It’s often said that the British are a nation of animal lovers. This trait plays out in this FTSE 250 growth stock that has a healthy dividend history to boot.

A recent survey from the Pet Food Manufacturers Association found that there are 40 million pets in the UK, and that 22% of households owned a dog, and another 18.% had a cat.

In total, there are thought to be 13 million dogs and 12 million cats in the UK, not to mention another three million small furry creatures that include rabbits, guinea pigs and hamsters.

Should you invest £1,000 in Reckitt Benckiser Group Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Reckitt Benckiser Group Plc made the list?

Because we love our animals, we are happy to spend money on them

As a nation, we shell out £180m per month on them.

For young adults aged between 24 and 35 — the highest-spending demographic — that equates to an expenditure of around £125 a month on their pets.

What’s more, that spending is likely to be ‘price inelastic’, which means that pet owners won’t be looking to cut back despite rising prices and inflation.

For example, a 2020 survey by consultant Oliver Wyman found that 70% of pet owners planned to make no changes to their pet’s diet, regardless of the state of the economy or their finances.

How can I take advantage of these trends?

One way would be for me to buy shares in Pets At Home (LSE: PETS), the London-listed UK pet care business, which provides pet owners with everything from food to bedding, toys and veterinary services, from a one-stop shop, and via its subsidiaries Vets 4 Pets and The Groom Room.

In the financial year 2022, Pets at Home enjoyed record growth in sales and attracted 1.1 million new customers, taking its market share of the UK pet care space to 40%.

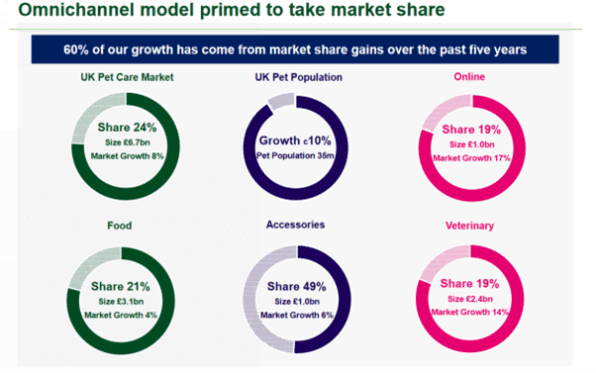

In fact, in the last five years 60% of the firm’s growth has come from increases in market share.

Group revenues grew to £ 1.32bn, up 15.3%, whilst like-for-like sales grew by 15.8% compared to 2021, and by almost 26% over two years. Pets at Home is also growing its online presence, and an omni- or multichannel approach to sales means that plenty of growth opportunities are still open to it.

Pets at Home grew its dividend by an impressive 47.5% to 11.8p per share, and it was able to increase customer revenue per staff member to almost £202,000 per annum, a jump of 10.2%.

Currently priced at 314p, the stock trades on an undemanding forward price-to-earnings ratio of 12 times 2023 earnings, with a prospective dividend yield of 4.30%.

With cash in the bank standing at £66m, it’s one of the few retailers in the current climate that can genuinely be said to be on a firm footing.

The shares have fallen by 32% year to date, a derating that wasn’t and isn’t justified by the fundamentals of the business.

These attributes are going to be in increasingly short supply and therefore very much in demand if the UK economy deteriorates further.

The risk in any investment in Pets at Home is that UK consumers could change their behaviour and attitudes toward spending on pets, in the face of a further substantial rise in the cost of living.

I will be watching Pets at Home closely looking for an appropriate entry level in the share price.