These are difficult times for investors who buy stocks for passive income. So I’ve invested in an investment trust to protect my wealth as the economy struggles.

As economic growth slows, profits are coming under pressure at plenty of UK dividend shares. This is casting a shadow over their dividend-paying potential in 2022, and possibly beyond.

Let me explain why spending some money on investment trust shares could be a good idea today.

Investment trust dividends have rocketed

Research released overnight from Link Group shows dividends paid out by investment trusts have just hit record levels. In the 12 months to March, these stocks lifted dividends 15.4% to an all-time high of £5.5bn.

Alternative asset funds lead the way

This handsome annual rise was driven by soaring dividends from trusts which invest in alternative assets. Payments from these trusts soared 25.1% year-on-year to £3.65bn.

Dividends from venture capital trusts (VCTs) recorded the biggest increase in the year to March. These surged 65.7% year-on-year to £556m.

Dividend growth from renewable energy infrastructure funds came in second place. These were up 38.3% at £583m.

Trusts can help investors in tough times

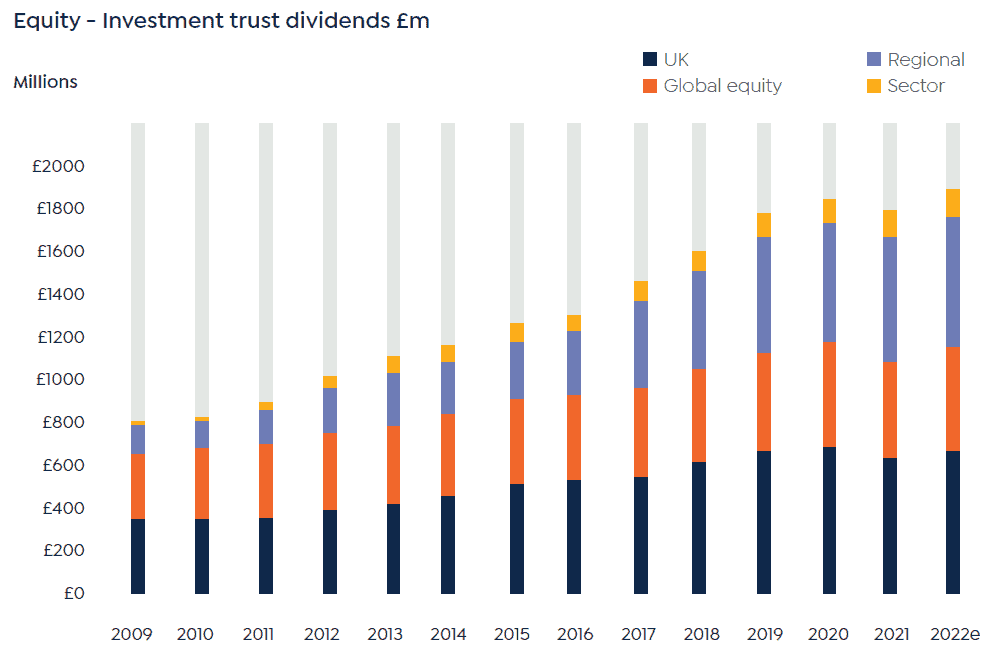

Dividends from trusts that invest only in equities performed far less spectacularly. In fact, they remained unchanged year-on-year at £1.85bn. However, this was still a strong performance, given the broader economic environment.

Payouts from the companies they invested in fell as earnings dipped during the pandemic. But investment trusts were able to keep dividends flat year-on-year “as [they] dipped into reserves and took advantage of special rules that permit them to distribute some of their realised capital gains,” Link Group says.

It also expects dividends from these types of investment companies to keep increasing in 2022 too. It predicts a 4% annual rise, to £1.92bn.

This is lower than broader dividend growth Link Group anticipates in the UK or globally however. This is because these categories of trusts are rebuilding their financial reserves following last year’s payouts.

A trust I bought for BIG dividends

Link Group’s data shows the advantage that investment trusts have for passive income investors in turbulent times. Their financial flexibility means that they can often continue paying a steady stream of dividends to their investors even when times get tough.

I have invested in The Renewables Infrastructure Group in recent weeks. This particular UK investment trust is one of those renewable energy infrastructure funds which Link Group notes raised dividends last year.

Profits at the business might disappoint in the near term if adverse weather conditions are frequent. A lack of sun or wind has obvious implications for energy production. However, I think the trust will prove an excellent buy over the long term as the world transitions towards green energy.

What’s more, I think The Renewables Infrastructure Group will have the financial strength to continue raising dividends, even if earnings disappoint. City analysts expect the business to keep raising the payout in 2022. As a result the investment trust yields a very decent 5.2%.