PayPal (NASDAQ: PYPL) stock is up over 30% in the last month. After posting excellent Q2 results, it takes the spotlight as my stock of the week. With that in mind, I think PayPal could rebound in the current stock market recovery.

Investment pays off

After the fintech firm reported its Q2 numbers, PayPal saw its stock rise by more than 10%. This was because it beat a number of analysts’ estimates on both its top and bottom lines. In fact, the company managed to surpass its own guidance on the majority of metrics!

| Metrics | Q2 2022 | Q2 2021 | Change (Y/Y) |

|---|---|---|---|

| Revenue | $6.81bn | $6.24bn | 9% |

| Non-GAAP earnings per share (EPS) | $0.93 | $1.15 | -19% |

| Total payment volume (TPV) | $339.8bn | $311.0bn | 9% |

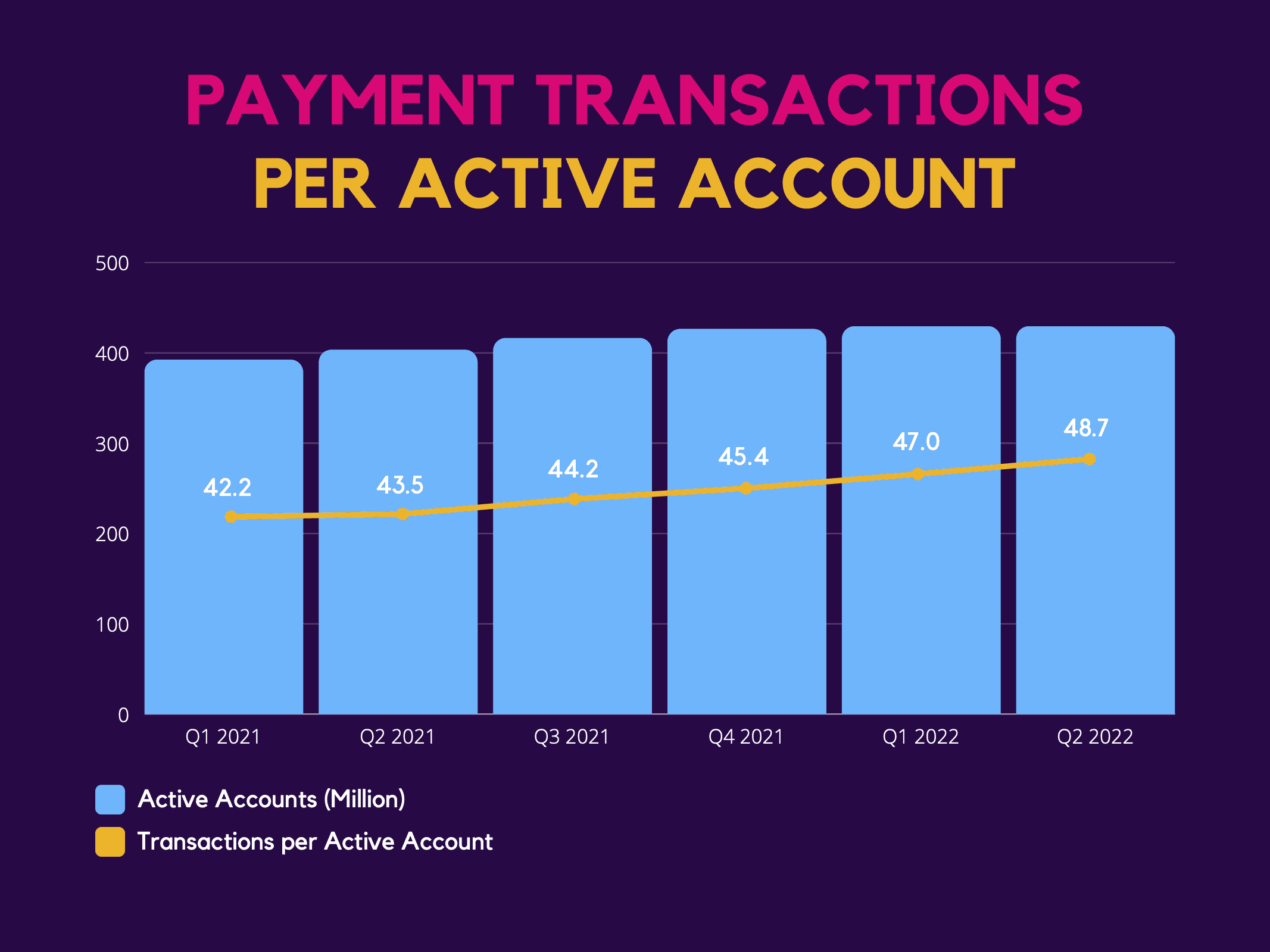

| Payment transactions per active account (PTPAA) | 48.7 | 43.5 | 12% |

| Total payment transactions (TPT) | 5.51bn | 4.74bn | 16% |

| Total active accounts (TAA) | 429m | 403m | 6% |

| Net new accounts (NNA) | 0.4m | 11.4m | -96% |

Nevertheless, the firm’s EPS saw a substantial decline. However, this was because of lower transaction margins from eBay, and the last year’s numbers getting a boost from the release of unneeded allowances for bad loans. Taking those factors into consideration, EPS stayed flat on a year-over-year (Y/Y) basis.

Pals bring quality

Since PayPal revised its goal of bringing more quality than quantity, it’s seen user growth decline, but PTPAA has gone up steadily. This was evident in this quarter’s numbers, with minuscule NNA, but robust PTPAA growth.

The growth can be attributed to two reasons. The first is the rise in core daily active users, which has seen a rise of more than 40% since 2019. This is crucial for PayPal because 80% of its transactions come from 30% of its most active users. The second is the continued growth of Venmo, which ended up driving more than 50% of PayPal’s revenue growth in Q2.

| Metrics (Venmo) | Q2 2022 | Q2 2021 | Change (yoy) |

|---|---|---|---|

| Total active accounts | 90m | 76m | 18% |

| Total payment volume | $61.4bn | $57.7bn | 6% |

As such, management provided a decent outlook for the rest of the year. The Nasdaq-listed firm now expects Q3 revenue of $6.8bn, with an upwardly revised non-GAAP EPS of approximately $0.95. For the full year, it expects 10% revenue growth, with a non-GAAP EPS of approximately $3.92. The board also forecasts to grow TPV by 12%, add 10m more accounts, and have a free cash flow of at least $5bn.

Long way to grow

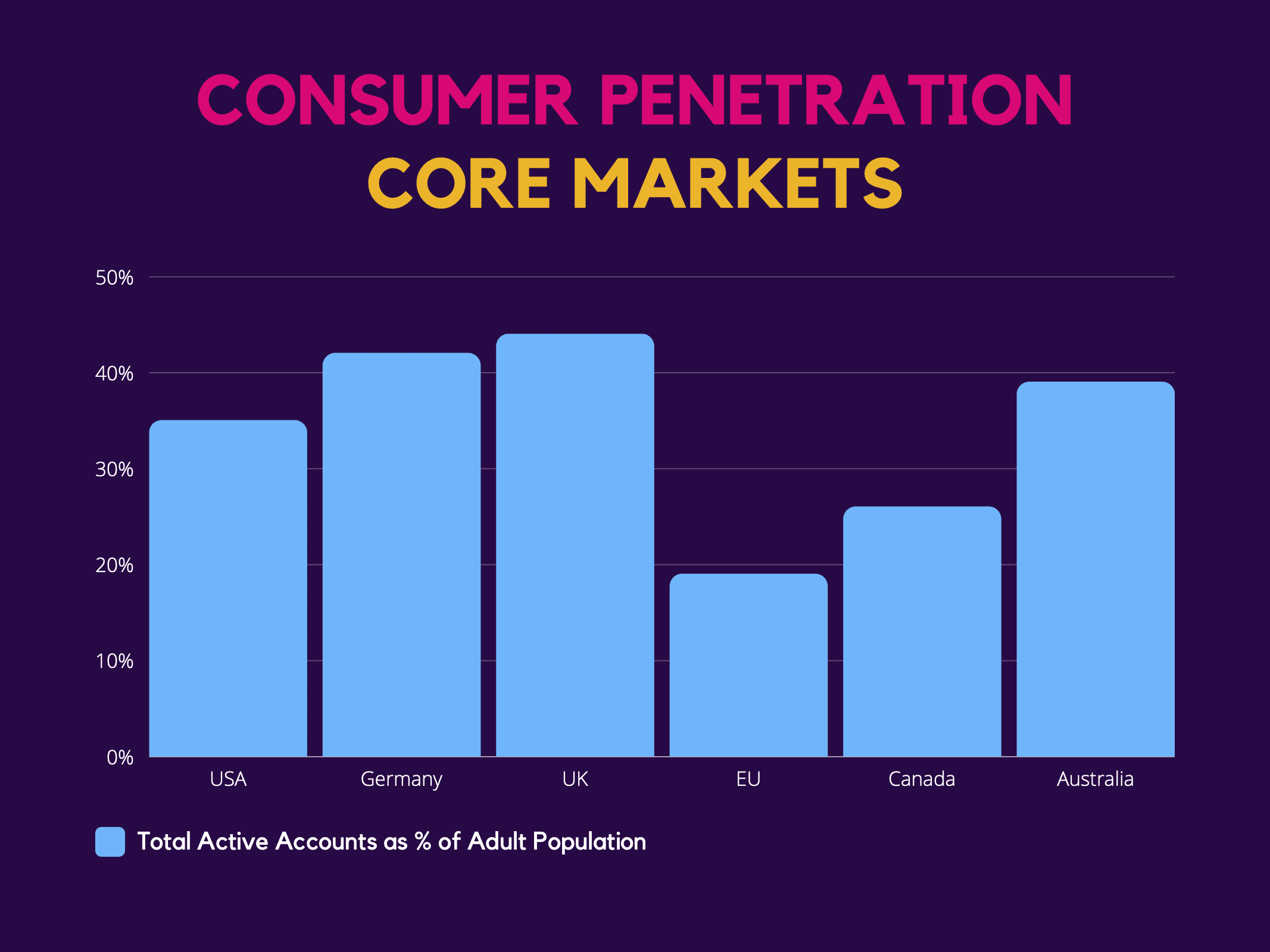

So, is PayPal stock worth a buy? Well, all signs seem to point towards yes. Aside from the excellent numbers and guidance provided, the impact on its cost savings are yet to be realised. Interim CFO Gabrielle Rabinovitch mentioned that PayPal expects $900m worth of cost savings in FY22, and a further $1.3bn next year. She also reiterated that the payments processor expects operating margin expansion of at least 0.5% starting in Q4. And with core markets yet to be fully penetrated, PayPal still has a long way to grow as it expands its digital wallet features to more regions worldwide.

Nonetheless, it’s worth noting that PayPal sits on $10.6bn worth of debt. But with no maturities for the rest of the year and margin expansions on the horizon, I’ve no doubt that incoming CFO Blake Jorgensen will be able to navigate through its debt pile without too much hassle.

| Year | Debt Repayments |

|---|---|

| 2022 | $0 |

| 2023 | $418m |

| 2024 | $1.25bn |

| 2025 | $1.0bn |

| 2026 | $1.25bn |

| Thereafter | $6.50bn |

Finally, the company saw its take rate remain flat at 2% (yoy), which is great news as PayPal continues to maintain its transactional margins while seeing TPV increase and growing its market share. Therefore, I think PayPal has a position on my portfolio with an average price target of $119.29.