Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as other company news due to their complex nature. Nonetheless, here I’m breaking down this week’s biggest director dealings from three FTSE firms.

Vodafone

Vodafone (LSE:VOD) is a British multinational telecommunications company. It predominantly operates services in Asia, Africa, Europe, and Oceania. The company runs at least some form of operations in over 150 countries.

Following lacklustre numbers from its Q1 trading update, the share price dropped by 5%. It has stayed there since. Despite that though, it’s a sign of confidence when a high-ranking director purchases shares. And this week, Vodafone’s Chairman decided to reinvest his dividends into buying more Vodafone shares.

- Name: Jean-François van Boxmeer

- Position of director: Chairman

- Nature of transaction: Dividend shares

- Date of transaction: 10 August 2022

- Amount bought: 9,975 @ £1.21

- Total value: £12,069.75

Deliveroo

Deliveroo (LSE: ROO) is a British online food delivery company. It operates in over 200 locations across the UK, and is the second-biggest food delivery platform in the country. It also operates internationally with operations in France, Singapore, Australia, and many more.

In this week’s transaction, a director exercised his option to redeem stock compensation. Following this, he opted to sell approximately half of the shares received to cover tax liabilities. That being said, it’s worth noting that this is a monthly occurrence from the company’s CFO. As such, these actions shouldn’t impact investor sentiment surrounding the stock. It’s worth pointing out, however, that the sale of these shares dilute shareholders’ value. This is because there are now more Deliveroo shares floating on the market.

- Name: Adam Miller

- Position of director: Chief Financial Officer

- Nature of transaction: Award shares

- Date of transaction: 15 August 2022

- Amount vested: 83,400 @ £0.96

- Total value: £80,247.48

- Name: Adam Miller

- Position of director: Chief Financial Officer

- Nature of transaction: Sales of shares to cover tax liabilities

- Date of transaction: 15 August 2022

- Amount sold: 40,402 @ £0.95

- Total value: £38,381.90

FirstGroup

FirstGroup (LSE: FGP) is a British multi-national transport group. The FTSE 250 firm is the leading transport operator in the UK and North America. It is widely known for being a provider of public transport, especially buses in the UK.

Rather surprisingly, its shares have managed to outperform the wider UK market index this year. But after the share price took an 11% hit last week, a couple of large director dealings were carried out. The first involves a non-executive director purchasing a substantial number of shares. But what really caught my eye were the conditional share awards that could be awarded to FirstGroup’s CEO and CFO. This should shore up investors’ confidence in the stock, as the group’s management will have to perform and meet investors’ expectations in order for these award shares to vest.

- Name: Sally Cabrini

- Position of director: Non-Executive Director

- Nature of transaction: Purchase of shares

- Date of transaction: 17 August 2022

- Amount vested: 10,000 @ £1.15

- Total value: £11,482

- Name: Graham Sutherland

- Position of director: Chief Executive Officer

- Nature of transaction: Award shares

- Date of transaction: 18 August 2022

- Amount vested: 972,590 @ Nil

- Total value: N/A

- Name: Ryan Mangold

- Position of director: Chief Financial Officer

- Nature of transaction: Award shares

- Date of transaction: 18 August 2022

- Amount vested: 1,003,226 @ Nil

- Total value: N/A

Types of Shares

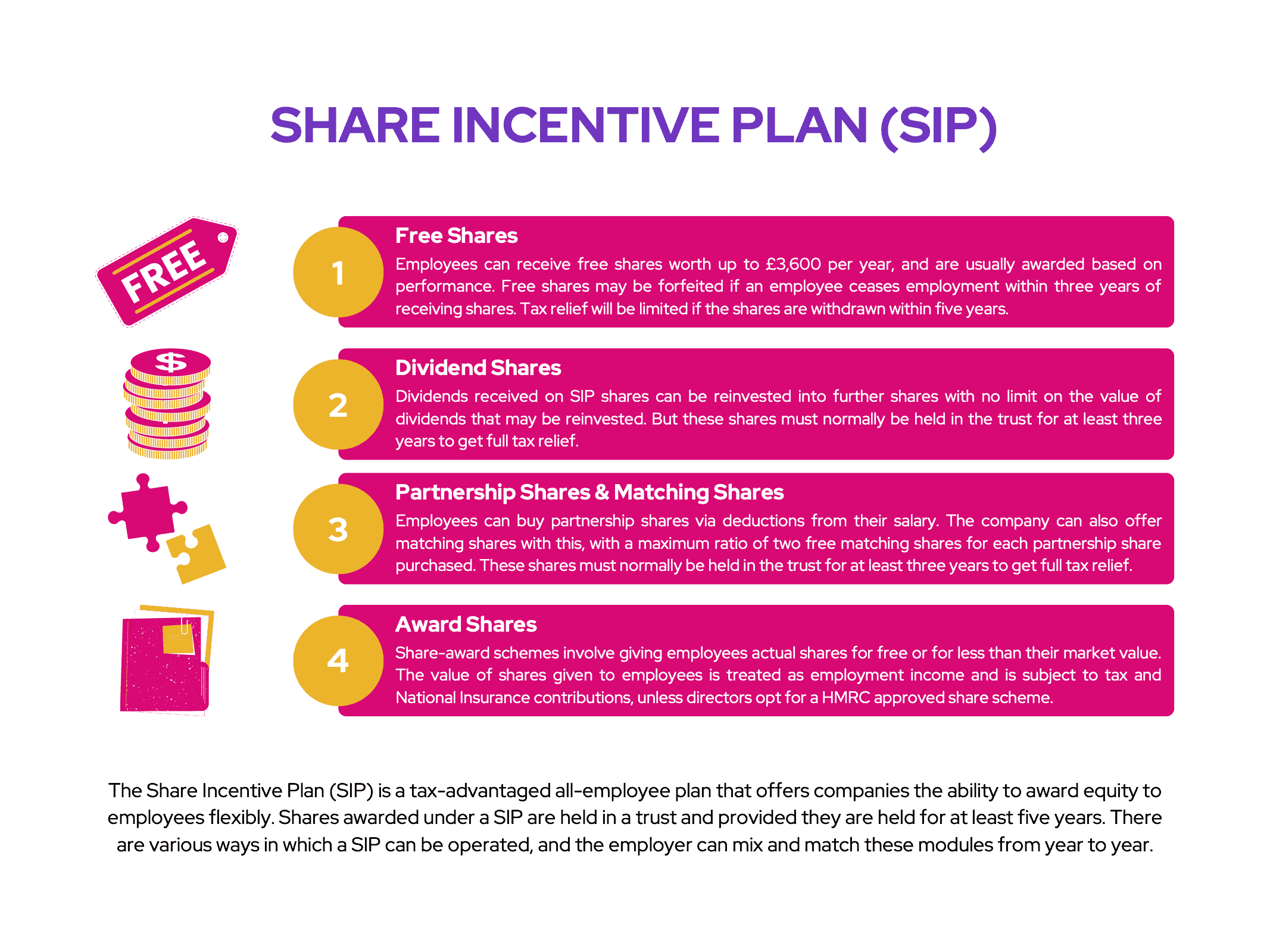

To provide context, there are a few types of shares that can be purchased by directors. Some directors opt to purchase shares via the open market. Having said that, directors also have the option to purchase and receive shares via a share incentive plan (SIP).

A SIP is an employee plan for companies within the UK to flexibly award shares to employees. Publicly listed companies normally exercise this option because it’s tax-efficient for both the employer and its employees.

In this week’s set of director dealings, a few types of SIPs were exercised. For starters, Vodafone’s Chairman opted to purchase more Vodafone shares from the dividends he received from his current shares.

On the other hand, Deliveroo’s CFO decided to exercise the option of redeeming his restricted stock units. These are a form of award shares which allow for directors to redeem shares at a later date, as either as part of their salary or based on meeting performance obligations.

FirstGroup’s CEO and CFO were awarded shares as well, but these will only be vested once performance targets are met. In this case, more than 1.5m shares are up for grabs between the two directors under the operator’s long-term incentive plan (LTIP). The LTIP award will normally vest on the third anniversary of the date of award, subject to satisfaction of performance conditions and continued employment. The award is also subject to an additional holding period of two years from the date on which the award vests.