Dunelm (LSE: DNLM) released its provisional FY22 results yesterday. While a couple of key figures were missing — earnings per share (EPS), profit before tax (PBT), and expenses — the numbers that were disclosed point towards a positive year for the FTSE 250 firm. Consequently, Dunelm shares rose 5%.

A green rebound

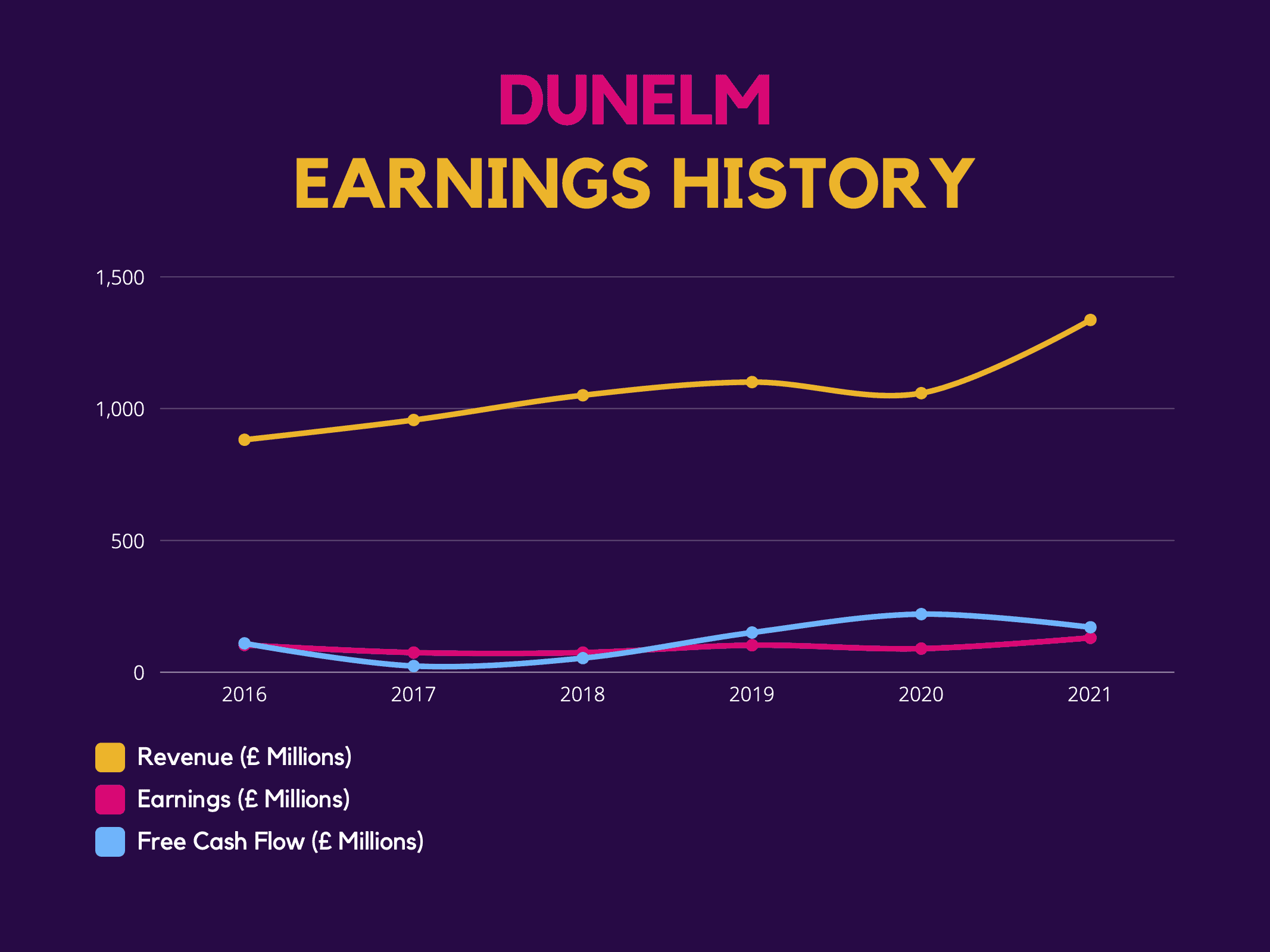

So far, so good — that’s my main takeaway from Dunelm’s latest trading update. The company managed to beat a large number of analysts’ expectations, while delivering growth in its top line. As an investor, this is music to my ears. On a three-year basis, total sales are 41% higher, which shows that Dunelm is growing beyond its pre-pandemic levels rather substantially.

| Metrics | FY22 | Y/Y Change | Q4 2022 | Y/Y Change |

|---|---|---|---|---|

| Total Sales | £1.55bn | 16% | £358m | -6% |

| Percentage of Digital Sales | 35% | -11% | 37% | 0% |

Additionally, Dunelm expects pre-tax profit to come in above the average consensus of £207m. The only bad figure in its top line report seemed to be the 6% year-on-year sales decline in Q4. Nonetheless, this was down to tough comparisons from pandemic reopening tailwinds, and was still above analysts’ estimates.

| Metrics | FY21 | Consensus FY22 | FY22 |

|---|---|---|---|

| Total Sales | £1.34bn | £1.52bn | £1.55bn |

| Diluted EPS | £0.63 | £0.80 | TBA |

| Profit Before Tax | £158m | £207m | TBA (above consensus) |

There wasn’t much information on the retailer’s bottom line, however. Management only disclosed its gross margin, which is expected to fall by 0.4% to 51.2%. This seems to be the only metric that missed estimates of 51.7% for now. Nevertheless, the board expects its gross margin to return to its long-term average in FY23. More details will be available on 14 September when the firm releases its full earnings report.

Lighting it up

Aside from stellar top-line numbers, Dunelm also has a number of developments lined up. For one, it opened and retrofitted four new stores last year. Additionally, it’s aiming to upgrade its digital functionalities to improve customers’ experiences. Moreover, it’s planning to strengthen its product capabilities, bringing better value proposition to its customers. These steps should help it capture more market share.

Furthermore, outgoing Whitbread CEO Alison Brittain was announced as an independent non-executive directors and chair designate. This is excellent news as I believe Brittain’s arrival on the board will help Dunelm grow while maintaining healthy margins in a high-inflationary environment. Her considerable experience and expertise from running a range of consumer-facing companies should come in useful.

Putting worries to bed?

Despite declining retail sales data in recent months, I identified Dunelm as an outlier to outperform its peers, given its growing base of customers, low average prices, and standout quality. This was evidenced in Dunelm’s sales performance, which beat the industry average on an annual basis (16% vs -4%), and three-year basis (41% vs 6%). This goes to show the British firm’s resilience in the current macroeconomic environment, amid declining sales in household goods stores. CEO Nick Wilkinson even mentioned that sales in the first half of July are off to a solid start.

Taking everything into consideration, are Dunelm shares a solid investment? I think so. For now, the company is hitting all the right notes, and I’m eager to see whether its EPS will beat estimates amid the current inflationary environment. If it somehow does, its current price of £8.60 and 4% dividend yield is going to seem like a steal. So, on the basis of these numbers, I’ll be looking to buy more Dunelm shares for my portfolio.