Albert Einstein reportedly once said that “compound interest is the most powerful force in the universe”. Considering the number of stock market millionaires that have been created over the past decade I’m inclined to agree!

It’s why I’ve taken steps to boost my passive income by adding more dividend stocks to my portfolio.

Compounding essentially works like this. Instead of spending my dividend income I can choose to reinvest it in UK shares. This would allow me to create extra earnings by getting dividends on what I’ve reinvested in, as well as on shares I originally bought.

Compound miracles

Compounding means I can make stunning returns without having to invest a huge amount when I start off. And by regularly investing in the stock market I even have a realistic chance of joining the millionaire’s club.

Let’s say that I have a £1,000 lump sum to invest today. I also have an extra £500 I can invest each month, and let us assume I’m happy to reinvest my dividends, too.

Thanks to the miracle of compounding, I could make an astonishing £1,057,096 over 30 years. I’d have invested £181,000 of my own money (that initial £1,000 plus £180,000 in monthly investments). The remaining £876,096 would be the compound returns I’ve made on those total investments.

These figures are based on the average annual return of 10% that long-term investors tend to make.

Beating the market

I have a plan to target making a million quicker than this, however.

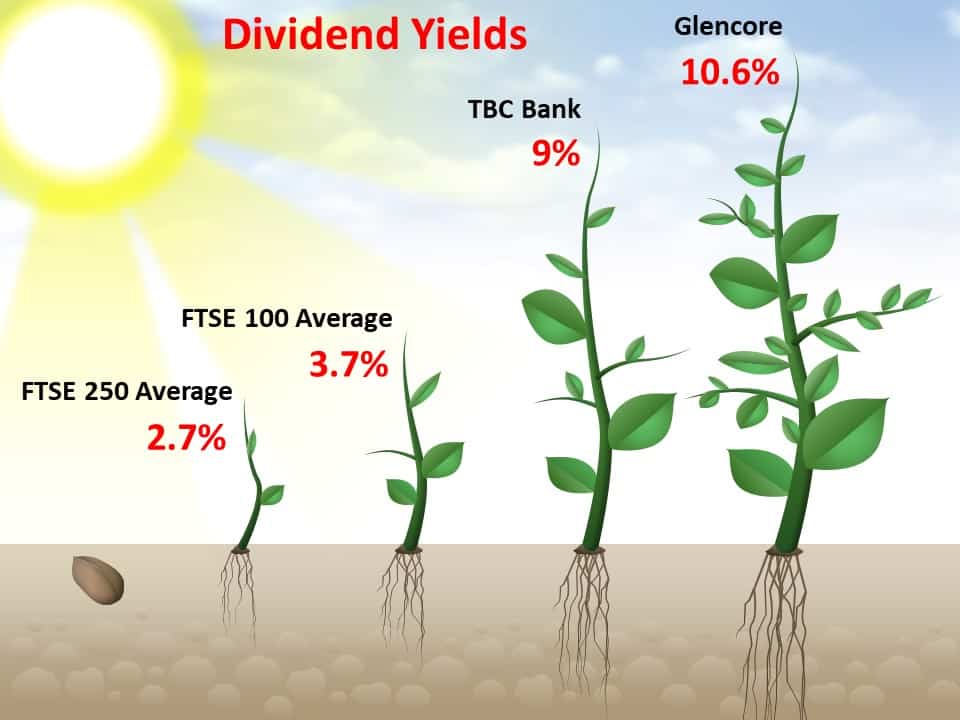

That 10% figure reflects a blend of share price appreciation and dividends. I’m seeking to supercharge my dividend income by buying stocks that offer above-average dividend yields.

This strategy could significantly boost the amount I have to reinvest and increase the impact of compounding on my wealth.

Of course yields are based on dividend forecasts, which can often miss their target. But with some proper research it’s possible to sort out the income heroes from the dividend traps.

2 top dividend stocks

Let me give you a couple of examples. Glencore is a FTSE 100 share whose double-digit dividend yield smashes the index average. And what’s more, the predicted payout is covered 2.5 times by anticipated earnings. This gives dividend forecasts extra strength.

Glencore could suffer some profits turbulence in the near term as China’s economy cools. But over the long term, I’m convinced earnings will soar as infrastructure spending accelerates and demand for green technology (from wind turbines to electric vehicles takes off).

I’d also buy Georgia-focussed TBC Bank, a share that boasts dividend cover of 3.2 times. The business could suffer if war in Eastern Europe drags on (Russia and Ukraine are major trade partners with the Eurasian country).

However, I think profits could surge over the long term as personal income levels, and therefore demand for financial services, improve. Like Glencore, I think TBC could enjoy exceptional share price gains and deliver solid dividend income over the next decade.