FTSE 100 shares derive around 75% of their earnings from abroad. Recently, I’ve been searching for stocks in the index that have significant exposure to emerging markets. I view these regions as key drivers of global economic growth in the future, propelled by population increases and burgeoning middle classes.

Here are two Footsie stocks I consider to be well positioned to capitalise on these trends.

Prudential

The Prudential (LSE: PRU) share price has struggled to sustain momentum since losing its UK and European businesses in October 2019 due to the company’s demerger from fellow FTSE 100 constituent M&G.

Should you invest £1,000 in Airtel Africa right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Airtel Africa made the list?

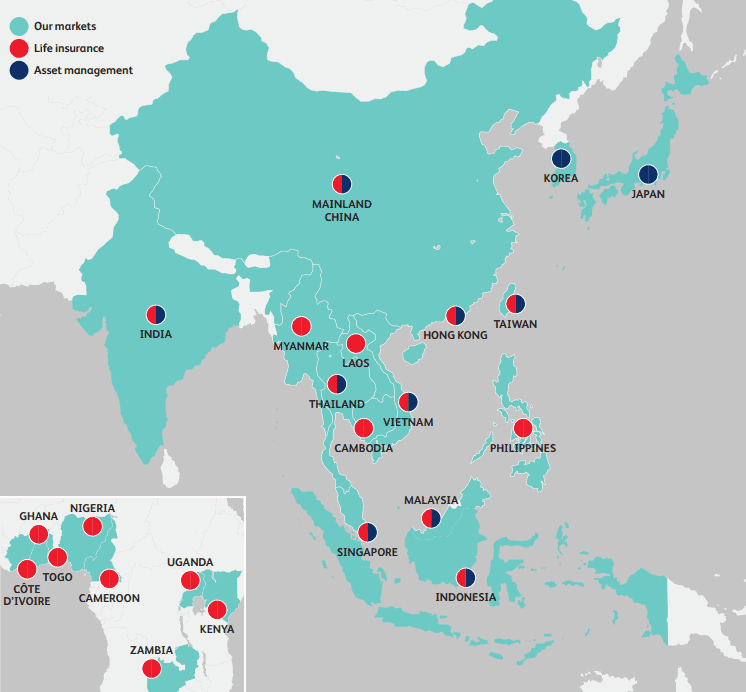

After spinning off its remaining US operations in 2021, the insurer now exclusively focuses on 15 Asian and eight African countries. It currently provides 18.6m customers with savings, health and protection solutions.

The transition came at a difficult time. Hindered by China’s ‘zero Covid’ policy and ongoing border closures between Hong Kong and the mainland, Prudential’s Hong Kong sales collapsed 27% in FY21. However, aggregated 16% sales growth in other jurisdictions did offset this.

Stringent coronavirus regulations remain a headwind, but the company’s long-term prospects look good to me. After all, the market is massive. Asia’s health and protection gap is estimated to be $1.8trn and over 80% of the Asian population has no insurance cover.

Prudential doesn’t lack ambition — it’s developing capacity to serve 50m customers by 2025. New Asia-based CEO Anil Wadhwani will spearhead these efforts from February next year.

Despite recent wobbles, untapped demand in the company’s key locations makes this FTSE 100 stock a tantalising investment prospect. I’d buy.

Airtel Africa

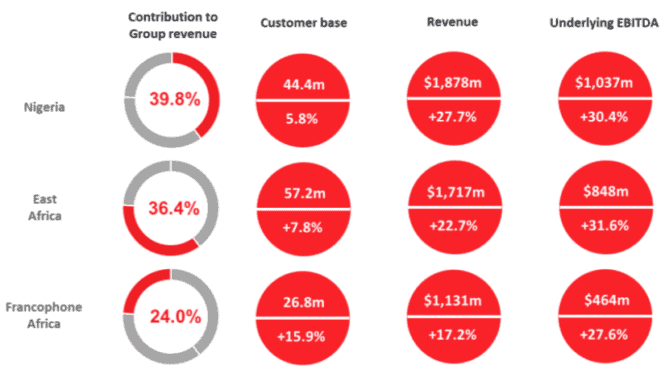

The Airtel Africa (LSE: AAF) share price has enjoyed substantial 81% growth over 52 weeks, although progress has come to a standstill in 2022. This company provides telecommunications and mobile money services in 14 sub-Saharan African countries.

A recent entrant in the FTSE 100 index, Airtel Africa boasts 128.4m mobile subscribers and 46.7m data subscribers to its name.

The business performed well across all of its regions in FY22. Indeed, the latest results marked an impressive 17 quarters of double-digit revenue and EBITDA growth up to 31 March.

Although the market penetration for mobile services in Africa is low, the company faces stiff competition for market share. For instance, Vodafone‘s mobile money service, M-PESA, is Africa’s largest fintech platform with over 51m customers. This is almost double Airtel Africa’s 26.2m subscribers for its equivalent service.

However, I do like the stock’s low price-to-earnings ratio, which is just above 10. The 3% dividend yield is handy, too. With strong brand recognition in the continent and a chunky market to take advantage of, Airtel Africa shares are a good buy for me provided the company can keep pace with its competitors.

FTSE 100 shares for the future

Emerging markets have risks and rewards. Political instability and volatile currencies can be stacked against faster economic growth anticipated in the developing world.

I believe investing in FTSE 100 shares with a strong presence in emerging economies, such as Prudential and Airtel Africa, adds important diversification to my portfolio as well as the prospect of competitive returns in the years to come.