I could buy AIM stock Renold (LSE: RNO) for 23.5p per share at the time of writing. If I had bought in May 2020, near the 20-year low price of 6.9p, I’d be sitting on a 246% gain. Alas, I did not. But then again, if I had bought in July 2015, at around 82p, then I would be down 72%.

It looks like I am dealing with a turnaround situation, given the highs and lows in the stock price. But before I deal with that, there is something I need to address.

Renold is an AIM stock?

Renold—founded in 1879—makes power transmission products like clutches, couplings, gears and gearboxes, sprockets, and industrial chains. How can a company founded in the 19th century, whose shares were first admitted for trading on the London Stock Exchange (LSE) in 1946, be an AIM stock?

Renold was listed on the main market of the London Stock Exchange. But it moved its entire share capital and became an AIM stock in June 2019. Being on AIM means Renold does not have to make acquisition approaches public unless the target’s market capitalisation, net assets, or pre-tax profit is greater than or equal to 100% of Renold’s. On the main market, the limit is 25%.

Renold’s CEO explained the move would allow the company to “execute transactions more quickly, more cost-effectively and with greater certainty“. Shifting to AIM is part of a broader strategy to cut costs and grow revenues after years of struggle — a turnaround.

Chaining together a turnaround

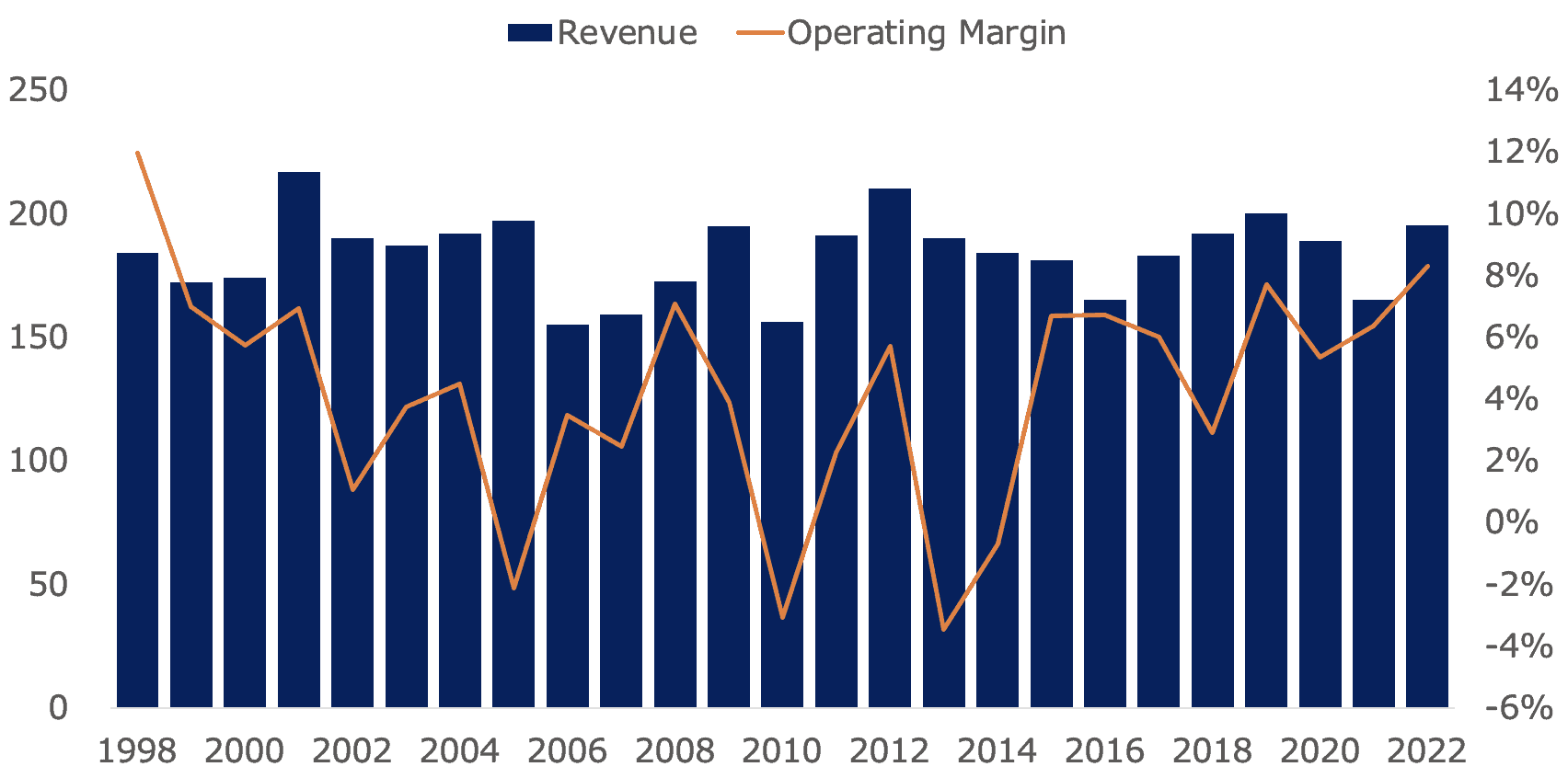

Renold had suffered through years of disappointing revenue growth and deteriorating margins that hurt the company’s share price.

Renold revenue (in millions of pounds) and operating margin (%) from 1998 to 2022

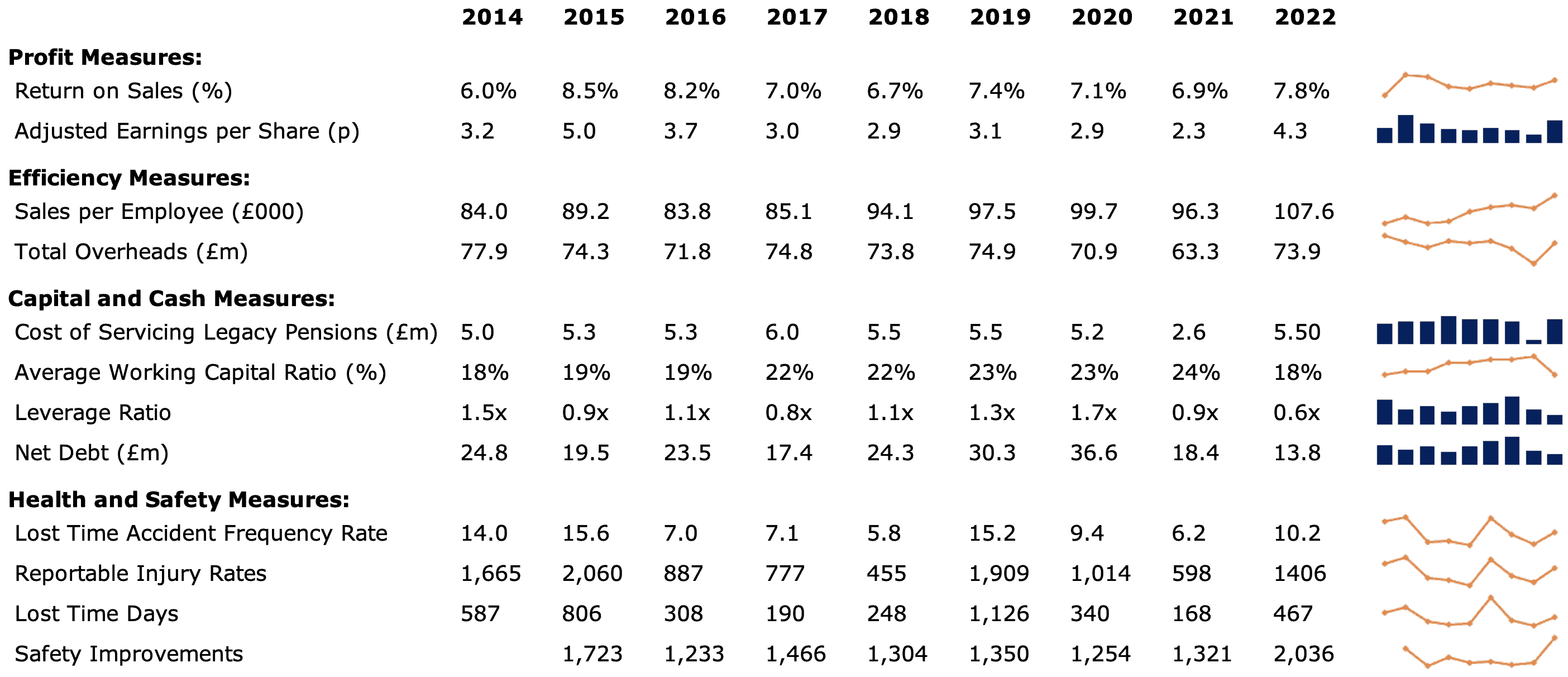

In 2014, a three-phase strategic plan was formalised to turn around the company’s fortunes. Renold managed to increase its revenues from 2016 to 2019 — the year it became an AIM stock. Operating margins were also increasing, explained partly by moving manufacturing to China. This suggests the turnaround plans were working. Then the pandemic hit. However, 2022 revenues bounced back strongly, and margins held up. Importantly, sales per employee are increasing, and total overheads are coming down, a clear sign of increasing efficiency.

Renold key performance indicators from 2014 to 2022

Renold operates in a highly fragmented market, making bolt-on acquisitions easier to come by. Only 7% of its sales are from high-growth economies. So Renold has room to manoeuvre for growth. Can it make meaningful advances and drive revenues beyond all-time highs? I would like to see that happen before I buy, and there is a new strategic plan that might help do this. Also, the company is spending around £5.5m in cash to fund its pension for the foreseeable future, which might drag on its growth potential.

Right now, I will keep an eye on this AIM stock and see if some of my concerns are allayed, but I won’t be buying today for my Stocks and Shares ISA. Sometimes in investing, it pays to wait and see how things develop.