Scottish Mortgage Investment Trust (LSE: SMT) shares continue to soar in value.

Sure, they remain a third less valuable than they were at the start of the year. But from the closing lows struck at the end of June, the Scottish Mortgage’s share price has soared 35% to current levels around 910p.

Have I missed the boat? Or can we expect the tech-focussed investment trust to carry on surging?

The story so far

Some say that the tech sector’s correction has been a long time coming. And so Scottish Mortgage’s share price slump in 2022 has also been overdue, many would argue.

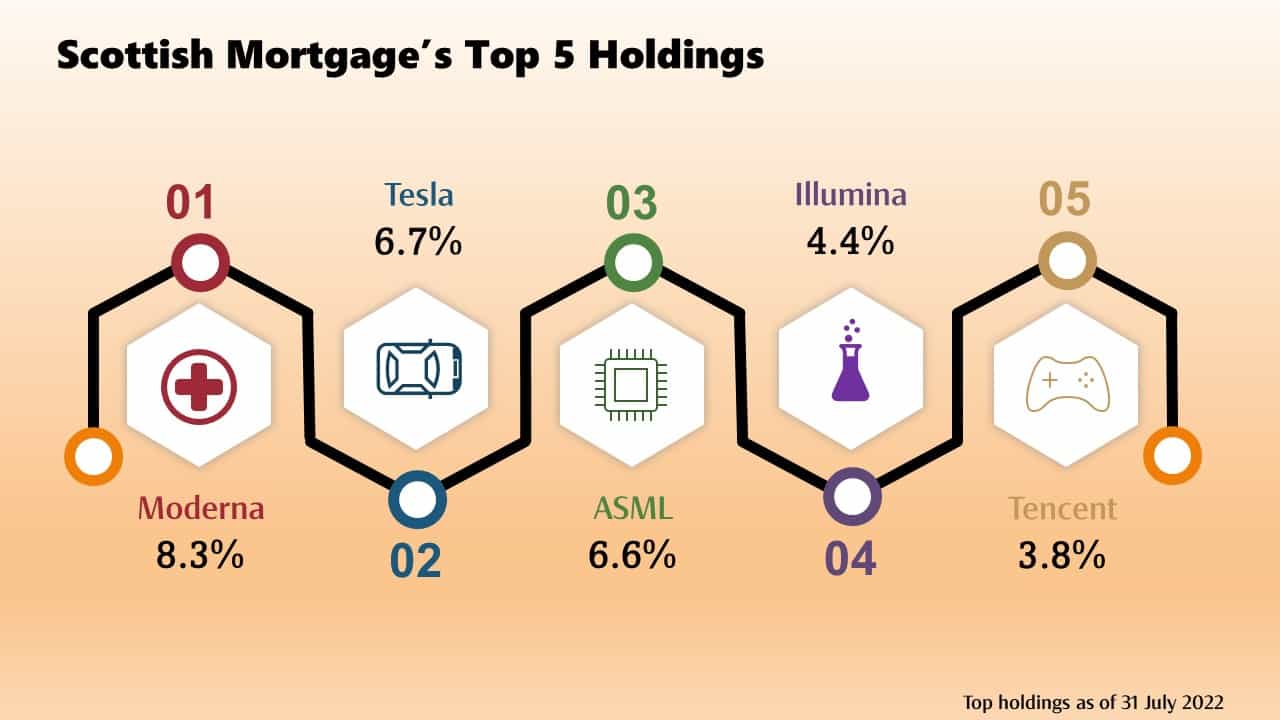

But I’m sure even the bears would argue that the scale of the decline has been shocking. Electric carbuilder Tesla and semiconductor manufacturing equipment supplier ASML — both major holdings in Scottish Mortgage’s portfolio — have, for example lost 25% and 30% respectively of their value in 2022.

Other tech stocks like Facebook-owner Meta, streaming giant Netflix, and video conferencing provider Zoom have posted even bigger declines.

Marc Deschamps, co-head of investment bank DAI Magister, comments: “while many would argue a correction has been on the cards for some time, the speed and depth of this correction has caught many off guard”.

Stable tech stocks

Tech stocks in particular are highly sensitive to economic downturns. So fears over runaway inflation and US interest rate hikes have caused swathes of them to sink in 2022.

However, Deschamps says that some tech sectors like Software as a Service (or SaaS) could remain resilient even as a recession approaches.

Companies like Zoom have boomed as working from home has taken off. And Deschamps says that their “predictable revenues from monthly or annual subscription fees” makes them a safe-haven for investors in tough times.

Specialists in green technology, like electric vehicle manufacturer Tesla, can also remain stable during recessions given the cost savings their products can offer, Deschamps says. And industries like logistics, e-commerce and supply chains, where tech penetration remains in its infancy, also retain enormous growth potential even during economic downturns.

Time to buy?

So should I consider buying Scottish Mortgage shares today?

Deschamps says that “while the immediate future inevitably looks less bright for the tech sector, it’s by no means doom and gloom”. There is the potential for many companies that Scottish Mortgage holds to bounce back from 2022’s bloodbath.

It’s also true that the investment trust is still trading at a discount, albeit a small one, to the value of its underlying assets. The tech trust trades 2% lower than its net asset value.

That said, I’m not tempted to buy Scottish Mortgage despite its recent share price rebound.

Many of the tech stocks it owns soared during the pandemic to trade at incredibly frothy valuations. And despite 2022’s share price correction many still command enormous P/E ratios.

These sorts of multiples remain especially hard to justify given the highly-uncertain outlook. This leaves them vulnerable to further bouts of heavy selling. Economic newsflow remains worrying and market confidence is still extremely fragile.

And while there are exceptions, the overwhelming proportion of Scottish Mortgage’s holdings remain extremely vulnerable in the current climate. I don’t think it would take much for the company’s share price to plummet again.