The Taylor Wimpey (LSE: TW) share price has seen a 10% recovery since it bottomed in mid-July, although it’s still in the red. With that in mind, I could consider buying some of its shares before a stock market recovery gets underway.

Building momentum

The FTSE 100 housebuilder reported its half-year results recently, and I must admit that I was rather impressed. The increase in house prices has managed to offset inflation in build costs, leading to an increase in operating margin, and that sat well with investors as its share price saw a 5% increase.

| Metrics | H1 2022 | H1 2021 | Change |

|---|---|---|---|

| Revenue | £2.08bn | £2.20bn | -5% |

| Adjusted Earnings per Share (EPS) | 9.0p | 9.3p | -3% |

| Completions (Excluding Joint Ventures) | 6,587 | 7,219 | -9% |

| Operating Margin | 20.4% | 19.3% | 1.1% |

| Free Cash Flow | £202m | £552m | -63% |

| Order Book Value | £2.89bn | £2.71bn | 7% |

| Average Selling Price (Excluding Joint Ventures) | £300,000 | £299,000 | 0% |

Although several figures saw declines, it’s important to consider context. For instance, the lower level in completions is due to tougher comparisons from last year, which saw orders from Q4 2020 pushed into H1 2021. Additionally, the fall in EPS is attributed to the increase in the pre-exceptional tax rate from 18.3% to 22.1%, as a result of the introduction of the property developer tax. Finally, the decline in free cash flow was down to further investments in land and current projects.

Should you invest £1,000 in Taylor Wimpey right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Taylor Wimpey made the list?

So, despite the drop on the top and bottom lines, Taylor Wimpey is still growing healthily. The board even revised its outlook upwards for the full year. They’re now guiding for FY22 results to be around the top end of analysts’ consensus.

| Metrics | FY22 Outlook |

|---|---|

| Completions | 14,660 |

| Operating Profit | ~£924m |

| Operating Margin | 22% |

| Net Cash | £600m |

| Average Selling Price | £313,950 |

Strong pipeline

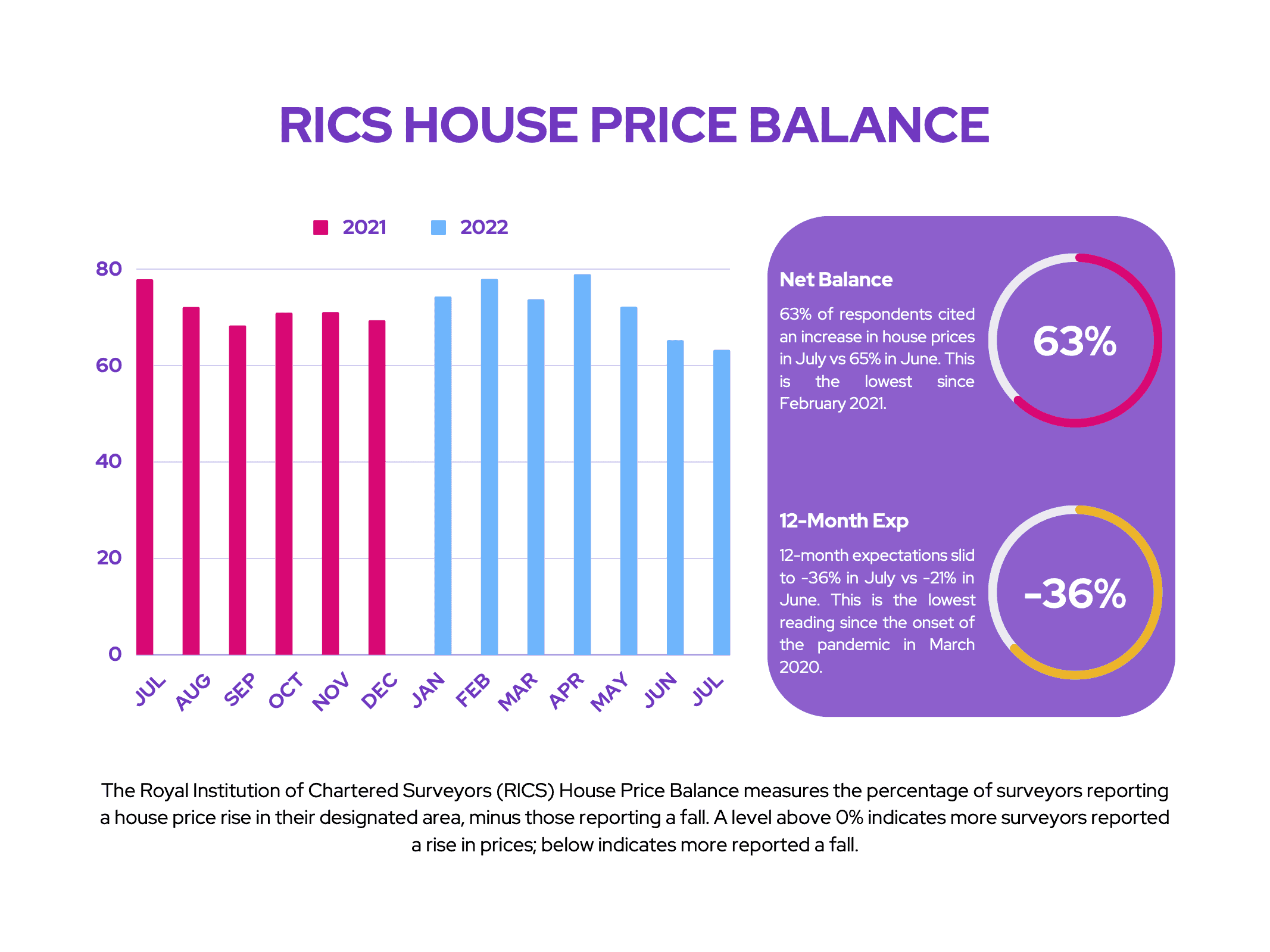

Even though management’s guidance is upbeat, it becomes a bit of a head-scratcher when taking the recent house price data into consideration. For example, the latest RICS house price balance indicates that house owners are expecting prices to decline over the next 12 months.

These expectations go hand in hand with the narrative that house affordability will dwindle as the Bank of England increases interest rates, thus driving mortgage rates higher. The effects of this can already be seen in the most recent Nationwide house price index, as house prices are beginning to stall. With inflation expected to only peak at 13%, the Bank still has a long way to go in its rate-hiking process.

Nonetheless, the Taylor Wimpey board still struck an optimistic tone in their H1 earnings call, and I can see why. For one, customer interest remains at high levels. Moreover, the property developer is already 92% forward sold for FY22, and has opened orders for Q1 2023. More importantly, cancellations in absolute numbers are down 9% year over year (yoy), and down 29% from 2019.

Solid foundations

Taylor Wimpey has got an excellent balance sheet. The company has a stellar debt-to-equity ratio of 2%, with £4.28bn in cash and only £87m of debt. Not to mention, the firm saw its profit margins increase by 2.5% (yoy). To complement this, its massive short-term land bank of ~88,000 plots leaves its business well positioned and flexible.

Therefore, despite macroeconomic indicators painting a gloomy picture, Taylor Wimpey looks to be heading in the opposite direction for now. But even with a decent price-to-earnings (P/E) ratio of seven, I’m cautious about buying Taylor Wimpey shares. The possibility of the UK staying in a recession for a prolonged period could send house prices and its share price lower. As such, I’ll be putting Taylor Wimpey on my watchlist for the time being, and may consider buying once housing data improves.