While risky, growth stocks provide me with the opportunity to multiply my money by large amounts. If successful, it gives my portfolio the ability to outperform the market. So, here are two stocks that could replicate that success in the next decade and beyond.

Arrival

Arrival (NASDAQ: ARVL) can be easily dismissed as another electric vehicle company. However, what makes this growth stock unique is its approach to producing vehicles. Arrival aims to utilise its in-house technologies to produce rapidly scalable microfactories around the world.

With an estimated cost of $50m, these factories can be set up in a matter of months. Not to mention, they are also 24 times smaller than most other factories. This model allows each factory to achieve unprecedented growth, with an annual gross margin of $100m, producing 10,000 vans a year.

Nonetheless, Arrival now trades at a mere $1.44 after losing 95% of its value from its all-time high. This was the result of an overpriced valuation, delays, and share dilution. That being said, I think the stock is now fairly priced given that its market cap ($920m) is now lower than its total assets ($1.5bn).

After numerous delays, start of production for its vans is set to begin this quarter. This leaves me excited as a long-term investor. Provided that all goes according to plan, I think this growth stock could be a huge winner for years to come.

Astra Space

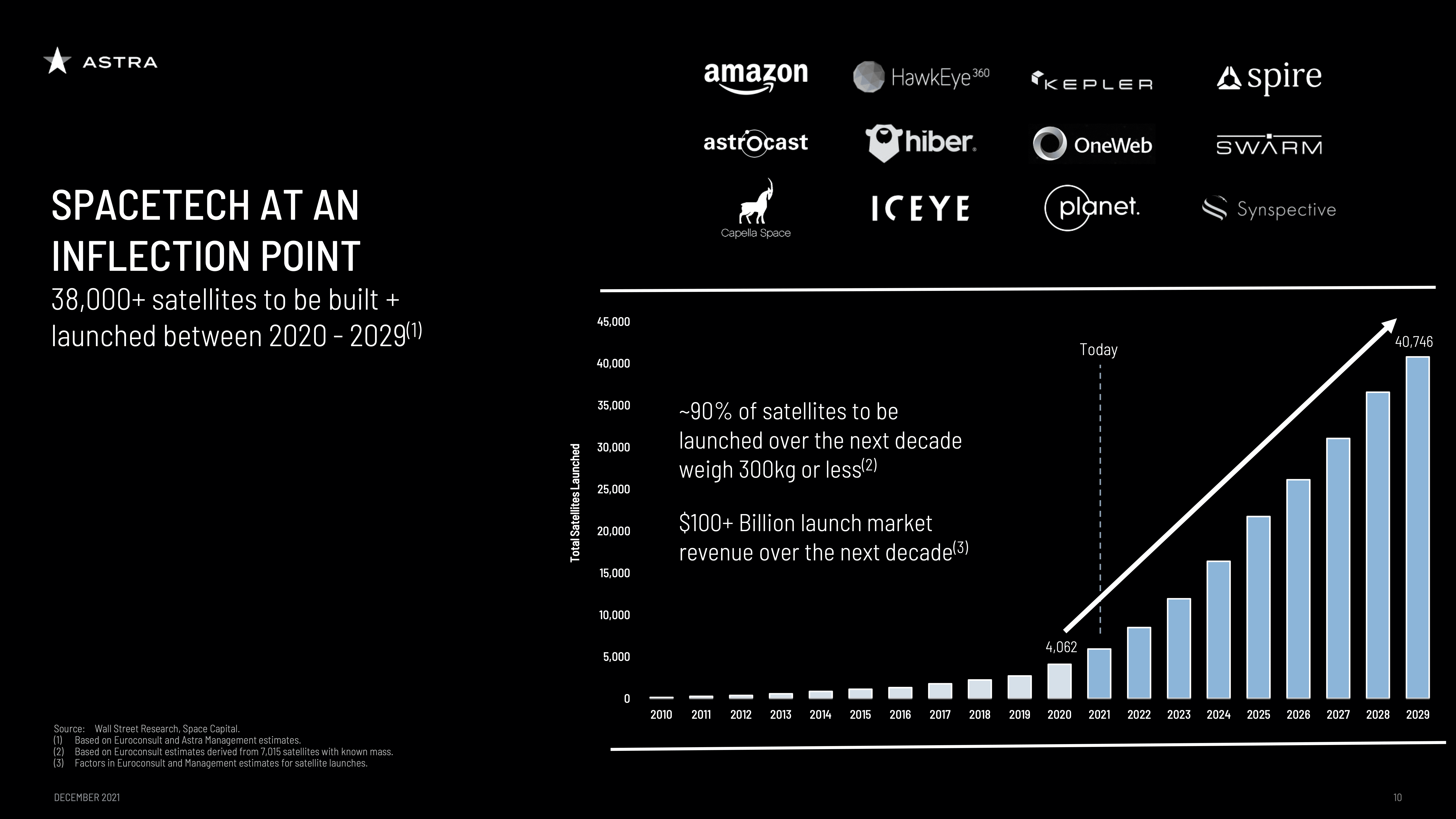

Astra Space (NASDAQ: ASTR) is a company targeting a niche portion of the space launch market. The firm offers to deliver payloads that are less than 300 kg to low earth orbit (LEO) while charging the most affordable fees.

The company has experienced unprecedented growth in its route to getting to space, as it’s the fastest space launch company to reach orbit. Its cheap method of producing rockets is what sets it apart from the competition. Even with a base launch cost of $2.5m, the Alameda-based firm is twice as cheap as its nearest competitor, Rocket Lab. This has allowed Astra to secure a backlog of over 50 launches with the likes of NASA, Spaceflight, Planet, and many others.

Having said that, Astra has also suffered a monumental drop in its share price of 80% this year. The current bear market hasn’t done growth stocks any favour either. Fears of a potential recession have soured investor sentiment and kept share prices low. Nevertheless, if Astra can manage to somehow deliver on its promises of daily launches by 2025, its current share price is going to be a steal.

Stunted growth?

Given the tremendous amount of potential from these growth stocks, are they a buy? Well, it’s important to note that while these companies have the potential to deliver a monumental return on investment, they can also fail.

I’m definitely intrigued by Arrival’s growth prospects. Even so, its cash position leaves me worried. With just $500m of cash, the unicorn has proposed restructuring its business. On the other hand, Astra has gone quiet since its most recent failed TROPICS launch. With no word from management as to what lies next for the company, I think there’s too much risk involved to buy more shares. As such, I’m holding onto both my Arrival and Astra positions for the time being.