Shares in Facebook owner Meta Platforms (NASDAQ: META) have experienced a huge decline recently. Over the last year, the stock has lost more than 50% of its value.

While I own a number of Big Tech stocks in my portfolio, I don’t currently own Meta. Has the recent share price fall presented an opportunity to pick the stock up at a bargain valuation? Let’s discuss.

Meta stock looks cheap

Let’s start with the valuation because Meta shares certainly look cheap right now. At present, Wall Street expects the company to generate earnings per share of $10.10 for 2022. That means at the current share price of $160, the forward-looking P/E ratio is just 15.8.

There’s no doubt that valuation is low, certainly compared to the company’s average historical valuation (it’s often been 30+ over the last decade). It’s also low compared to other Big Tech stocks such as Apple (26), Alphabet (22), and Amazon (343). And it’s lower than the US market (17.5) as a whole. So there could be some value on offer here.

It’s worth noting that in the last quarter, the company bought back $5.1bn worth of its own shares. This suggests management believes Meta stock is cheap right now.

Cheap for a reason

The thing is though, cheap stocks are often cheap for a reason. And that appears to be the case here. For starters, growth has really stalled. In the last quarter, Meta’s revenue fell 1% year-on-year (its first ever drop in quarterly revenue). And the group forecast another quarterly revenue decrease for the current quarter.

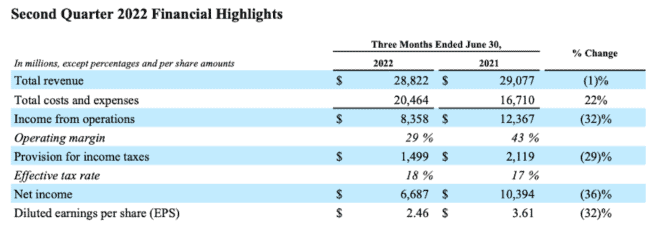

Secondly, profitability has declined. The table below shows that in Q2, net income fell to $6,687m from $10,394m a year earlier – a 36% year-on-year decrease.

As for why revenue and profits are falling, much of it is related to weakness in the digital advertising market. On the Q2 earnings call, CEO Mark Zuckerberg said he believed the economy was entering a downturn that would have a “broad impact” on digital advertising.

Major challenges

It’s not just lower digital advertising spending that’s problematic here though. Additionally, Meta has to deal with:

- Slowing user growth. In the last quarter, Facebook had 2,934m users versus 2,936m in the prior quarter.

- Apple’s privacy changes. These have made it harder for Meta to target users with ads.

- Competition from TikTok. Meta is trying to compete with TikTok using ‘Reels’. However, this is cannibalising more profitable content and leading to unrest among Instagram users.

Metaverse

On top of all this, there’s the uncertainty related to the metaverse. Right now, Meta is spending a ton of money (about $10bn per year) to develop this new technology platform.

The problem is, no one knows whether this will pay off. Meta could end up being a leader in the metaverse space. Or it could be beaten by other companies such as Microsoft.

My move now

Now, Meta Platforms could overcome all these issues. It has overcome challenges before. However, given the number of challenges, I’m happy to leave the stock on my watchlist for now.

All things considered, I think there are better shares to buy right now.