Penny stocks can be volatile investments that expose an individual to high levels of risk. But when they succeed, they can also turbocharge an investor’s wealth levels.

The trouble with such small-cap companies is that they’re less financially robust than most larger UK shares. So when times get tough, the casualty rate here is higher than usual.

There can be a huge advantage in buying small-caps like penny stocks, however. They often tend to be young companies that have the potential to grow earnings much faster than established businesses. This means that early-stage investors have a chance to make market-beating returns.

The mighty Amazon

Amazon (NASDAQ: AMZN) is often used to illustrate how a small-cap company can over time deliver spectacular shareholder profits.

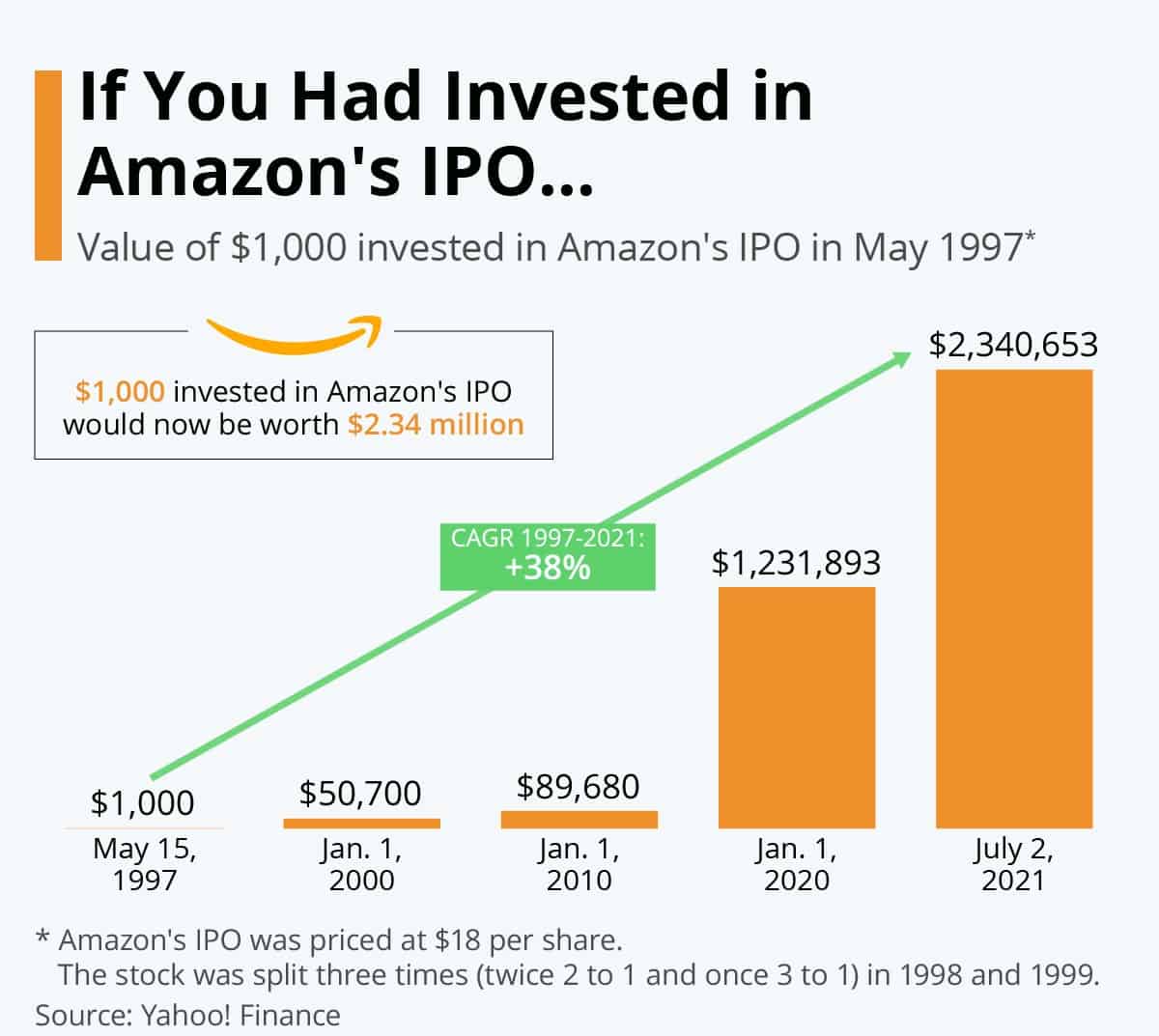

At the time of Amazon’s initial public offering (IPO) in 1997 its market capitalisation stood at just $438m. Meanwhile its shares traded at just $18 each.

The rise of e-commerce in the following 25 years has subsequently made Amazon one of the world’s most valuable companies. Today it’s a $1.37trn Nasdaq behemoth whose shares trade at around $135. And its trading results are used to gauge the underlying strength of the economy.

Buying the company’s shares back in the late 90s was a far riskier proposition than today. But many investors who foresaw the growth of online shopping and bought the retailer have made a fortune.

The chart below shows that someone who invested $1,000 in Amazon back in 1997 would have made $2.34m as of mid-2021!

A hot UK share

Investors don’t need to go to the US to find high-growth companies to invest in, of course. The London stock market is also packed with exciting small-cap companies to buy.

Take penny stock Savannah Resources.

On the one hand, this early-stage miner is packed with risk. It doesn’t have the mighty balance sheet strength of, say, a FTSE 100 mega miner like Rio Tinto. And it’s still waiting to receive environmental approval to start producing lithium at its Barroso project in Portugal.

But Savannah Resources also has considerable investing potential. Barroso is the largest lithium mine in Western Europe. And demand for the metal — a critical material in batteries — is tipped to explode as electric vehicle sales take off.

Another top penny stock

Let’s look at Corero Network Security too. It provides protection against Distributed Denial-of-Service (or DDoS) cyber attacks.

Sure, the business faces huge competition from industry giants like Microsoft and McAfee, to name just a couple. However, the rate at which cyber crime is growing still provides the business with exceptional profits possibilities. Order intake at Corero grew 22% in the six months to June.

Only time will tell if these penny stocks will generate stunning long-term returns like Amazon has. But despite the undeniable risks, those who are brave enough to invest in early-stage companies like these can get extremely wealthy by taking the plunge.