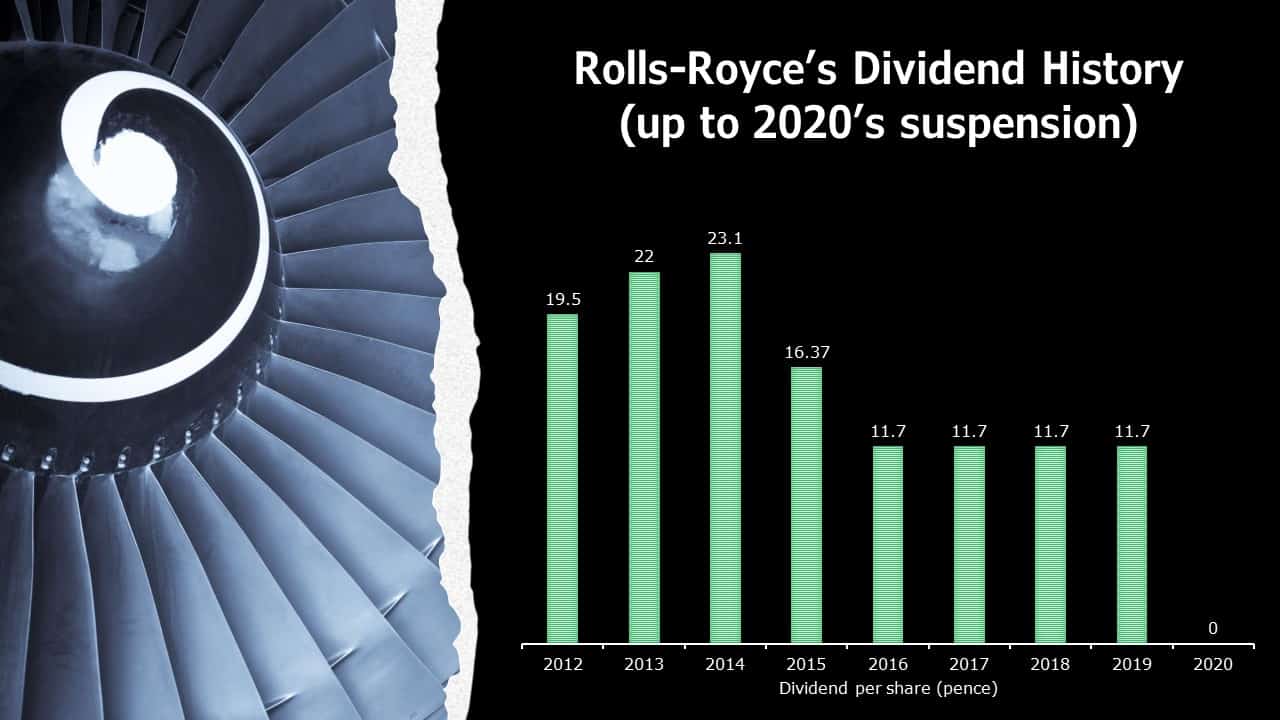

In days gone by Rolls-Royce (LSE: RR) shares paid investors a decent-if-unspectacular dividend. But the carnage caused by Covid-19 forced it to ditch dividends in 2020 and it hasn’t made any cash payouts since.

City analysts think this could all be about to change, however. And they think that annual dividends from the FTSE 100 firm will grow rapidly too.

So should I buy Rolls-Royce shares to boost my future income?

Payouts returning?

Unfortunately Rolls-Royce isn’t predicted to begin paying dividends again in 2022. But it’s expected to get the ball rolling next year when it’s projected to pay a total dividend of 0.72p per share.

The dividend yield for 2023 consequently sits at 0.8%, well below the Footsie index average of 3.7%.

However, in 2024 the company is expected to hike the annual payout to 1.35p per share, almost double 2023’s anticipated levels. This in turn pushes the yield to a much-improved 1.5%.

Well protected

Of course these are simply estimates. And they rely on a strong and sustained recovery in the civil aviation industry.

But the predicted dividend payment for 2023 and 2024 is well covered by anticipated earnings. Dividend cover ranges between 5.2 times and 6 times, well above the security benchmark of 2 times.

Rolls-Royce’s low dividends-to-earnings forecasts reflects in part the huge debts it still has to pay down. Its net debt pile stood at a hefty £5.2bn as of the end of 2021. Though a raft of asset sales recently and further cost-cutting will help the business tackle its gigantic liabilities.

Patchy history

So should I buy Rolls-Royce shares to receive a healthy passive income?

Well the company’s yields aren’t the biggest through to 2024. However, investing for passive income involves more than looking at near-term yields. It also involves finding stocks that could grow dividends over the long term.

The trouble with Rolls-Royce is that it had a poor record of dividend growth even before the pandemic. The firm cut the dividend for the first time in a quarter of a century in 2015 due to disappointing trading and balance sheet trouble. And things have got worse since.

The verdict

As an investor I like the steps Rolls-Royce is taking to embrace green technologies. Investment in building cleaner plane engines and nuclear reactors could pay off handsomely as the battle against climate change intensifies.

I also like the engineer’s important role in the defence sector. Demand for its engines could rise strongly global arms spending ratchets up.

But this doesn’t mean Rolls-Royce will become a lucrative dividend stock any time soon. Delivering big shareholder payouts is secondary in the company’s mind to investing for future growth. And the engine builder has to use vast sums of capital to get its engineering projects off the ground.

What’s more, any fresh downturn in the civil aerospace sector — whether that be due to Covid-19, weakening economic conditions or something else — could put broker forecasts of significant dividend growth in severe jeopardy. And particularly given the huge amounts of debt Rolls-Royce still has on its balance sheet today. I won’t be buying.