Rolls-Royce (LSE: RR) shares have proved a volatile investment in recent times. Yet today it remains a popular FTSE 100 stock thanks to its reputation as an industrial heavyweight.

Rolls-Royce is one of Britain’s most successful and proudest engineering stories. It invented the luxury automobile market with its first car in 1904. Its Merlin engines later helped the Royal Air Force win the Battle of Britain, and today Rolls is the world’s third-largest supplier of commercial engines.

Money trap

But despite these landmark successes the business has a long history of corporate turbulence. In the past decade alone it’s had to swallow huge fines related to historic corruption, endured sinking demand for its Trent 700 engines, and more recently had to watch on as Covid-19 grounded the global aviation industry.

As a result, Rolls-Royce’s share price has continued to crumble. Had I invested £1,000 in the engineer a year ago my shares would now be worth £674. And unfortunately the business hasn’t been paying a dividend to cushion this blow.

But past performance is not always a reliable indicator of the future. And someone who’s made large losses over the past year may still be optimistic that Rolls will prove a lucrative investment in the coming decades.

As a long-term investor myself, should I consider buying Rolls-Royce shares today?

Three reasons to like Rolls-Royce shares

As a leading aviation technology provider, Rolls could see demand for its engines and its aftermarket services soar if, as expected, the civil aviation sector grows strongly in the coming decades.

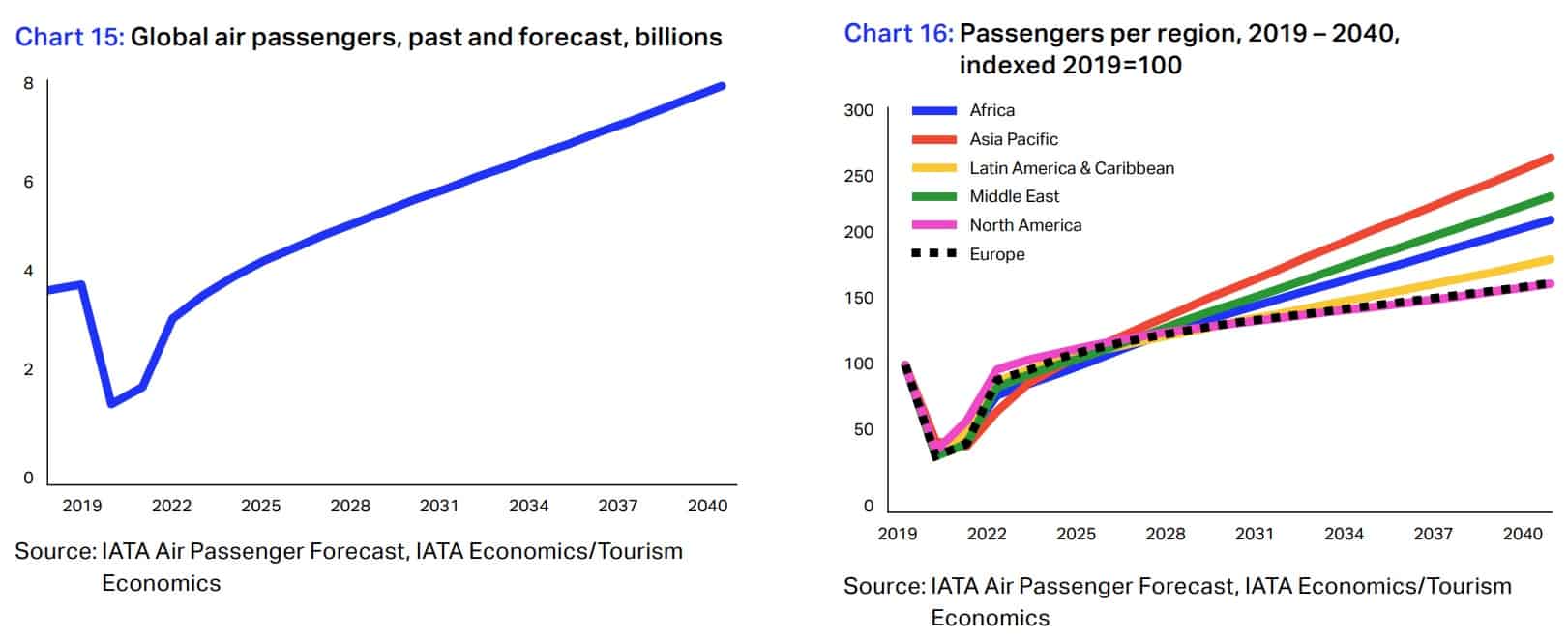

The International Airt Transport Association (IATA) thinks that global passenger numbers will reach pre-pandemic levels by 2024. And it predicts the industry will “expand substantially” over the next two decades, resulting in an average 3.3% annual increase in traveller numbers between 2019 and 2040.

At the same time, sales of Rolls-Royce’s hardware to military customers could take off as the geopolitical landscape deteriorates.

The company’s Defence division booked orders of £1.4bn between January and June, pushing its total order book to £6.5bn. Business could remain bubbly too as the West worries about a ‘Cold War 2.0’ and rising tensions with China.

I also think Rolls-Royce’s development of green technologies could prove lucrative as the fight against global warming intensifies. Its programmes include creating its fuel efficient UltraFan jet engine and designing a fleet of nuclear reactors for the UK.

Too much risk

Despite these positives, Rolls-Royce is a share that I’m not tempted to buy for the moment.

My chief concern as an investor is the company’s weak balance sheet. Net debt continues to rise and clocked in at £5.13bn as of June. Rolls is facing a steady increase in the cost of servicing this debt too as interest rates soar.

Such huge liabilities could significantly affect Rolls-Royce’s ability to invest for growth. It also casts doubt on when the business will restart dividend payments as well as the size of future payouts.

Finally, Rolls’ fragile financial position could see the company try to tap shareholders for more cash if the global economy keeps sinking and its markets cool.

Rolls-Royce’s share price could well bounce back strongly. But at the moment I think the risks of owning this share remain far too high.