In light of stalling house price growth, housebuilder stocks in the UK have had a torrid time this year. With drops of more than 35%, the industry has significantly underperformed the FTSE 100. Nevertheless, Berkeley (LSE: BKG) has managed to hold on and outperform its closest peer by 10%! This makes me wonder why that’s the case and whether its shares are worth me buying.

Standing tall

As mortgage rates continue to rise as a result of interest rate hikes, demand for homes has cooled. This can be seen in Rightmove‘s June house price index, which shows that house price growth is slowing. As such, analysts are actually expecting prices to drop, hence the overall weakness among the FTSE 100 housebuilder stocks.

Nonetheless, Berkeley stands out as doing better than its Footsie peers year-to-date (YTD). The shares’ performance becomes even more puzzling when I consider that it’s the only developer not paying a dividend. So, what’s behind the stock’s relative strength (bearing in mind that it’s still down this year)?

| Developer | YTD Performance |

|---|---|

| Barratt | -39% |

| Persimmon | -35% |

| Taylor Wimpey | -33% |

| Berkeley | -23% |

Berkeley loves the south

Upon analysing the number of houses built, Berkeley’s more solid stock performance gets even more confusing. The Croydon-based developer doesn’t even rank within the top five builders in Britain for house completions.

| Developer | Number of Houses Sold/Completions |

|---|---|

| Barratt | 17,579 |

| Persimmon | 16,449 |

| Taylor Wimpey | 14,933 |

| Bellway | 10,307 |

| Redrow | 5,718 |

| Berkeley | 3,678 |

However, there’s a metric in which Berkeley excels in — average selling price. Due to the housebuilder’s speciality in building posher, London properties, its average house price is two to three times higher than its competitors.

| Developer | Average Selling Price |

|---|---|

| Barratt | £320,000 |

| Persimmon | £237,000 |

| Taylor Wimpey | £300,000 |

| Berkeley | £603,000 |

As a ‘luxury’ builder, Berkeley has been able to pass on most of its higher costs to its customers without impacting demand. This was evident in its FY22 results with management citing resilient demand for its properties.

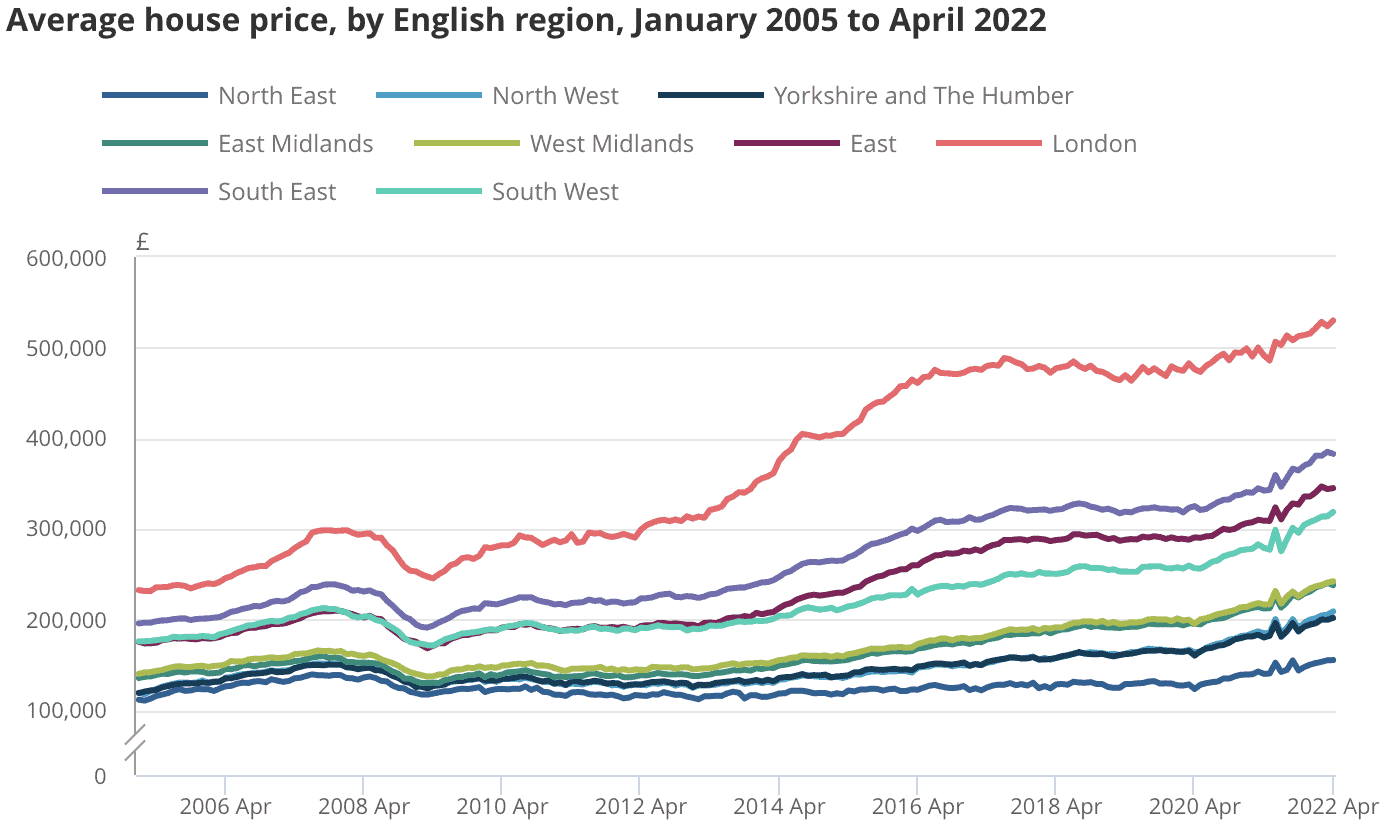

Moreover, Berkeley’s exposure to London and the South East has allowed it to benefit from higher house prices, with the average house price in the capital costing £530,000. This is almost double of the UK average. More importantly, the lack of supply in these regions will most probably protect Berkeley’s top line from declining house prices.

Built like bricks

Aside from its solid stock performance, Berkeley also boasts a solid balance sheet. Although its debt-to-equity ratio of 21% is slightly higher than that of its FTSE 100 peers, its cash position covers its debt comfortably. Additionally, it’s got the second highest profit margin in the industry, at 20.5%, which is also higher than the industry’s average.

Having said that, it mentioned free cash flow of -£131m in its latest results. This would normally alarm me, but this was down to the company’s recent acquisition of St. William. This free cash flow impact should be a one-off and the board expects positive cash flow ahead. The company sold 42% more homes last year after all, and has an order backlog worth £2.2bn, which is an increase from £1.7bn a year ago.

I think Berkeley could be a lucrative housebuilder for me to invest in, if not for one thing. A great deal of uncertainty lies ahead for the housing market, with a potential recession on the cards, the company may be vulnerable, even with its London exposure. For that reason, I’m not ready to buy Berkeley shares at the moment. Instead, I’ll be scouting for potential winners in the event of a stock market crash.