The Scottish Mortgage Investment Trust (LSE: SMT) share price is rocketing. It’s up 24% in just over six weeks. And on Wednesday hit its most expensive since early May.

It’s important to remember, however, that it remains a tough year for the FTSE 100 share. At 875p per share Baillie Gifford’s showcase fund is a third cheaper than it was at the turn of 2022.

Should you invest £1,000 in Scottish Mortgage right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Scottish Mortgage made the list?

So where next?

I won’t try to predict where Scottish Mortgage’s share price will move next.

The tech sector in which it’s heavily invested is highly cyclical. And with inflation still soaring and key global economic indicators worsening, market sentiment could easily deteriorate rapidly again and pull the fund lower.

But there’s also reasons why Scottish Mortgage’s share price could continue rebounding. These include:

#1: Earnings continue to beat forecasts

The performance of Scottish Mortgage’s shares is closely linked to broader investor sentiment. So in recent weeks it’s benefitted from a slew of positive earnings updates from the US.

Ben Laidler, global markets strategist at eToro, comments that, “60% of S&P 500 companies have reported second quarter earnings, with three-quarters beating forecasts, along with nearly all sectors”.

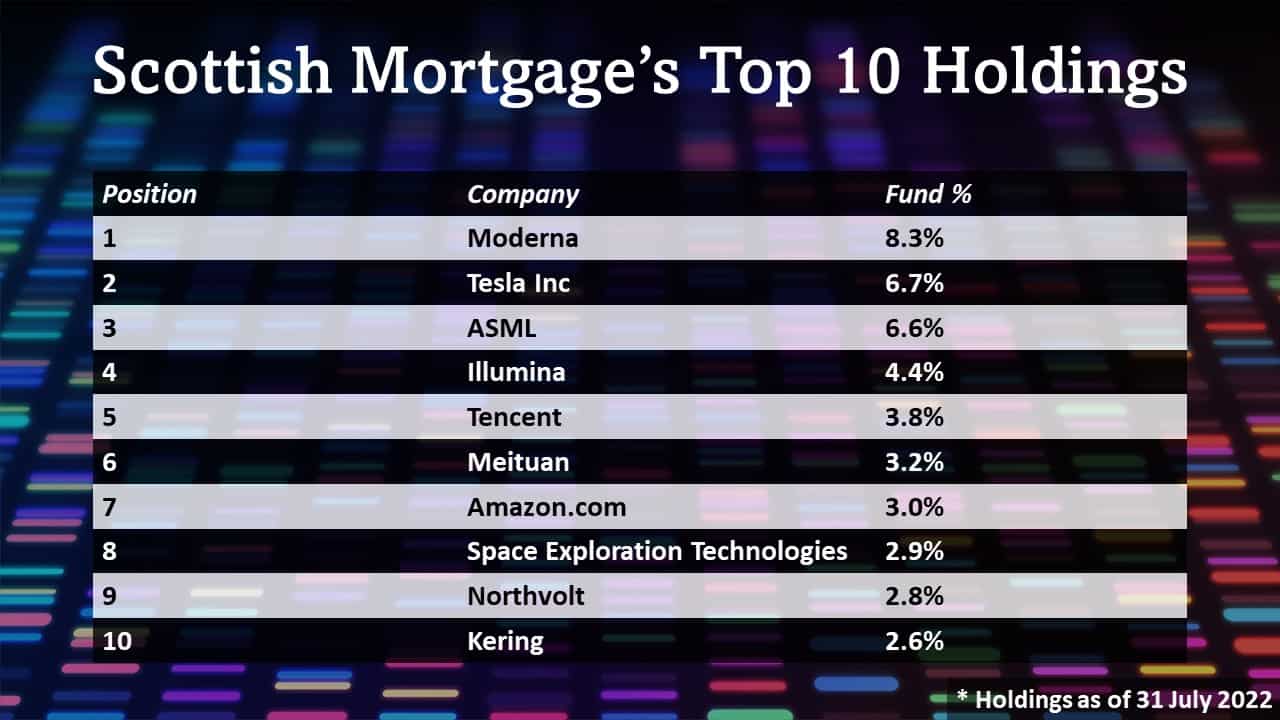

Good news from the States is important for Scottish Mortgage given its high exposure to US shares. American businesses Moderna, Tesla, and ASML alone made up almost 22% of all the fund’s holdings as of 31 July.

#2: The Federal Reserve loosens policy

Central banks including the Federal Reserve have been rapidly hiking interest rates in 2022 to reduce inflationary pressures.

But speculation is rising that policymakers are pivoting towards less heavy measures going forwards. Berenberg analysts for example have predicted that the Federal Reserve could even cut interest rates in 2023 “in response to lower inflation and recessionary conditions”.

A more accommodative stance from the Fed would likely boost market confidence and subsequently demand for growth stocks like those Scottish Mortgage holds.

#3: Dip buying continues

Scottish Mortgage’s share price slump in 2022 means the fund has been trading well below the value of its assets.

And despite the recovery of recent weeks the FTSE 100 share continues to change hands at a discount to its net asset value (or NAV). Its NAV now sits just above 900p per share, a 4% premium to Scottish Mortgage’s shares.

This leaves further room for dip buyers to exploit.

Should I buy Scottish Mortgage shares?

But despite these possible share price drivers I’m still not convinced to buy the fund today.

Many of the tech companies Scottish Mortgage has invested in continue to trade at sky-high valuations. Yet the growth outlooks for these firms are looking increasingly fragile. And this could cause them to sink in value.

Interest rates are rebounding from the rock-bottom levels of the last decade. Meanwhile the benefits that Covid-19 lockdowns brought to many businesses like Netflix and Amazon.com are rapidly declining too.

I wouldn’t touch many of the US and Chinese stocks that Scottish Mortgage holds with a bargepole. So in turn I’m not planning to buy the FTSE 100 investment fund, either.