Pinterest (NYSE: PINS) released its Q2 results on Monday evening. Although most of its numbers came in below estimates, the stock rallied by more than 10%, which is a head-scratcher. So, here are the possible reasons why Pinterest stock popped.

Pinning the bottom

While Pinterest reported rather lacklustre numbers, I think there were several key figures that served as catalysts for the stock’s rally. I imagine this to primarily be its revenue, monthly active users (MAUs), and average revenue per user (ARPU).

| Metrics | Q2 2022 | Q2 2021 | Change (Y/Y) |

|---|---|---|---|

| Revenue | $666m | $613m | 9% |

| Non-GAAP Earnings per Share (EPS) | $0.11 | $0.25 | -56% |

| Adjusted EBITDA margin | 14% | 29% | -15% |

| MAUs | 433m | 454m | -5% |

| ARPU | $1.54 | $1.32 | 17% |

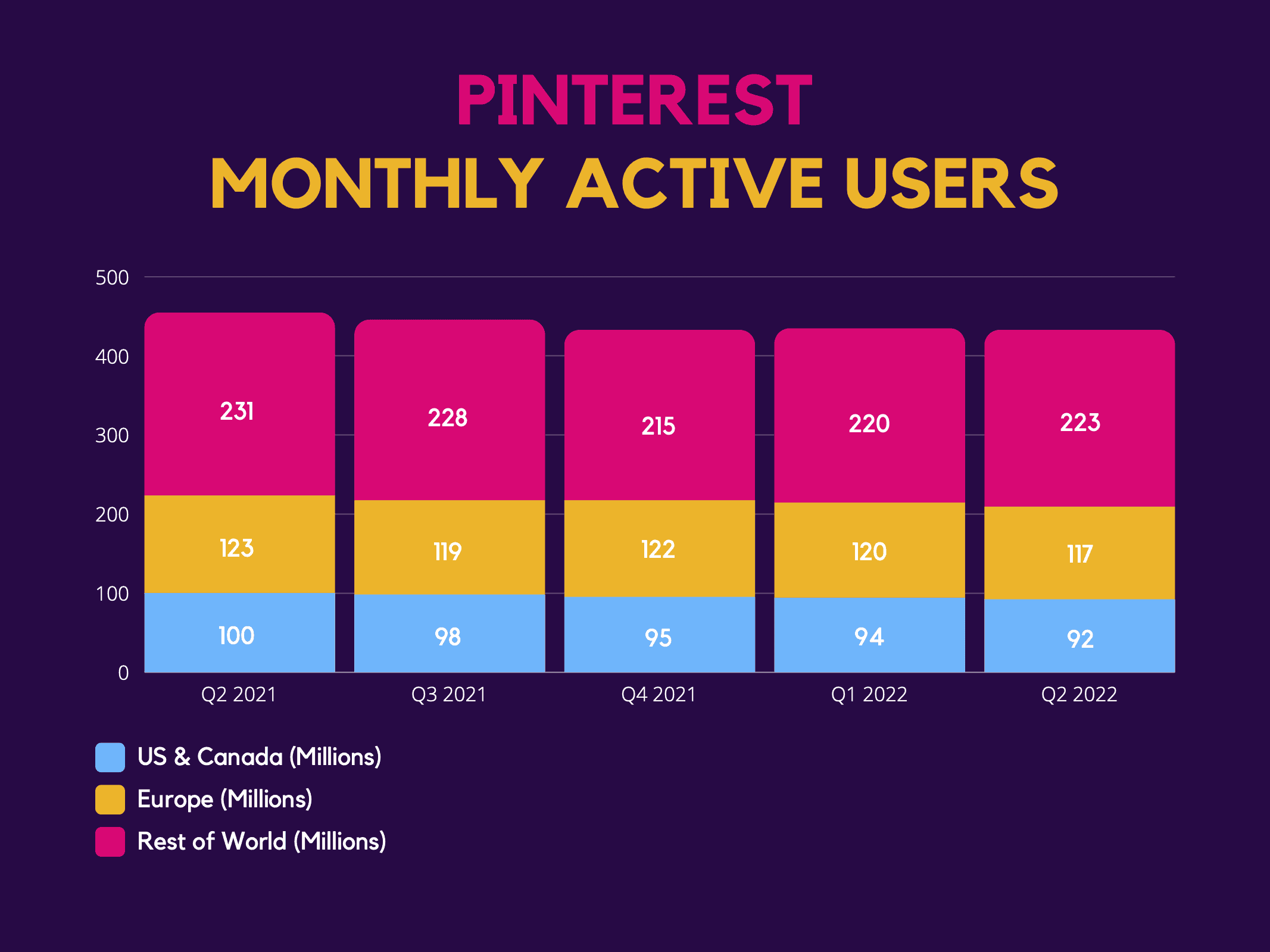

After disappointing revenue numbers from the likes of Alphabet, Meta, and Snap last month, investors were relieved to see Pinterest perform in line with the guidance it set out in the last quarter. Although there were misses on EPS and EBITDA, it was also a relief to see MAUs bottom, as predicted by CFO Todd Morgenfeld in last quarter’s earnings call.

More importantly, mobile MAUs grew by 8%, while desktop users declined by 30%. This is significant because mobile users constitute more than 80% of the revenue generated. Therefore, Pinterest is seeing growth in higher quality users. And with the launch of its new app, Shuffles, for collage-making and mood boards, I’m expecting growth in mobile users to continue.

Elliott says Pinterest is ready

Another key catalyst for the pop in Pinterest stock can be attributed to Elliott Management disclosing its stake in the company. The activist investor now holds a 12% stake and is the company’s largest investor. Elliott also gave the vote of confidence to Pinterest’s new CEO Bill Ready, which shored up investor sentiment.

The impact of the appointment is already taking effect. Under Ready, ARPU saw an increase of 17% despite a challenging macroeconomic environment. This is most likely due to Pinterest expanding its ad reach to more regions. In Q2, the firm launched ads in Japan, and finally launched Idea Ads in 34 markets. Moreover, it expanded its ad coverage in South America, which should boost rest-of-world ARPU in the future.

| ARPU | Q2 2022 | Q2 2021 | Change (Y/Y) |

|---|---|---|---|

| Global | $1.54 | $1.32 | 17% |

| US & Canada | $5.82 | $4.87 | 20% |

| Europe | $0.86 | $0.72 | 20% |

| Rest of World | $0.10 | $0.06 | 80% |

Boarding for take off

All that being said, is Pinterest stock worth a position in my portfolio? Well, its monumental drop from an all-time high of $89.90 and high price-to-earnings (P/E) ratio of 60 isn’t very pleasing. Furthermore, inflation and supply chain disruptions are already impacting several of its advertisers, specifically in the consumer packaged goods market.

However, there’s so much more potential behind Pinterest. Its evolution to becoming a hybrid e-commerce and social media platform is starting to take shape. This is evident with the growth in its product catalogue, which now hosts over a billion items. In addition to that, shopping ad revenue grew twice as fast as overall revenue in Q2. And with 90% of search queries still unadvertised, there could be plenty of unexplored revenue waiting in the pipeline.

It’s also worth noting that its balance sheet is as perfect as it comes. With $3.25bn worth of cash and equivalents, and zero debt, I believe Pinterest has got a long runway to expand its business and earnings potential.

The board also mentioned its intention to continue investing this year, and expects to return to meaningful margin expansion in 2023, as Pinterest reaps the rewards of those investments. Having taken everything into consideration, I’ll definitely be buying more Pinterest stock for my portfolio.