Taylor Wimpey (LSE: TW) shares, along with other housebuilder stocks, have been in a steady decline this year. The stock is down by more than 30% on a year-to-date (YTD) basis. But with a price-to-earnings (P/E) ratio of 8 and a dividend yield of 7%, its shares look lucrative to me.

Housing market gets wimpy

The rise in mortgage rates paired with sky-high inflation have pushed both the Halifax and Rightmove House Price Index to indicate slowing house price growth. Consequently, analysts are predicting prices to drop in the coming months. This has been one of the main reasons behind the drop in the Taylor Wimpey share price.

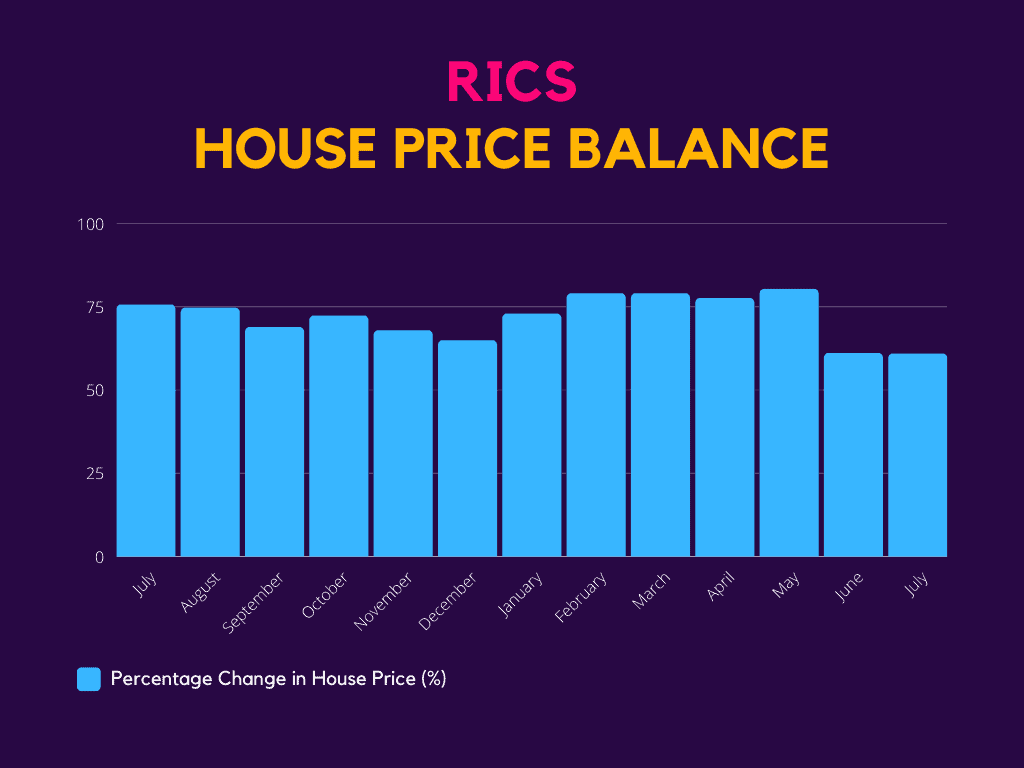

This trend has been further underlined by the latest RICS data, which has shown that house prices have seen the lowest increase in over a year. The index measures the percentage of surveyors reporting a house price rise in their designated area, minus those reporting a fall.

More crucially, however, the Help to Buy scheme is set to end in March. With the scheme contributing to 36% of Taylor Wimpey completions last year, this could have a substantial impact on the housebuilder’s top line.

In a tight spot

The UK housing market has been lacking supply for quite some time now. As such, the Taylor Wimpey board has talked of its commitment to addressing the housing shortage. It has cited plans to significantly increase annual completions in the next few years. However, this is on condition that the market remains broadly stable, which may not be the case if it starts to dip.

A lack of demand gives less incentive for housebuilders to meet supply needs, especially when it drives house prices further down. Not to mention, higher material, fuel, and labour costs will impact profit margins as well. These factors don’t give the developer any reason to build more houses.

Furthermore, Taylor Wimpey faces tough competition from Persimmon and Barratt. It has the fewest number of completions as compared to the other two housebuilders, and has a higher average house price than the former. This puts it in a tough spot in the market without a unique niche. Therefore, the company’s fate is in the hands of the wider housing market for the time being.

| Developer | Number of Houses Sold/Completions (2021) | Average Selling Price (2021) |

|---|---|---|

| Barratt | 17,579 | £320,000 |

| Persimmon | 16,449 | £237,000 |

| Taylor Wimpey | 14,933 | £300,000 |

| Bellway | 10,307 | £305,000 |

| Redrow | 5,718 | £338,500 |

| Berkeley | 3,678 | £603,000 |

Landing big profits?

So, are Taylor Wimpey shares worthy of an investment on my part? Well, the builder has an excellent set of financials — a 1.9% debt-to-equity ratio, £921m in cash, and a 13% profit margin. This shows healthy pricing power and a strong balance sheet to withstand a recession. Moreover, it’s got a landbank of approximately 232k plots, giving it a lot of room to build. This is evident from its £3bn backlog in orders.

That being said, I’ll only be putting Taylor Wimpey on my watchlist for now. While its exposure to markets across the UK gives it more potential to expand, I don’t think it has a strong enough unique selling point given the current macroeconomic environment. As a result, I don’t see this as an opportune time to buy its shares as I expect the housing market to cool further. But if its share price continues to drop, I may consider opening a position, as the British housing market has a history of providing healthy, long-term returns.