I’m looking to add more income stocks with high dividends to my investment portfolio following 2022’s market volatility.

It’s my belief that the dividend yields of many UK shares are too good to miss. The sinking stock market has sent yields across the London Stock Exchange through the roof.

However, I need to consider carefully where to invest my money as the global economy stalls. Worsening conditions could derail the dividend forecasts of many income stocks.

These are difficult times for investors. As the head of BlackRock Larry Fink recently commented:

“the first half of 2022 brought an investment environment that we have not seen in decades. Investors are simultaneously navigating high inflation, rising rates and the worst start to the year for both stocks and bonds in half a century, with global equity and fixed income indexes down 20% and 10% respectively.”

A high-dividend stock to buy

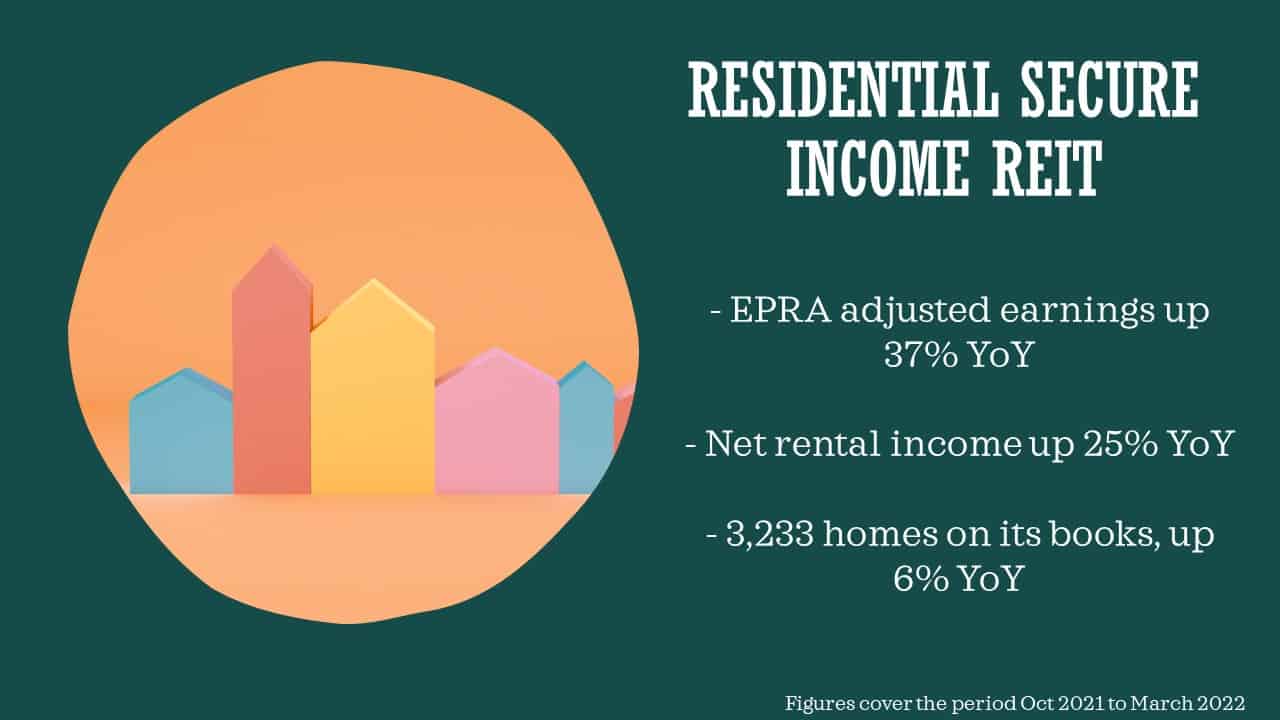

With this in mind let’s take a look at residential lettings business Residential Secure Income REIT (LSE: REIT).

Right now the business carries a healthy 5% forward dividend yield. It’s a reading that is more than double the 2% yield on offer from industry rival Grainger, for instance, and much higher than the 3.5% average that FTSE 100 shares currently boast.

The residential rentals market is one of safest places that I can park my cash right now. Spending on accommodation is something almost all of us will continue doing even as economic conditions worsen. As a consequence, profits at companies like Residential Secure Income should remain quite stable.

Furthermore, with rents soaring in the UK, I can expect to make a decent return on my money if I invest it the right way. Estate agency Hamptons believes tenants will pay £63bn worth of rent in 2022, a new all-time high. This is almost double the £32.1bn paid out in 2009.

Residential Secure Income’s earnings prospects could take a hit if it fails to secure decent acquisitions in the coming years. But the rate at which rents are tipped to keep soaring fills me with confidence.

Rocketing rents

Rents in the UK have surged due to a combination of falling homes supply and rocketing demand. And the need for private rented homes looks set to keep surging due to demographic changes, a positive signal for landlords.

Analysts at Capital Economics for instance believe the key 15-to-24-year-old population will grow by around 866,000 (or 11%) by 2030.

Residential Secure Income REIT then looks in great shape to deliver solid long-term profits growth. And this is good news for income investors as its status as a real estate investment trust requires it to pay nine-tenths of yearly earnings out by way of dividends.