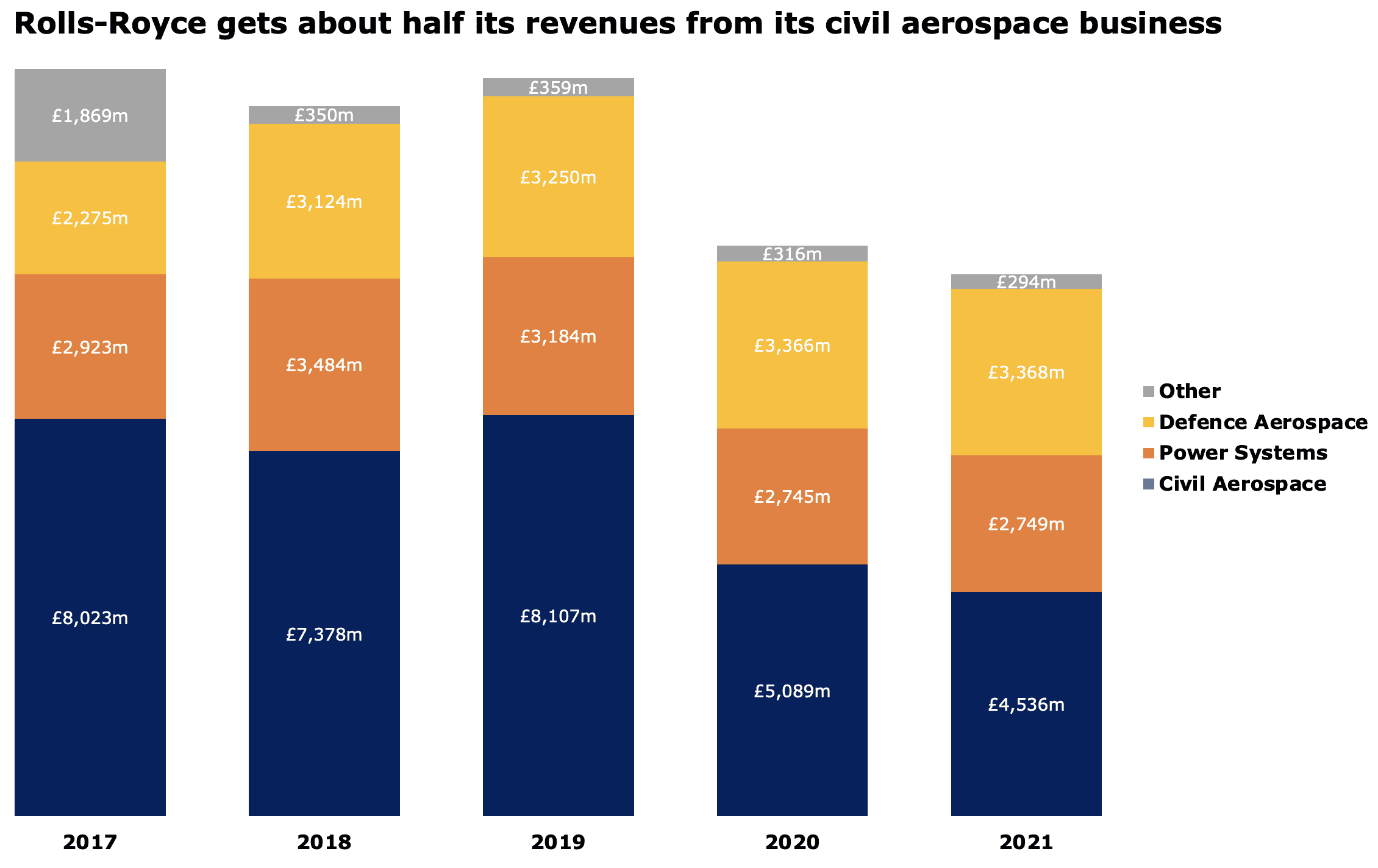

Rolls-Royce makes aircraft engines. But, it doesn’t collect as much revenue from selling the engines as it does from servicing them. Take 2019, for example. Rolls-Royce took £8,107m in revenue from its civil aviation business. But, 60% of that came from after-market services. When the pandemic hit, aircraft stopped flying. When aircraft are not flying, their engines do not require much in the way of servicing. So, Rolls-Royce saw a significant chunk of revenue and, perhaps more importantly, steady cash flow evaporate when the pandemic hit.

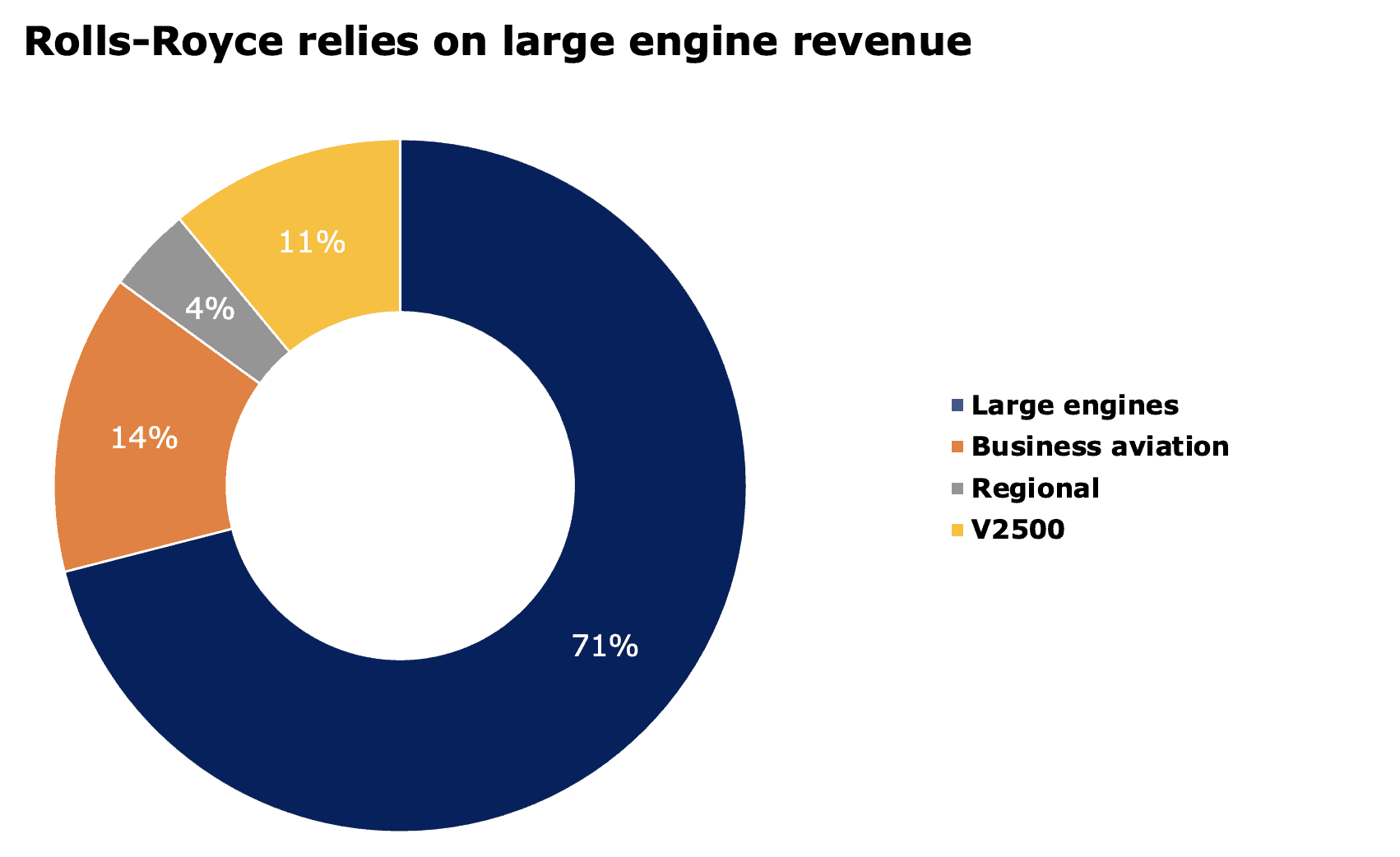

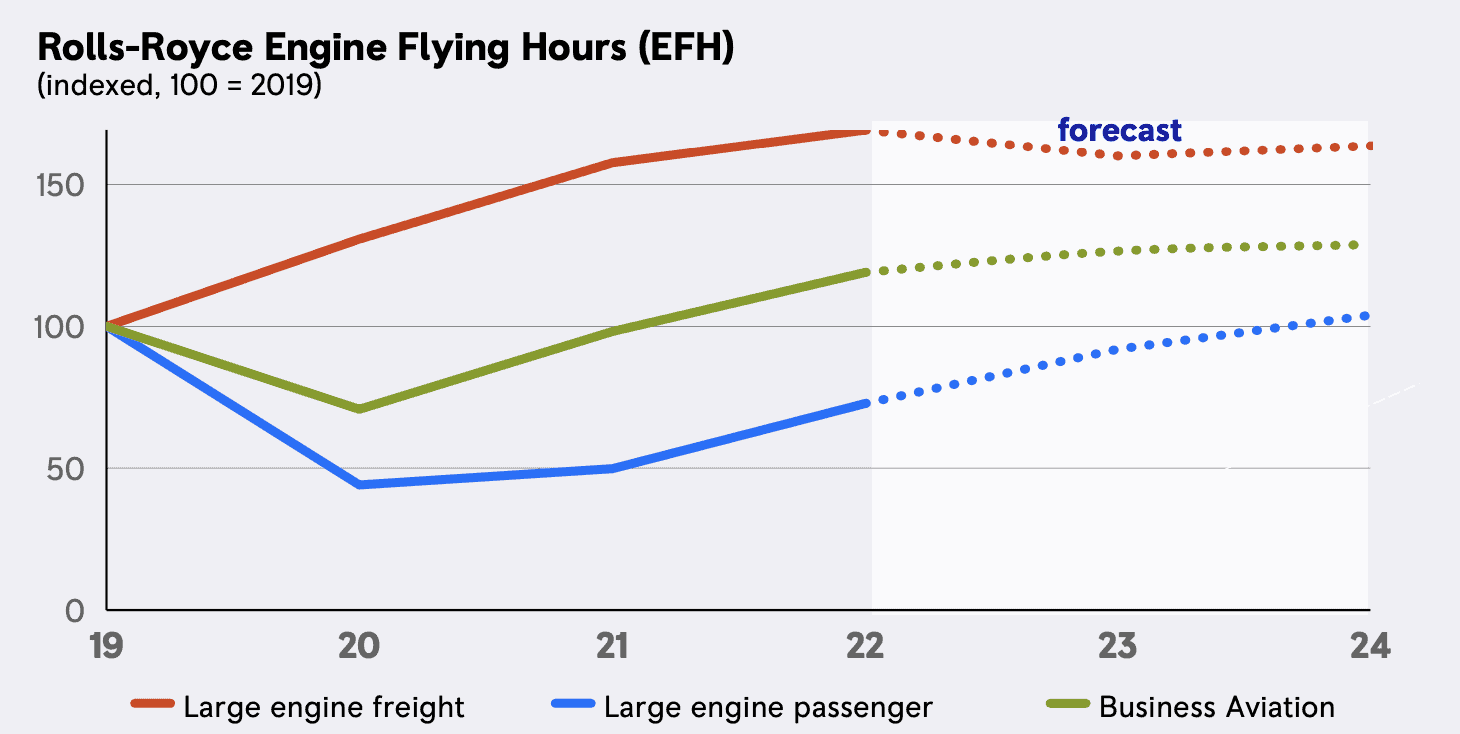

For the Rolls-Royce stock price to gain altitude, planes must start flying again, particularly wide-body ones. These fly long-haul routes and have large engines slung under their wings. Rolls-Royce leant heavily into the large engine market before the pandemic. That might have been a mistake, as long-haul air travel seems to have been pivoting to narrowbody aircraft even before the pandemic.

Planes are taking to the skies again. However, in line with other industry forecasts, Rolls-Royce does not see large engine passenger flying hours returning to pre-pandemic levels before 2024. Therefore, Rolls-Royce cannot expect its revenues to bounce back until then, either.

Of course, Rolls-Royce does have other business segments. However, Civil Aviation is by far the largest. The ups and downs of the aviation business will likely continue to dominate the mood around the Rolls-Royce share price until at least 2024.

Debt and dilution will drag on the Rolls-Royce stock price

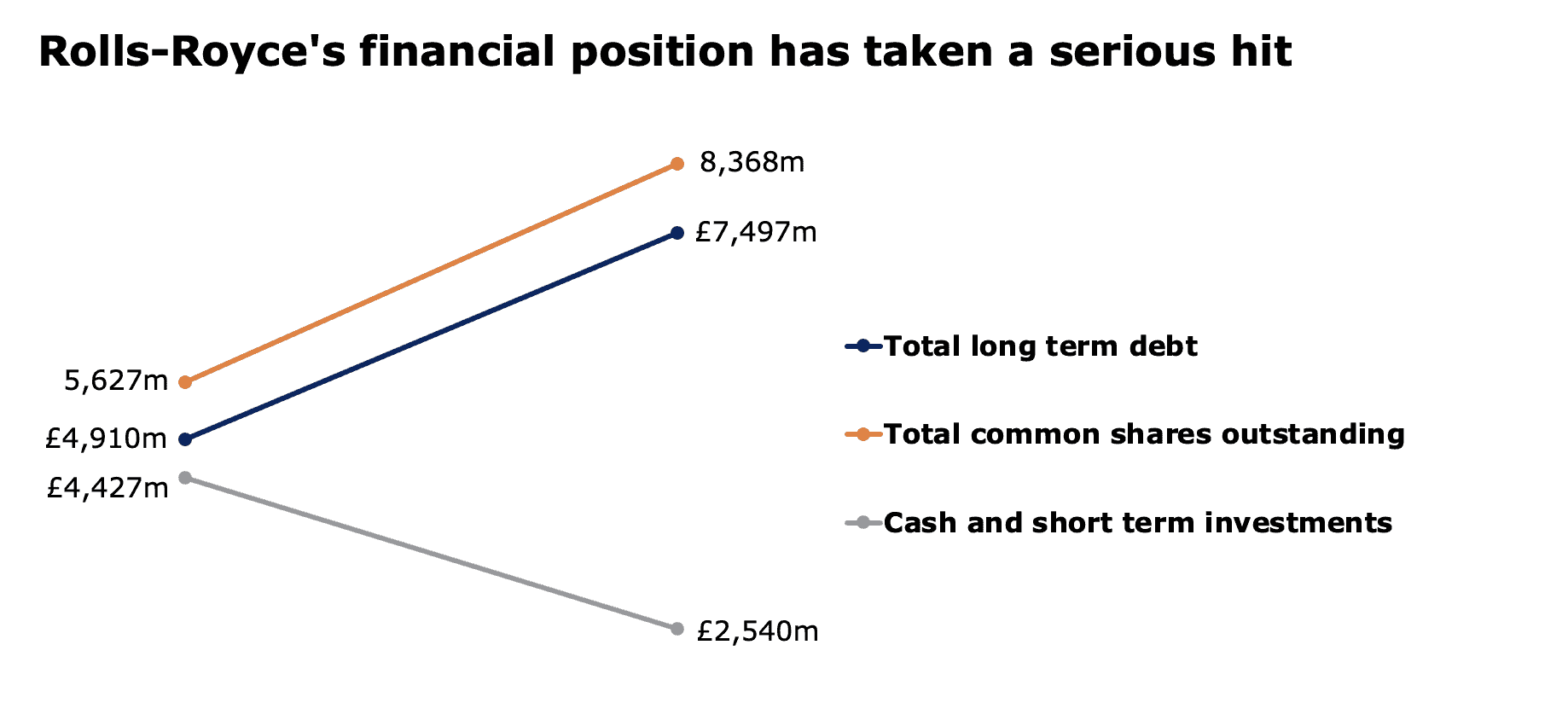

The drop in cash flow during the pandemic forced Rolls-Royce into emergency measures. It cut its dividend and significantly changed its balance sheet and business operations.

Rolls-Royce’s long-term debt almost doubled from £4,910m to £7,497m between 2019 and 2021. Without this debt raise, the company might not have survived. In addition, it sold new shares to raise funds in the form of equity. The common share count of the company rose from 5,627m to 8,368m over two years. To make matters worse, it sold the shares at knockdown prices as the Rolls-Royce’s stock price had collapsed. Despite all of this, the company’s cash position worsened significantly.

Rolls-Royce has raised some cash through asset sales of underperforming and non-core businesses. A restructuring effort seems to have started to improve its operating margin. Then there are forrays into green technologies to get excited about alongside that 2024 forecast for a return to form for Rolls-Royce’s biggest business.

But, shareholders old and new own a far smaller slice of Roll-Royce, and claim on its earnings, than they did in 2019. Until the balance is paid down, debt holders will collect lofty interest payments that could have been reinvested into the business or paid as dividends. I don’t think it’s over for Rolls-Royce, nor do I thinks its best days are behind it. But I do believe a Rolls-Royce stock price recovery will take years.