Can you name the top five FTSE 100 shares? It sounds such a simple question — but is it?

After all, ‘top’ can mean many things to different people. And frankly, if everybody thought the same way, then trading markets wouldn’t exist!

So, if I’m looking for good shares to buy, in what useful ways can I answer the question?

Does size matter?

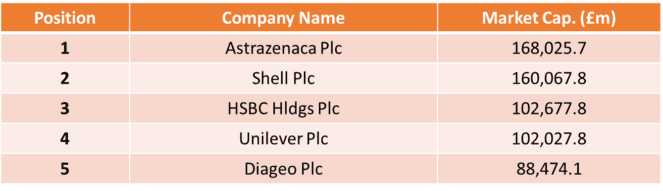

When it comes to looking for great shares, is the size of a company important? For example, if I look at the FTSE 100 by market capitalisation, these are the top five shares:

Now, clearly it’s not a static picture, since market capitalisation is linked to a company’s underlying share price. But it’s an easy way to see who are the big boys (and girls) of the FTSE 100.

Why does size matter? Well, if I’m looking for shares that are relatively stable, then these so-called ‘large-cap’ companies are more likely to fit that bill. They tend to be mature companies in established industries.

That makes them potentially less volatile than other smaller shares, with the trade-off being they are less likely to experience huge growth ahead.

But that’s just one way of looking for the top footsie shares — what else can I see?

Highest dividend-yielding shares of the FTSE 100?

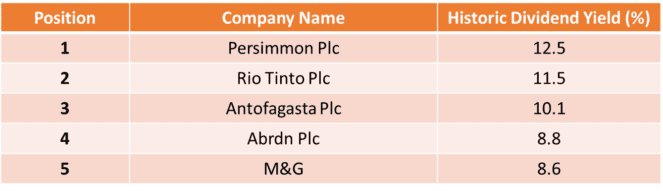

Another popular way of looking at the FTSE 100 is to try and find the best dividend payers. One simple way of doing this is to compare historic dividend yields, which gives me this top five list:

The main thing I must remember when looking at these high-yielding dividend shares is that history is far from guaranteed to repeat itself. Many companies cut or cancelled dividends during 2020, for example. Likewise, a high dividend yield can be a warning sign to check the underlying share price isn’t taking an unexpected dive.

Now, dividend shares are useful if I’m looking for income — but what if I’m still trying to grow my wealth?

What are the top five FTSE growers?

As a long-term Foolish investor, I’m interested in buying and holding shares for the next three to five years, at a minimum. And if growth is what I wanted, then these are the top five FTSE 100 shares I would have been delighted to buy five years ago.

These five shares are particularly interesting, since over that period, the FTSE 100 index itself has gone nowhere from a growth perspective.

They look great — unless you compare these growth figures to the wider FTSE 350, where none of these companies would make the top five.

So, what is the answer?

What are my top five FTSE 100 shares?

The most honest, if a little unsatisfying, answer to the question of the top five FTSE 100 shares is – “it depends”. I can ask the question in a variety of ways and get entirely different answers.

That’s why when it comes to looking for shares to buy, I need to be clear on what I’m really looking for — and why. Then I can start to research the best shares for me — and that’s what really matters.