HSBC (LSE: HSBA) shareholders will be pleased with the bank’s FTSE 100 index-beating returns so far this year. While Barclays, NatWest and Lloyds shares are firmly in the red, the HSBC share price has maintained a positive trajectory.

So, what’s next for this banking stock and would I buy? Let’s explore.

The bull case for HSBC shares

One bullish factor is the tightening monetary policy environment. Banking shares tend to outperform when interest rates rise and HSBC is no exception. The Bank of England recently hiked borrowing costs for the fifth time in a row to 1.25%. With warnings of 11% inflation by the autumn, further increases look highly likely.

HSBC’s latest quarterly financial results show some encouraging signs. The bank was profitable in all regions. MENA saw particularly healthy year-on-year growth of 21%, driven by a strong FX performance. A $21m share buyback as part of a $1bn total buyback programme has also helped lift the HSBC share price.

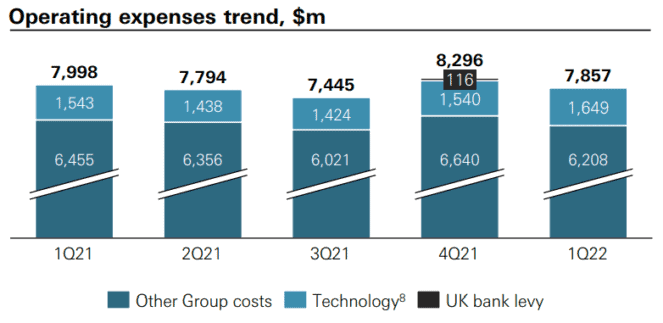

Moreover, HSBC revealed good cost control figures. Adjusted operating costs were down 2% compared to Q1 2021 as performance-related pay declined and cost saving initiatives proved effective. The bank continues to target total cost savings of $2bn for 2022.

This year, the bank completed its acquisition of AXA Singapore, expanding its wealth capabilities in Asia. Turning closer to home, the financial giant also grew its mortgage book by $6bn compared to Q4 2021. Half of that came from the UK market.

And the bear case

Although the HSBC share price has increased this year, the devil is in the detail. Ping An Insurance, a Chinese company and one of the bank’s largest shareholders with a 9.2% stake, has been pushing for a split between HSBC’s Eastern and Western halves. Such a move would potentially release $26.5bn of capital for shareholders. This news boosted the share price recently.

However, its leaders are resisting the proposal. Concerns that it could be a costly year-long distraction cast doubt over the future for the shares. Indeed, Barclays analysts predict it could reduce HSBC’s market value by up to 8%. If the bank were to be divided, I’m concerned short-term share price gains may come at the expense of the long-term outlook.

I also think the stock is pricey compared to its closest FTSE 100 competitors. Its price-to-earnings ratio of 11.50 and price-to-book ratio of 0.66 are markedly higher than those of Barclays, Lloyds and NatWest. What’s more, HSBC offers the lowest dividend yield of the quartet at 3.54%.

Finally, it faces headwinds from China’s ‘zero Covid’ policy, which has suppressed growth in the Asian behemoth. Geopolitical tensions continue to escalate and potential flashpoints in Hong Kong and Taiwan could spell trouble for the HSBC share price in the future.

Would I buy?

The outlook for the shares is mixed in my view. The price may well rise further from the current level of 537p, but there are a number of risks that make me hesitant.

Despite a strong performance in 2022 so far, I think there are better Footsie banking stocks for me to buy with my spare cash. Accordingly, I wouldn’t buy HSBC shares today.