2022 has been disastrous for many FTSE 100 stocks. But it hasn’t been at all a catastrophe. In fact, some stocks have enjoyed terrific share price gains. Take BP (LSE: BP), whose share price has risen by mid-teen percentages in the year to date.

BP’s share price is still 37% more expensive than it was 12 months ago too, though it’s fallen more recently.

Can the FTSE 100 business shoot higher again? And should I buy the oil company for my dividend portfolio?

Where are oil prices heading?

BP’s soaring share price is thanks of course to rocketing oil values. Brent traded at 14-year highs near $140 per barrel but has retreated sharply since early June, pulling oil stocks lower again. The crude benchmark was last trading around $105.

Guessing how oil prices will move in the short-to-medium term is in a way a fool’s errand. On the one hand, a spluttering global economy and a strengthening dollar could pull black gold prices lower. Conversely, signs of prolonged weakness in Russian oil output might drive them higher.

For this reason I won’t try to predict what BP’s share price will do next. But to be honest this has little consequence over whether I’d buy the FTSE 100 firm today.

Going green

Put simply I buy UK stocks based on a company’s outlook for the long term. As a rule of thumb I’ll invest in a share based on what returns I can make for a decade.

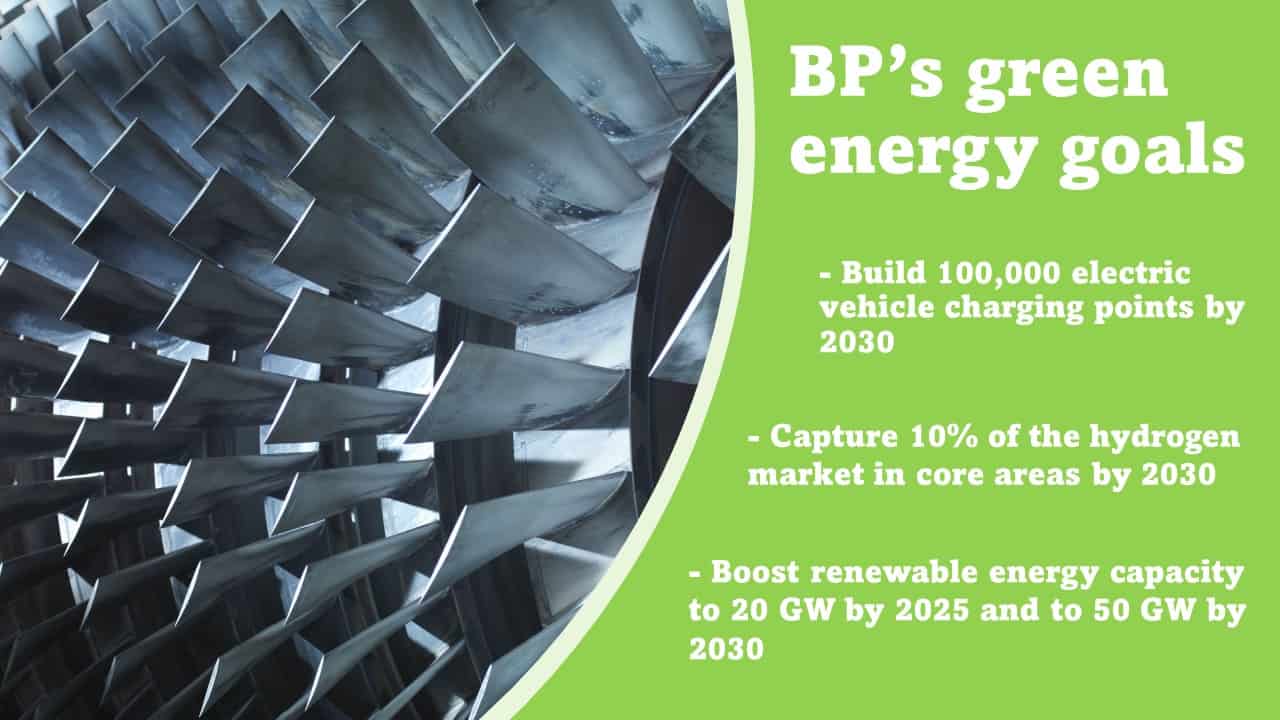

And I’m concerned about what profits I’ll make from oil stocks like BP as renewable energy takes over. Sure, BP is investing massive sums in cleaner fuel sources like hydrogen, solar and wind power. But it will still rely on strong crude oil demand to drive profits for years to come.

What’s more, having one of the most ambitious energy transition plans among the oil majors opens BP up to extra risk. Areas like green hydrogen and building electric vehicle charging infrastructure represent uncharted territory for the firm.

And they are highly expensive areas to break into as well, leaving BP in danger of burning money. The firm aims to spend between $3bn and $4bn on low carbon energy a year by 2025, and to increase this to $5bn by the end of the decade. That’s up from the $2.2bn it spent last year.

That 2022 dividend

So despite the company’s 5% forward dividend yield — and its low P/E ratio of 3.6 times — I’d rather buy other income stocks today.

BP looks in great shape to make 2022’s predicted dividend payment. The dividend of 22.7 US cents per share is covered 5.5 times by anticipated earnings. And the amount of cash BP generates gives it extra financial headroom to meet City forecasts. Operating cash flow soared 34% quarter-on-quarter between January and March (to $8.2bn).

However, an uncertain profits outlook for 2023 and beyond means I’ll be comfortable not buying BP shares today.