Investing in FTSE 100 shares has long been a great way to build long-term wealth. I believe the importance of buying blue-chip shares is rising too as pensioners’ finances come under increasing strain.

The age at which Britons can claim the State Pension is rising. At the same time, the rate at which the benefit is growing continues to lag the rate at which living and social costs soar. And it’s my opinion that things could get worse as the UK grapples with its high debts and rapidly ageing population.

£364,200!

I’ve built a portfolio packed with FTSE 100 shares. And I plan to continue investing in the index to help me retire in comfort.

In the past decade the index has delivered an average annual return of 7.38%, according to IG Group. If this rate of return continues (which isn’t guaranteed), an investor who buys £300 worth of FTSE index stocks each month for 30 years could have more than £364,200 to retire on.

A FTSE 100 stock I’ve bought

Investors can buy a FTSE 100 tracker fund to try and build wealth with London’s premier share index. As the name suggests, this investment vehicle tracks the performance of the index and pays out dividends.

But I prefer to buy individual stocks. This is because I think that, after doing some careful research, I have a chance to make a better return than the-almost 8% long-term Footsie average.

For example, Ashtead Group (LSE: AHT) is a FTSE 100 stock I invested in during 2019 and again in mid-2022. Here I’ll explain why I think it could help me to retire comfortably.

Expanding for growth

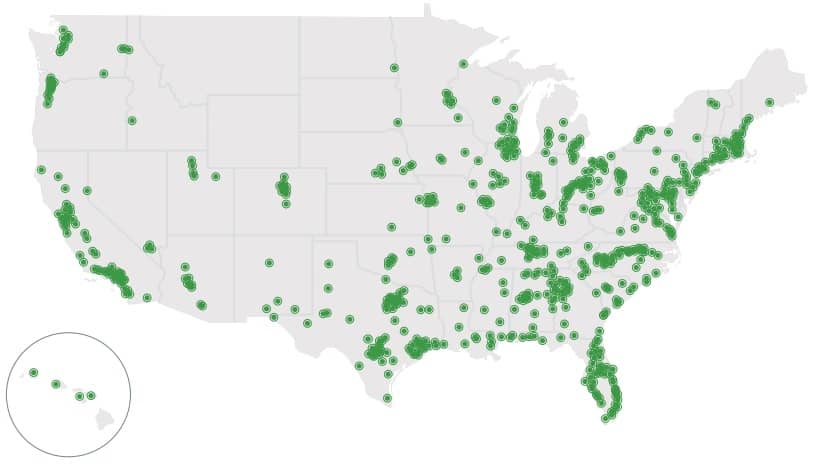

Ashtead rents out industrial equipment across the globe. Its main market is the US where it’s aggressively expanding to build market share. Its Sunbelt division commanded a 12% share as of April, making it the industry’s second-largest player.

The company’s hunger for acquisitions in fact allowed it to deliver the best returns across the entire FTSE 350 during the last decade. Refinitiv data shows that £1,000 invested here at the start of 2010 would have made an investor more than £35,600 at the end of 2019.

Pleasingly Ashtead remains committed to expanding its North American footprint too. The FTSE 100 firm spent a whopping $1.3bn on bolt-on acquisitions in the 12 months to April. Its formidable cash flows should give it ample room to continue investing heavily in acquisitions and organic growth too.

Developing a business through mergers and acquisitions can be dangerous. They can throw up unexpected integration problems and revenues can disappoint, to name a couple of pitfalls. But as an investor in Ashtead myself, I find the company’s excellent track record on this front extremely reassuring. I think it could make me a lot of money by the time I come to retire.