Dividends from UK shares have rocketed in recent months.

And even though the economic picture is darkening I continue searching for top income stocks to buy for my own portfolio. But more on that shortly.

A report from Link Group shows that total dividends from London Stock Exchange shares jumped 38.6% in quarter two on a headline basis.

Total payouts came in at £37bn, representing the second-largest quarter two amount on record.

Falling pound boosts payouts

The data business says that bloated special dividends helped push total payouts to those eye-popping levels. These one-off rewards totalled £5bn in the quarter.

Meanwhile underlying dividends shot 27% higher year-on-year, to £32bn. Underlying payments were boosted by a falling pound, which added £1.4bn to the sterling value of British dividends.

Link Group thinks a weak pound could continue boosting UK dividends in the second half of 2022. It notes that “exchange rates are acting powerfully to boost the sterling value of payouts and will add significant impetus in the second half if sterling is unable to recover its poise”.

Dividend forecasts rise

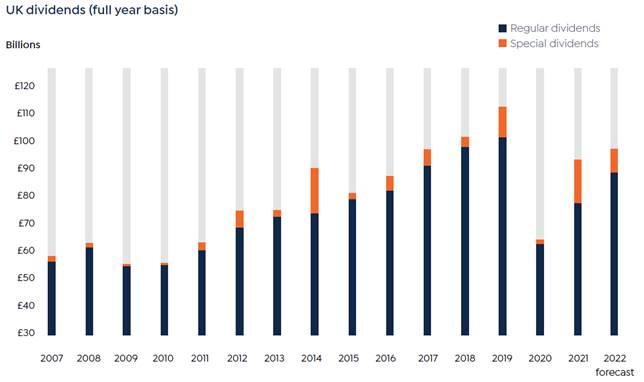

Second-quarter dividends were so strong, in fact, that Link Group upgraded its full-year dividend forecasts. It now expects headline dividends to rise 2.4% in 2022, to £96bn.

So who were the best dividend payers in the second quarter? According to Link Group the mining, oil, and banking sectors contributed to around three-quarters of the year-on-year increase. It warned, though that dividends from mining businesses have probably peaked.

Unfortunately, the data firm thinks that headwinds facing UK dividends are strengthening as we move into 2023. It notes that “an economic recession will crimp the ability and willingness of many companies to grow dividends”.

8.1% dividend yields

Rampant inflation means the economic picture is deteriorating rapidly. This is putting corporate profit forecasts under extreme scrutiny and by extension many dividend estimates.

However, there are still many UK stocks I think should pay big dividends over the short-to-medium term. It’s why I myself continue to buy income shares right now.

For example, I’ve bought The Renewable Infrastructure Group in recent months. This UK share invests in renewable energy assets across Europe and yields a decent 5.2% for 2022.

Adverse changes to green legislation could damage shareholder returns here. But present things look extremely positive as lawmakers step up the fight against climate change. And I expect the essential service that the company’s assets provide to keep delivering big dividends for investors even as economic conditions worsen.

I’m thinking of adding Vistry Group to my portfolio, too. Higher interest rates pose a threat to the housing sector and by extension to this major builder. But I’m confident that profits here should continue rising as Britain’s colossal homes shortage keeps prices rapidly rising. Annual house price growth hit 13% in June, according to Halifax.

Vistry’s dividend yield for 2022 sits at an enormous 7.9%. And it moves to 8.1% for 2023.