Value stocks are often considered to be Warren Buffett‘s favourite type of stock market investment. Generally, a value stock is one that trades below its fundamental value, providing investors with an opportunity to buy shares at a bargain rate. This type of share can be contrasted with growth stocks, which investors pay a premium for because of the potential for big increases in future earnings.

I’ve identified two FTSE 350 value stocks paying big dividends that I’d buy in July. Let’s explore each in turn.

Imperial Brands plc

Imperial Brands (LSE: IMB) is the world’s fourth-largest tobacco multinational. This FTSE 100 stock has a price-to-earnings (P/E) ratio of 8.65 and a whopping 8.71% dividend yield.

The Imperial Brands share price has outperformed in 2022, rising 10%.

The company’s half-year results show encouraging progress on a constant currency basis. Adjusted revenue increased slightly by 0.3%. Adjusted operating profit and basic earnings per share saw healthy growth of 2.9% and 7.7%, respectively.

Resilient cash flow is an attractive feature of tobacco companies and Imperial Brands doesn’t disappoint, with a 12-month cash conversion rate of 102%. This acts as a strong foundation upon which the group can strive to maintain its status as one of the top 10 dividend stocks in the FTSE 100 index.

The outlook isn’t all rosy for this value stock, however. There’s a risk governments could increase taxes on tobacco products, thereby eating into profit margins. These are popular taxes to raise in tough times considering smoking is a minority pursuit in many populations.

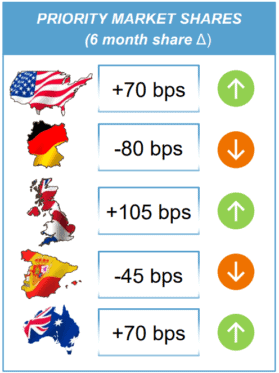

Furthermore, Imperial Brands has suffered declines in market share in Germany and Spain this year. These are two of its five largest markets. Plus, an exit from Russia reduced pre-tax profit by £225m in the first six months of the year — a 39% haircut.

Nonetheless, growth in the US, UK, and Australia more than offset declines in other parts of the world. I also view the stock’s P/E ratio and high dividend yield as compensating factors for the risks facing the business. I’d buy.

IG Group Holdings

IG Group (LSE: IGG) is an online trading provider offering access to spread betting and contracts for difference (CFDs) across equities, bonds, and currencies. This FTSE 250 stock has a P/E ratio of 7.22 and a dividend yield of 6.15%.

The IG share price is down 15% in 2022.

Despite the recent drawdown, IG Group goes from strength to strength. The company delivered pre-tax profit of £450.3m for FY2021 — a substantial increase from £295.9m the year before. Basic earnings per share grew to 100.7p from 65.3p.

What’s more, the company maintained dividend payments throughout the pandemic. It has paid a total dividend per share of 43.2p since 2018. With net trading revenue from continuing operations up 13% in Q3 2022, signs point to another good financial year.

However, the business faces stiff competition from other trading platforms, such as Plus500. If retail traders lose enthusiasm as the bear market in the US continues, IG Group could experience challenges in retaining its market share.

Nevertheless, I’m encouraged by the company’s healthy finances. Overall, I consider this value stock to be a good buy for my portfolio in July.