I’ve spent much of 2022 looking for defensive shares to weather macroeconomic storms ahead. However, I’m also keeping an eye out for oversold growth stocks to buy with the potential for big future returns in mind.

Here’s one cheap growth stock in the FTSE 250 index that I’m considering as a higher-risk play amid the stock market chaos.

Breakthrough potential

IP Group (LSE: IPO) has a unique business model. It specialises in the creation and commercialisation of intellectual property (IP) rights in partnership with leading British and American universities. The IP Group share price has declined 39% in 2022. However, this could present a great opportunity to build a position in a company with big disruptive potential.

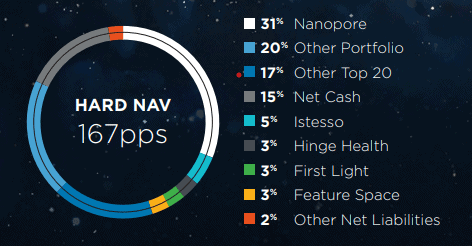

The business backs early-stage companies that exploit ground-breaking IP across a range of technologies. For example, its investment in gene sequencing outfit Oxford Nanopore Technologies makes up nearly a third of its portfolio following an IPO on the London Stock Exchange last year.

The Oxford Nanopore share price has fallen 47% since its flotation. Nonetheless, it’s testament to the nature of IP Group’s business — namely that one or two breakthrough investments can significantly lift its portfolio value and result in considerable cash realisation.

The net asset value of its investments according to its latest financial results is £1.7bn. This equates to 167p per share. The IP Group share price trails that significantly at just over 74p, suggesting it’s currently a value investment proposition.

The FY2021 financial results bolster the case for this growth stock being oversold. Post-tax profit increased by 142% to £449.3m. Liquidity is also healthy, evidenced by 33% growth in net cash to £270m. Moreover, investment remains strong. The company poured over £1.1bn into a variety of science-based businesses.

Looking to the future, the company’s portfolio is concentrated in a range of life sciences and green technology businesses. Highlights include companies exploring possible solutions to nuclear fusion, carbon capture, and long-duration battery technology, as well as product developers focusing on ‘virtual touch’ technology to make the digital world more human.

Risks for the shares

The macroeconomic climate isn’t favourable to IP Group. Growth stocks tend to underperform as interest rates rise. With inflation well above its 2% target, it’s likely the Bank of England will continue to hike rates throughout the year and possibly beyond.

The group operates in a sector where data security is paramount. Given the confidential nature of ideas before patent applications are filed, the company is a target for cyber attacks. The growth of state-sponsored hacking to steal technologies is a risk it will potentially have to contend with in the future.

Finally, the company needs to raise significant capital to operate at optimum levels of investment activity and overheads. The impact of a possible recession next year on capital markets could harm the growth prospects for the shares.

Would I buy this FTSE 250 growth stock?

IP Group shares certainly aren’t risk-free. However, at 74p, I like the risk/reward profile.

This is a company brimming with ideas to solve some of the 21st Century’s greatest problems. I’d buy this growth stock as a long-term hold.