Lloyds (LSE: LLOY) shares have been in a steady downtrend in 2022 since touching a 52-week high of 56p at the beginning of the year.

With the Lloyds share price currently at 43p, here’s why I think now could be a great time to add some more shares in this FTSE 100 bank to my portfolio.

Rising interest rates

First, banking stocks tend to be rare beneficiaries from a tightening monetary policy environment. Although it has been less bold than the Federal Reserve in hiking interest rates, the Bank of England is coming under increasing pressure for faster increases as UK inflation spirals well above its 2% target.

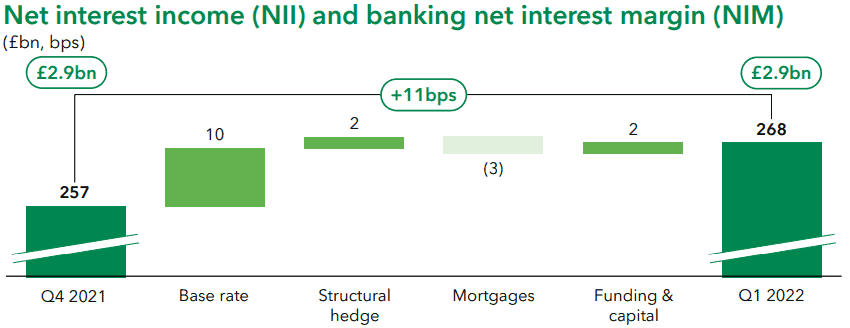

There’s evidence from its latest quarterly results that Lloyds is already benefitting from changes to the base rate. The bank’s net interest margin — the difference between the net interest income it generates from credit products, such as loans and mortgages, and the outgoing interest it pays on savings accounts — increased to 2.68% versus 2.49% in Q1 2021.

I suspect the UK’s central bank will continue to hike rates throughout the year. Lloyds shares stand to benefit in this macroeconomic climate.

A high dividend yield

I also consider Lloyds to be a good investment for investors seeking passive income. The stock’s current dividend yield is 4.61%, which beats the FTSE 100 average of 3.98%. This is a higher yield than those offered by Barclays and HSBC at 3.77% and 3.54% respectively, and almost equal to NatWest‘s 4.73% yield.

What’s more, Lloyds recently announced a £2bn share buyback programme, which lifted its total capital return for 2021 to the equivalent of 4.82p per share.

Shareholders should be able to expect solid distributions going forwards, according to the group’s latest guidance. It has stated there will be “progression in the dividend per share in 2022 and beyond” in line with its commitment to a progressive and sustainable dividend policy.

A value proposition

Finally, at current prices, Lloyds shares look good value to me. The dark horse bank compares favourably to its closest Footsie competitors in respect of its price-to-earnings ratio and price-to-book ratio.

| FTSE 100 Bank | Price-to-earnings Ratio | Price-to-book Ratio |

|---|---|---|

| Barclays | 4.55 | 0.35 |

| HSBC | 11.50 | 0.66 |

| Lloyds | 5.82 | 0.52 |

| NatWest | 7.93 | 0.56 |

Using multiple criteria, it’s a strong performer among its peers. In my view, the drawdown in the Lloyds share price means the bank is oversold in light of its impressive recent results and valuation metrics.

One risk facing Lloyds shares

Despite the favourable comparisons I mention above, Lloyds lacks the international diversification enjoyed by some of its competitors. The bank is the UK’s largest mortgage lender and has significant exposure to the UK housing market.

Leading property agent Savills expects house prices to decline by 1% in 2023. This could be a particularly acute headwind for the Lloyds share price. However, fundamental issues with the lack of housing supply mean any pain should be temporary in my view.

I already own Lloyds shares and I like it when stocks I own go on sale as this provides a nice opportunity for me to buy more, which is exactly what I’ll do with Lloyds trading at 43p.