Director dealings are essentially insider transactions for shares between directors and the companies they work for. These dealings are always made public, and are often considered a good indicator of a company’s future prospects. However, they don’t get nearly as much attention as other company news due to their complex nature. Nonetheless, here I’m breaking down this week’s biggest director dealings from three FTSE firms.

Rolls-Royce

Rolls-Royce (LSE: RR) is a British multinational aerospace and defence holdings company. It is one of the world’s largest makers of aircraft engines, and operates in four different segments. These include civil aerospace, power systems, defence, and new markets.

After a disappointing set of H1 results, Rolls-Royce shares saw yet another decline. But this week, a number of director dealings were carried out. Most notably, there was a huge purchase of shares from Chairwoman Anita Frew. The purchase from such a senior director should improve sentiment surrounding the stock.

- Name: Anita Frew

- Position of director: Chairwoman

- Nature of transaction: Purchase of shares

- Date of transaction: 5 August 2022

- Amount bought: 50,000 @ £0.83

- Total value: £41,300

- Name: Lee Hsien Yang

- Position of director: Non-Executive Director

- Nature of transaction: Share purchase plan

- Date of transaction: 8 August 2022

- Amount bought: 1,161 @ £0.84

- Total value: £980.23

- Name: Wendy Mars

- Position of director: Non-Executive Director

- Nature of transaction: Share purchase plan

- Date of transaction: 8 August 2022

- Amount bought: 2,156 @ £0.84

- Total value: £1,820.31

- Name: Sarah Armstrong

- Position of director: Chief People Officer

- Nature of transaction: Share purchase plan

- Date of transaction: 9 August 2022

- Amount bought: 175 @ £0.86

- Total value: £149.84

- Name: Rob Watson

- Position of director: President (Rolls-Royce Electrical)

- Nature of transaction: Share purchase plan

- Date of transaction: 9 August 2022

- Amount bought: 175 @ £0.86

- Total value: £149.84

Admiral

Admiral (LSE: ADM) is a British-based insurance company. It specialises in car insurance products, but also has a line of other offerings. These include home insurance, travel insurance, pet insurance, and van insurance.

The FTSE 100 firm released its H1 results earlier this week. Although profits slumped by almost half, the stock still shot up by 15% this week. This was most likely due to the announced special dividend of 15.8p. This would bring its total dividend to 60.0p per share. Investor sentiment was also further boosted when the Chairwoman purchased shares worth over £25,000.

- Name: Annette Court

- Position of director: Chairwoman

- Nature of transaction: Share purchase plan

- Date of transaction: 11 August 2022

- Amount bought: 1,181 @ £22.44

- Total value: £26,501.64

Dunelm

Dunelm (LSE: DNLM) is one of Britain’s biggest home furnishings retailers with an ever-growing market share. It operates over a 170 stores throughout the UK and offers over 50,000 products across a broad range of categories.

The FTSE 250 firm released its Q4 trading update not too long ago, and the interim numbers resonated well with investors. Nevertheless, its bottom line figure is yet to be released, and investors are wondering whether their expectations will be met. Therefore, the recent purchases by its CFO and another director could be an indicator of an earnings beat. The company is expected to report its official FY22 results in less than a month’s time.

- Name: Vijay Talwar

- Position of director: Non-Executive Director

- Nature of transaction: Purchase of shares

- Date of transaction: 4 August 2022

- Amount bought: 9,670 @ £8.50

- Total value: £82,156.32

- Name: Karen Witts

- Position of director: Chief Financial Officer

- Nature of transaction: Purchase of shares

- Date of transaction: 5 August 2022

- Amount bought: 1,174 @ £8.45

- Total value: £9,922.18

Types of shares

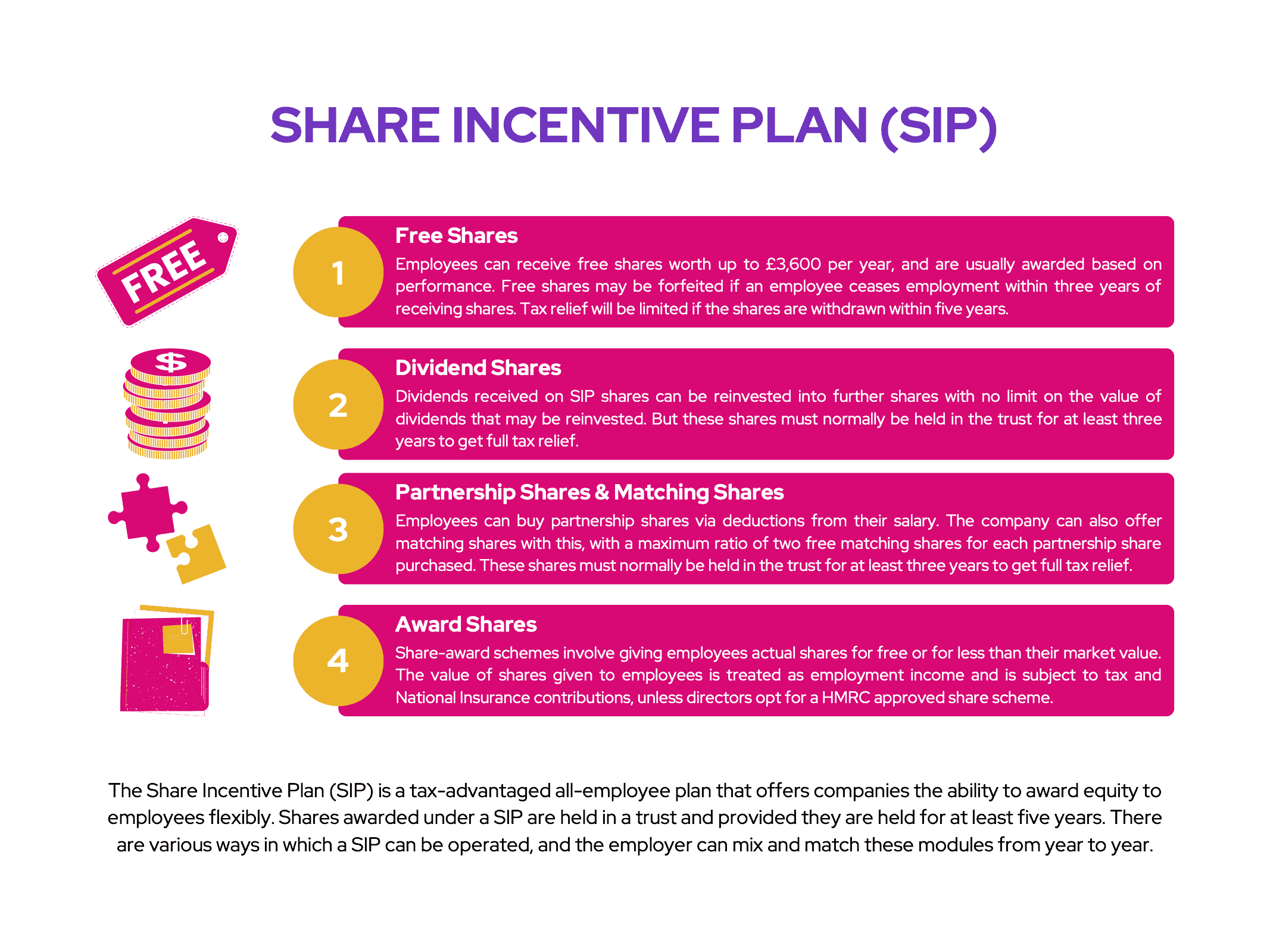

To provide context, there are a few types of shares that can be purchased by directors. Some directors opt to purchase shares via the open market. Having said that, directors also have the option to purchase shares via a share incentive plan (SIP).

A SIP is an employee plan for companies within the UK to flexibly award shares to employees. Publicly listed companies normally exercise this option because it’s tax-efficient for both the employer and its employees.

In this week’s set of director dealings, a certain number of directors opted to purchase shares via their companies’ share purchase plans. This allows employees to purchase shares through automatic deductions from their pay. And this was the case with a number of Rolls-Royce directors, as well as Admiral’s Chairwoman.