Inflation is running at a fresh 40-year high. As my cash in the bank loses value day by day, this summer I’m turning to FTSE 100 shares that can provide me with sizeable passive income streams to soften the blow.

Here are two Footsie dividend stocks with tasty yields I’d add to my stock market portfolio today.

Admiral Group

The Admiral Group (LSE: ADM) share price has trailed the FTSE 100 index by a significant margin this year — it’s down nearly 38%. The fall has pushed the stock’s dividend yield up to a whopping 6.78%.

The insurer recently suffered a heavy sell-off due to a profit warning issued by competitor Sabre Insurance Group, which itself was caused by inflationary pressures. Admiral shares were dragged down amid growing fears of a risk the company will post disappointing H1 results on 10 August.

However, now trading below £20 per share, the stock could be oversold in my view. A key advantage the business has over its competitors is greater diversification. This may help shield it from higher claim volumes and rising car repair costs.

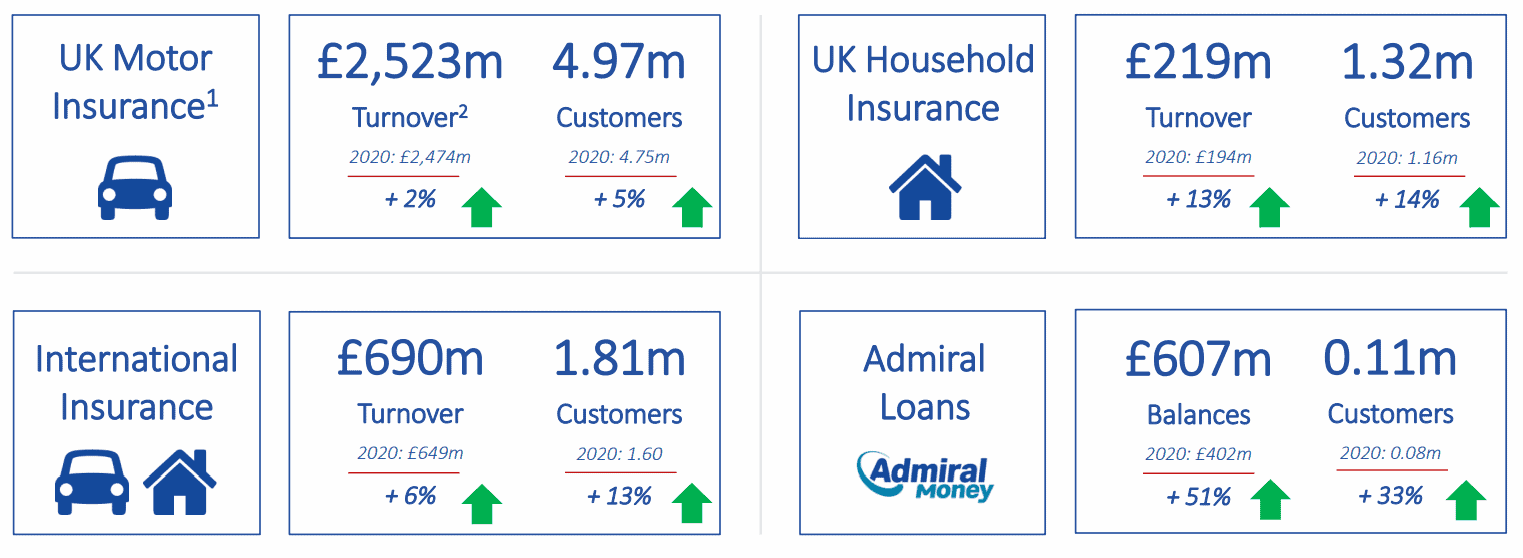

Granted, UK motor insurance makes up the lion’s share of Admiral’s revenue. Nonetheless, UK household insurance, international insurance, and loans also contribute significantly to the company’s bottom line.

I’m particularly encouraged by the firm’s loan book growth to £607m gross balances in FY21 (up 51% on the previous year). The group is optimistic this will hit £800m-£950m this year.

I’ll wait to see whether the company makes substantial revisions to its dividend forecast on results day before investing. Provided Admiral can demonstrate it’s able to navigate the inflationary climate successfully, I view the share price slump as an excellent dip-buying opportunity for me.

Land Securities Group

Land Securities Group (LSE: LAND) shares have fared better this year, falling 5.5%. Structured as a real estate investment trust (REIT) since 2007, it’s the UK’s largest commercial property development and investment company. The stock yields a healthy 5.29%.

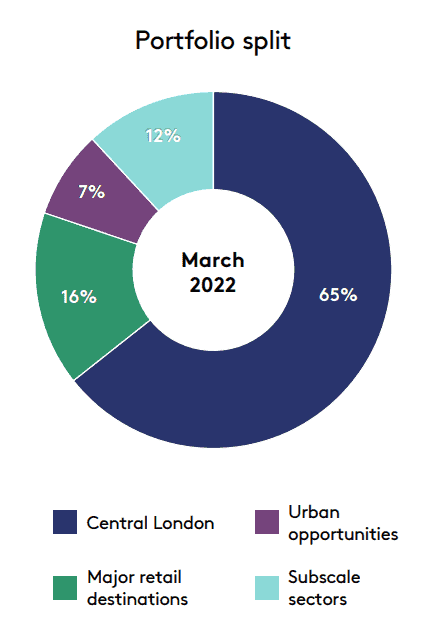

At 31 March, this FTSE 100 property business owned a £12bn portfolio of retail, leisure, workspace and residential hubs spanning 24m square feet. It has a particularly high concentration in central London, with 56% of its portfolio located in the West End alone.

The latest financial results were largely positive. The company’s gross asset value increased 11% year-on-year and dividends per share rocketed 37%. Gross rental income was also slightly up, rising 3% to £586m.

It’s not all plain sailing for Landsec shares, however. The Q2 2022 RICS UK Commercial Property Survey results signalled “a more cautious tone…with a weakening outlook across the broader economy anticipated to weigh on the market going forward“. A sharp downturn in commercial real estate prices would be a headwind for the share price.

Nonetheless, the REIT has a high-quality portfolio and I’m bullish on its long-term investment prospects. With flagship properties to its name, such as the Brighton Marina and Bluewater in Kent, I like Landsec’s diversification as well as its strength in the capital. I’d buy this stock for additional real estate exposure in my portfolio and solid dividends.