Arrival (NASDAQ: ARVL) stock has been absolutely battered this year. Its most recent Q2 earnings didn’t help either, as its share price saw it take another 25% hit. But with start of production expected for the British electric vehicle specialist, its share price could bounce back.

Being productive

Arrival didn’t exactly cover itself in glory when it reported its most recent Q2 results. It disappointed on many fronts with more delays, which led to a huge sell off in its stock. Nonetheless, there were a couple of bright spots that are worth pointing out.

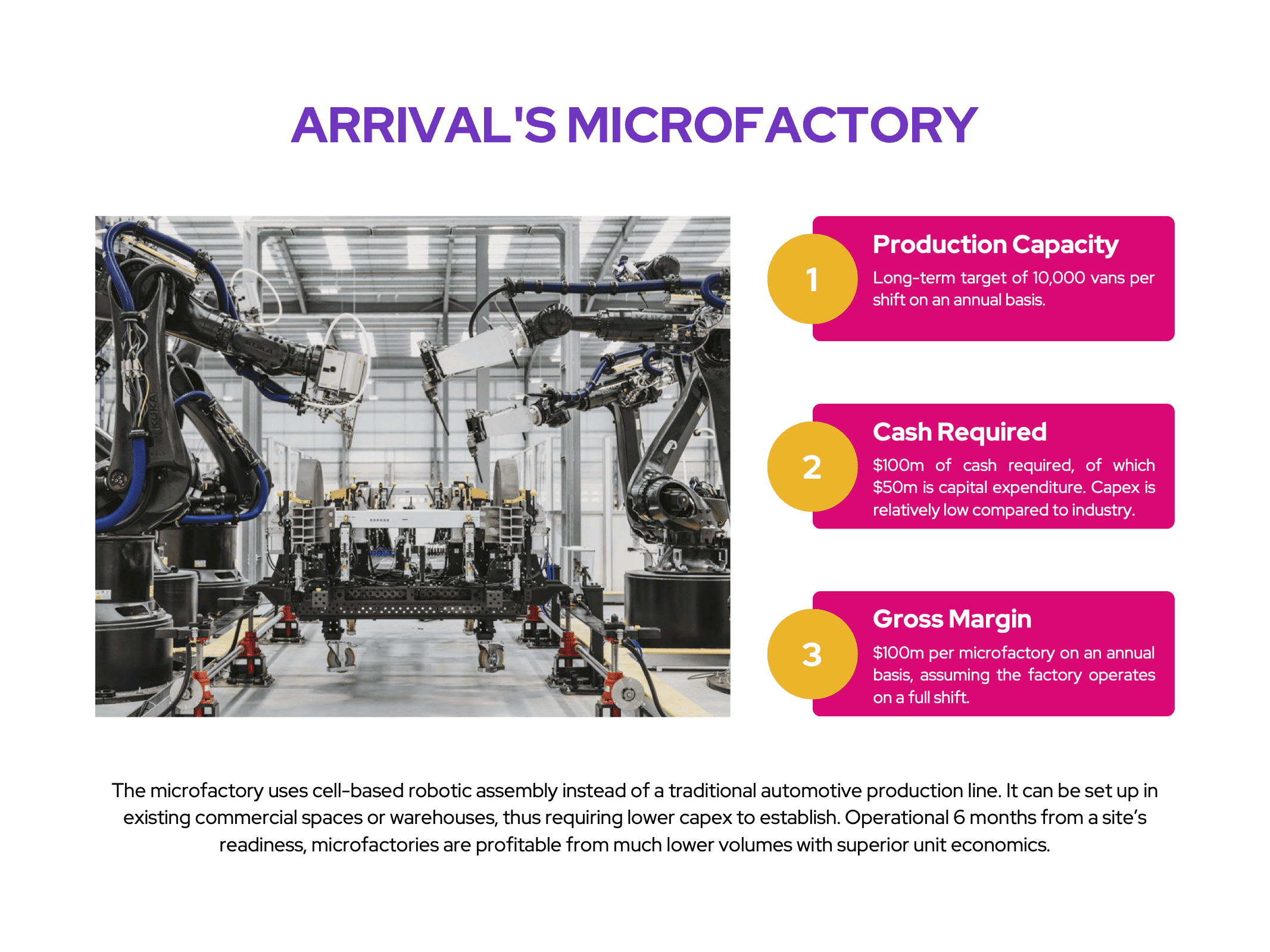

The first would be that the company saw yet another increase to its memorandum of understandings and orders, from 143k in Q1 to 149k in Q2. This now adds up to a total of approximately $6bn in potential revenue. But most importantly, it reaffirmed its commitment to start production this quarter. CEO Denis Sverdlov mentioned on the earnings call that the microfactory concept is coming to fruition, expressing his excitement and entrepreneurial spirit to radically change the traditional assembly line.

Yet another delayed Arrival

I’m afraid that’s about it for good news, unfortunately, as the rest of the report was mostly disappointing. Despite the firm confirming start of production in Q3, this is only for 20 vans, which is down from the initial 400 to 600 vans promised in the Q1 earnings report. This is because of cash preservation reasons, as well as the manufacturer only having enough parts for 200 vans currently. Arrival also doesn’t expect revenue to come in this year either due to the timing of these deliveries, which are expected to happen at the very end of the year.

To make matters worse, the company is having to dilute shareholders like myself once again. Sky-high inflation has forced the unicorn to seek additional capital. This is being done through an at-the-market (ATM) offering, worth $300m. Arrival plans to sell its shares into a secondary trading market, with $90m expected to be raised this year, and another $210m in 2023. The offering should give it enough cash until the end of 2023, with CFO John Wozniak guiding for it to finish 2023 with at least $300m in cash and equivalents.

That being said, it continued to burn through quite a substantial amount of cash in Q2. As such, it’s had to conduct some cost-cutting measures by putting its bus and car projects on pause until additional capital can be raised, while also cutting spending by 30%.

| Metrics | Q2 2022 | Q1 2022 | Change |

|---|---|---|---|

| Adjusted EBITDA | -$76m | -$67m | -14% |

| Capital Expenditure | $95m | $99m | -4% |

| Cash and Equivalents | $513m | $735m | -30% |

| Cash Burn | -$222m | -$170m | -30% |

Lagging behind

Admittedly, Arrival has a great vision with wonderful economics, which was why I chose to invest in its stock. However, numerous delays and disappointments have only made me doubt whether this radical innovation can truly be executed.

With the company continuing to burn cash, profitability isn’t expected anytime soon. Although the board expects margins to reach breakeven by 2024, I can only imagine that it’s another empty promise after so many disappointments.

Arrival has had a terrible record of over promising and under delivering. So, I’m taking any future outlook with a big pinch of salt. Therefore, I don’t think the stock will be hitting $2 soon, and I won’t be adding to my position. Instead, I’ll be looking to purchase other stocks with better track records.