The Admiral Group (LSE: ADM) share price has plummeted 42% in 2022. Based on its dividend forecast for this year, the collapse means Admiral shares currently carry a 9.1% dividend yield.

So is now the time for me to add Admiral shares to my dividend portfolio? Here, I’ll drill into the insurer’s dividend forecasts for the short-to-medium term and reveal whether I’d buy this income stock today.

Should you invest £1,000 in Energean Oil & Gas Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Energean Oil & Gas Plc made the list?

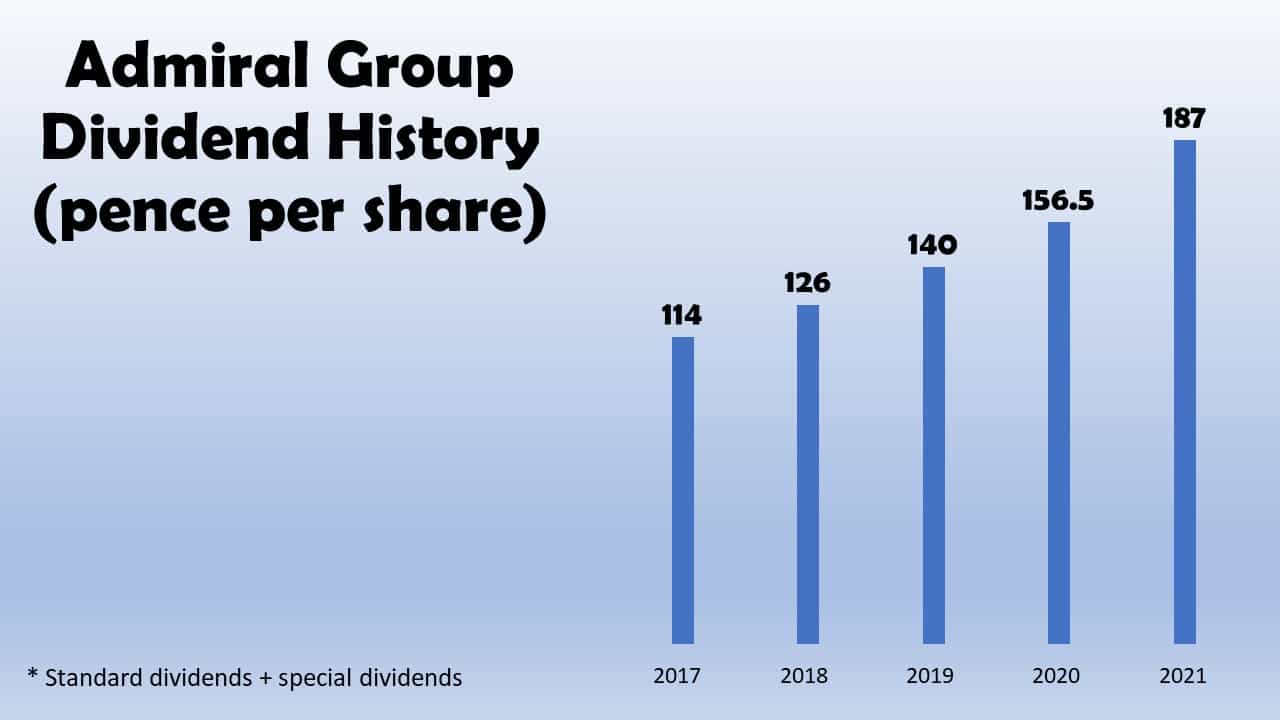

Admiral’s payout history

Admiral has been a very profitable income stock in recent times.

It has a policy of paying a normal annual dividend equating to 65% of post-tax profit. It also seeks to distribute excess cash to shareholders — that is money not needed for investment or for regulatory reasons — by means of a regular special dividend payment.

Pleasingly for investors, Admiral’s ultra-defensive operations has given it the means to keep hiking dividends even during the height of the pandemic.

Spending on general insurance, and especially on motor insurance, which is a legal requirement, remains broadly stable during all points of the economic cycle. This explains why Admiral has continued to grow annual earnings in recent years.

In addition, a strong balance sheet has also allowed Admiral to keep growing the annual dividend recently. The business has remained financially robust too and its solvency ratio improved to 195% as of December 2021.

Mixed dividend forecasts

Its strong financial footing means City analysts believe Admiral will continue to raise the yearly dividend, to 165.8p per share. That’s even though earnings are expected to fall 28% year on year in 2022.

However, things begin to look a little less rosy for 2023. A full-year dividend cut to 130.9p per share is forecast. Yearly profits are tipped to slip 4% from this year, too.

Admiral’s dividend yield therefore slips to 7.1% for 2023.

The verdict

On balance then, should I buy Admiral shares for the dividend? Its defensive operations and cash-rich balance sheet makes it attractive. But the impact of soaring claims inflation is a worry to me.

It’s a problem that caused industry rival Direct Line to slash its profits forecasts last week. Then the business warned that “higher used car prices… higher third party claims costs, longer repair times and inflation in the cost of car parts” meant cost inflation was outpacing the rate at which premiums were rising.

This is worrying for Admiral’s dividend forecast. This year’s 165.8p estimated dividend is already higher than predicted earnings of 141.3p.

That being said, I’m still tempted to buy Admiral shares today. Even if 2022’s dividend fails to live up to that 9%-plus yield, there’s still a good chance the insurer will beat the broader FTSE 100 forward average of 3.8% by a mile. The same goes for next year, too.

Furthermore, as a long-term investor I view Admiral’s share price slump as a dip buying opportunity. Soaring inflation is a problem today. But in my opinion Admiral’s broad product offering, its excellent brand strength and global footprint should deliver solid profits growth in the years ahead. And this should result in many more lucrative dividends.